Navigating the rapidly evolving investment landscape, distinguishing between AI stocks and traditional tech stocks is crucial for investors aiming to stay ahead. The proliferation of AI technologies is reshaping industries, offering innovative growth opportunities, while traditional tech stocks continue to demonstrate steady performance. This dynamic interplay not only impacts individual portfolios but also reflects broader trends within the tech and AI markets. Understanding these shifts enables informed decision-making, ensuring strategic alignment with emerging market opportunities. Whether you’re an experienced trader or a new investor, unraveling these complexities can unlock significant potential in your investment strategies.

Key Highlights

- AI stocks exhibit explosive growth potential, driven by innovation and demand in sectors like healthcare and finance.

- Traditional tech stocks offer stability and reliability, appealing to investors seeking consistent performance and steady growth.

- The tech market thrives on rapid innovation, with AI and traditional stocks presenting lucrative yet diverse investment opportunities.

- iShares ETFs provide diversified exposure to both AI and traditional tech stocks, balancing risk with potential returns.

- Staying informed of market trends and leveraging analytics are essential for strategic investments in the evolving tech landscape.

Understanding the Distinction: AI Stocks vs Traditional Tech Stocks

Delving into the nuances differentiating AI stocks from traditional tech stocks unveils a rich landscape for investors. AI stocks, fueled by advancements in artificial intelligence, present distinct characteristics and growth trajectories compared to their traditional counterparts in the tech industry. While traditional tech stocks remain foundational with established companies and technology solutions, AI stocks captivate with their innovative potentials and rapid revenue growth. In comprehending these distinctions, investors can better navigate stock prices and market demands, determining aligned investment strategies. Let’s explore the defining attributes of AI stocks and the core characteristics of traditional tech stocks.

Defining AI Stocks and Their Unique Attributes

AI stocks, representing companies heavily focused on artificial intelligence development and deployment, showcase remarkable growth potential in today’s tech landscape. These stocks are part of a burgeoning tech sector where big data, machine learning, and automation converge to redefine technological capabilities in diverse industries. AI companies often introduce innovative software solutions and automation technologies that provoke significant market interest. Investors drawn to AI stocks typically look for opportunities in sectors like healthcare, finance, and automotive where AI innovation can dramatically enhance efficiency and open new revenue streams.

Unlike traditional tech stocks, AI stocks are often distinguished by their rapid product iteration and adaptability to market changes. This agility allows for swift adaptation to emerging market demands, enabling AI companies to maintain competitive advantages in a dynamic environment. Such dynamism is reflected in stock prices, which can be volatile but promise substantial returns for those willing to embrace risk. Moreover, AI-driven companies frequently enjoy enhanced revenue growth thanks to their ability to innovate continuously and meet evolving customer expectations.

However, it’s crucial for investors to appreciate the associated risks of AI stocks, considering the technological challenges and frequent regulatory changes inherent in this sector. Strategic investment in AI stocks requires a keen eye on market trends and the specific capabilities of companies within the AI realm. Those with expertise in software and data analytics can leverage these insights to identify promising investment opportunities. With AI’s potential to disrupt various traditional industries, understanding these unique attributes is essential for investors aiming to capitalize on the future growth trajectory of tech stocks.

Moreover, international interest in AI stocks is on the rise as global companies invest in AI solutions to remain competitive. This increasing demand can drive up stocks’ value, making them attractive investment prospects. The surge in AI development is mirrored by societal shifts towards automation, prompting savvy investors to align their portfolios accordingly. Observing market trends, particularly those impacting tech stocks, allows investors to anticipate which AI stocks might yield the highest returns.

Characteristics of Traditional Tech Stocks

Traditional tech stocks have long been the cornerstone of the tech industry, representing well-established companies with stable and enduring market positions. These stocks often include big tech giants and reputable software firms that have been influential in shaping the technology landscape. Investors are typically drawn to traditional tech stocks for their reliability and consistent performance. These companies generally exhibit stable revenue streams and proven track records, appealing to those who prefer steady growth over high-risk opportunities. The resilience of traditional tech companies even in fluctuating market conditions ensures their appeal to a broad base of investors.

