Yesterday, we discussed why concerns about an imminent recession are misplaced. Thanks to the drop in the cost for corporations to refinance their debts since early 2019, debt maturities are starting to be pushed out. And without a debt crunch, there’s no risk of a recession.

But even corporations’ reported costs to borrow overstates how risky corporate debt is. This is particularly true for debt with the largest yields.

Market credit default swap (“CDS”) metrics are driven by investor demand, which is driven by how credit looks based on as-reported accounting figures.

The big credit-rating agencies – Moody’s, S&P, and Fitch – all use traditional accounting metrics when analyzing a company’s credit risk. So do Wall Street analysts.

Because of this, their conclusions on credit risk lag reality.

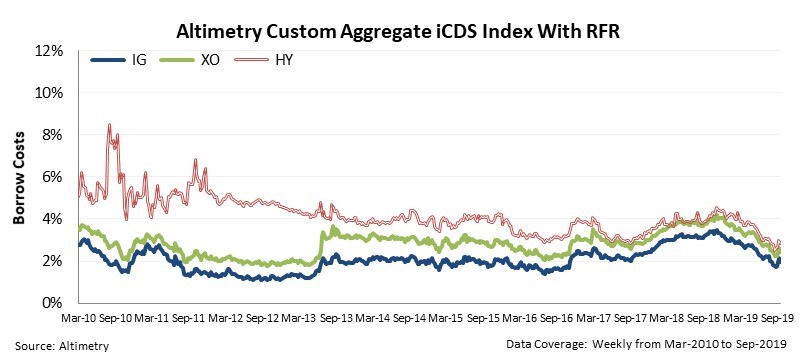

Once we apply our Uniform Accounting metrics, we can calculate what credit risk really is for a company. We call this metric “intrinsic CDS,” or iCDS. The chart below highlights the iCDSs broken into three buckets: investment grade (“IG”), crossover (“XO”), and high yield (“HY”), plus the risk-free rate (“RFR”). The real credit risk companies are facing is even lower than CDSs show you…

Our iCDS takes into account the real risk factors impacting each bucket of companies to understand what their real costs to borrow should be, based on that risk.

For the less volatile companies (IG and XO), intrinsic cost to borrow looks more or less the same as the current market costs for these companies to borrow. The market is correctly pricing their low and declining credit risk.

However, looking at the riskiest group of companies (HY), we can see something very powerful…

The market is overstating credit risk for HY companies.

While the market cost to borrow for an average HY company is around 4% right now, the intrinsic cost to borrow is around 3%. In the bond world, a percentage-point difference like that between market values and where a bond should trade is massive.

HY bonds are where most credit crises start. These are the companies closest to the cusp of bankruptcy and corporate restructuring at any given moment. Because of that, they are a particularly important canary in the coal mine for the economy as a whole.

If HY bonds are flashing an “all clear” signal – which they are today – that is a huge positive by itself… But when we’re seeing signals that credit risk is even lower than the market realizes, that lowers the risk of a credit crunch and recession even more.

And that’s before we even get into what it means as an opportunity for investors to buy individual high-yield credits, because they’re being overcompensated for the risk they are taking when they buy those bonds. This is also something we’ve seen Porter Stansberry highlight with his bond work at Stansberry Research.

We already know that the risk of a recession is much lower than many on Wall Street are claiming, just by understanding how important the refinancing market is to economic growth.

But by using Uniform Accounting, we can see even more… Not only is the risk of a recession overstated, the actual risk of HY corporates – the highest-risk businesses – is even lower than the market realizes. As the market adjusts to this reality, it will give even more tailwinds to the refinancing cycle, extending out the risk of a recession to 2022 – if not even further.