One defining feature of traditional tech stocks is their robust infrastructure and expansive product offerings. Many of these companies dominate in areas such as enterprise software, hardware manufacturing, and cloud computing. The diversified portfolios of these tech companies allow them to capably weather economic downturns while still showing moderate growth. These firms tend to reinvest profits into R&D, enabling ongoing innovation that sustains their market position and appeals to investors focused on long-term dividends rather than short-term gains.

While they may not match the explosive growth potential of AI stocks, traditional tech companies do offer relative safety and predictability, making them a staple in balanced investment strategies. The stability of these stocks can be attributed to their scalability and the indispensable nature of their technology solutions across various sectors. ETFs often feature a significant portion of traditional tech stocks due to their market reliability, offering investors diversified exposure without excessive risk.

Furthermore, the brand recognition and consumer trust associated with traditional tech companies contribute to consistent stock prices, providing comfort to conservative investors. However, the success of investing in traditional tech stocks depends on understanding the market realities influencing these companies. Factors such as competitive pressures, technological advancements, and regulatory changes can impact their performance. By staying informed about these influences, investors can make educated decisions and optimize their tech-based portfolios. Through careful analysis and strategic placement of investments, one can efficiently balance the growth prospects of AI stocks with the dependability of traditional tech stocks.

Market Trends Shaping AI and Tech Stocks

As the tech market continues its rapid evolution, investors are tasked with navigating complex market trends that impact both AI and traditional tech stocks. With AI stocks surging due to cutting-edge advancements, traditional tech stocks remain a staple, providing stability amidst the volatility. Wall Street analysts closely observe these market changes, driven by data analytics and technological innovation. From revenue growth to investment in big tech and ETFs, understanding these market factors is crucial. Let’s delve into the current state of the tech market and the key factors contributing to AI stock growth.

The Current State of the Tech Market

The tech market today is a dynamic landscape characterized by rapid transformation and digital innovation. Driven by the relentless march of technology, tech stocks have emerged as some of the most lucrative and, at times, volatile investment opportunities. This sector is a hotbed of innovation, with artificial intelligence (AI) being one of the most potent drivers. Data-driven insights are crucial in this domain, where Wall Street closely follows stock charts and stock prices to gauge performance and future potential. Traditional tech giants continue to influence the market with stable growth and strong revenue streams, remaining critical players in this evolving ecosystem. They offer a buffer against market volatility, presenting a dichotomy for investors balancing AI’s explosive possibilities with tech’s solid foundation.

A snapshot of today’s tech market shows an intriguing composition of burgeoning AI innovators and resilient big tech companies. Index funds and ETFs often feature a mix of these stocks, providing a broader range of exposure and an opportunity for diversification, a must in today’s trading environment. As data becomes the currency of the digital age, tech stocks wield significant influence over market narratives, driving the ongoing surge in stock prices.

Investors frequently turn to reliable market analysis to inform strategic decisions, as evidenced by the heightened interest in tech stocks among trading enthusiasts. Trading within this sector requires a keen understanding of market trends and an appreciation of the technological advancements reshaping industries worldwide. In this dynamic environment, the ability to analyze index movements and predict trends becomes invaluable. The continuing prominence of big tech in daily commerce and digital infrastructure cements its importance.

Despite the challenges posed by rapid innovation and market fluctuations, the tech sector’s overall robustness continues to attract savvy investors. By carefully selecting a balanced portfolio that incorporates both AI and traditional tech stocks, investors can maximize growth while mitigating risks associated with sector-specific volatility. This equilibrium aids in weathering market swings while capitalizing on significant revenue growth opportunities. The adaptability of tech stocks amid such change underscores their enduring relevance, ultimately driving the strategic investment decisions necessary to thrive in the tech market.

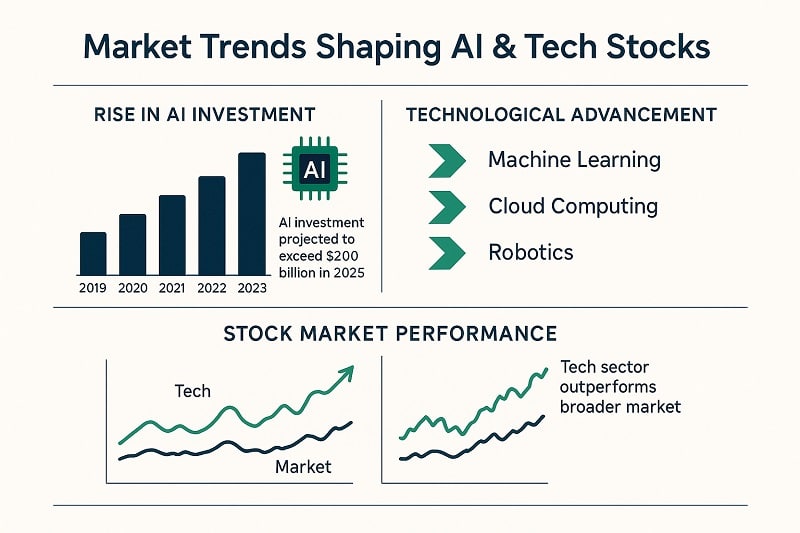

Key Market Factors Driving AI Stock Growth

In the realm of tech stocks, AI has emerged as a formidable force, reshaping industries and capturing the imagination of innovators and investors alike. Key market factors catalyzing this growth include technological advancements, robust data analytics capabilities, and a burgeoning demand for AI-driven solutions. Companies heavily invested in AI continue to leverage machine learning, big data, and automation to redefine industry standards, ensuring these stocks have surged in value on Wall Street.

One driving factor behind AI’s meteoric rise is its capacity to unlock new revenue streams by transforming operational efficiencies across sectors. With AI at the forefront, industries like healthcare, finance, and automotive have witnessed unprecedented productivity gains, thanks to intelligent software and automation. This adaptability fuels investor confidence, allowing AI stocks to maintain brisk momentum in a competitive market. In such an environment, investors are increasingly drawn to AI’s revenue growth potential, as evident in the elevated stock prices reflective of market optimism.

The AI market’s vibrancy is further enhanced by strategic corporate investments in research and development. These efforts propel technological breakthroughs that continually reshape conventional tech landscapes. Interest from global investors manifests in diverse portfolios featuring AI-focused ETFs, highlighting the sector’s strategic significance. The resultant stock chart trends showcase steady inclines, reinforcing AI as a transformative pillar in the tech market.

Fueled by society’s pivot towards digitalization, AI’s potential to exceed market expectations propels stocks towards sustained growth. As AI conquers traditional boundaries, investors recognize its power to disrupt established market realities, prompting a strategic realignment of investment approaches. This ongoing evolution requires vigilance, as adapting to AI’s fast-paced developments demands a deep understanding of market trends and data insights. Consequently, trading AI stocks involves navigating complex stock indices, where knowledge becomes an invaluable asset in capturing AI’s true market value.

Investors keen on capitalizing on AI’s rise should consider diversified strategies that incorporate both traditional and AI stocks. This approach balances risk and opportunity, ensuring a robust investment posture amidst ever-evolving tech market conditions. With AI continuing to spearhead transformative change, understanding its nuances allows investors to anticipate and ride the waves of innovation , securing their place in the future of tech.

Investment Strategies for Savvy Investors

Strategies for investing in both AI and traditional tech stocks have evolved considerably. For savvy investors, the key lies in balancing the high-reward potential of AI with the stability that traditional tech stocks offer. The benefits of investing in AI stocks are immense, driven by rapid advancements and growing market demand, while traditional tech stocks demand careful risk considerations. By analyzing the unique traits and market positioning of each, investors can craft a diversified portfolio that aligns with ongoing tech market trends, potentially leading to significant returns in both sectors.

Benefits of Investing in AI Stocks

The allure of AI stocks largely stems from their potential for explosive growth, driven by rapid technological advancements and substantial market interest. As AI increasingly integrates across various sectors, the demand for AI-driven solutions escalates, making these stocks attractive investment prospects with high potential returns. Key to AI stocks’ appeal is the ever-growing field of machine learning, which offers boundless possibilities for redefining industry standards. Companies at the forefront of AI development demonstrate impressive adaptability to market changes, often sparking innovative solutions that capture investor attention and facilitate revenue growth.

Investors in AI stocks often seek the thrill of navigating a dynamic market brimming with potential. The volatility inherent in AI stock prices may deter some, but for those willing to embrace calculated risks, the rewards can be substantial. This risky but rewarding landscape invites investors to speculate based on technological trends and enterprise capabilities, achieving significant gains from well-timed investments. Investment in AI stocks has witnessed a surge because of their potential to transform traditional business models, automate processes, and consequently enhance efficiency. The impact of AI on sectors like healthcare and finance illustrates how quickly AI solutions can seize market share, underscoring their role in reshaping the future of industries.

Furthermore, the proliferation of data analytics as a tool to inform investment strategies cannot be overstated. It empowers investors to identify promising AI investments by evaluating stock charts and discerning emerging trends. This analytical approach, coupled with an understanding of the broader AI market, equips investors to anticipate shifts and act swiftly on investment opportunities. Moreover, exchange-traded funds (ETFs) focused on AI offer diversified entry points, mitigating risks while maximizing exposure to burgeoning AI sectors.

AI’s continual innovation cycle invigorates investor enthusiasm, continuously redefining stock market narratives and fostering a vibrant ecosystem for AI-centric ventures. As AI stocks continue to morph in response to technological advancements and evolving consumer needs, investors driven by technological curiosity and a forward-looking mindset are well-placed to capitalize on these shifts. The key to success in investing in AI stocks lies in recognizing the transformative potential of AI and aligning investment strategies with the technology’s trajectory towards broader market integration and acceptance.

Analyzing Risk Considerations in Traditional Tech

Investing in traditional tech stocks offers a different appeal, underpinned by stability and established market presence. Traditional tech stocks often represent companies with firmly rooted positions in the tech world, providing investors with reliable, if more modest, growth. The relative predictability of these stock prices and their enduring presence in critical sectors like software and cloud computing make them attractive for risk-averse investors seeking steady returns.

For investors analyzing traditional tech stocks, the focus often shifts to understanding the technological landscapes these companies navigate. With competition high, maintaining a competitive edge requires constant innovation and strategic reinvestments in research and development. This reinvestment propels their sustainable growth, providing a reassuring buffer against market volatility typical of more speculative investments. The enduring brand recognition and trust these companies command often translate into reliable revenue streams and stock performance, further enhancing their appeal.

Understanding the risk factors impacting traditional tech stocks is essential for astute investors. With technological advancements progressing at breakneck speed, even established companies must navigate pressures to innovate while preserving their core offerings. Regulatory environments, evolving consumer preferences, and competitive dynamics also play critical roles in determining the performance of these stocks. Those equipped with market insights and capable of analyzing stock charts accordingly can maneuver these risks effectively, leveraging traditional tech stocks’ strengths for long-term gains.

The integration of traditional tech giants into ETFs acknowledges their market significance and offers investors diversification advantages. This approach mitigates individual stock risks, presenting a route to capture general tech sector growth. Meanwhile, trading in these stocks offers opportunities for capitalizing on market stability, ensuring that portfolios reflect both growth and security. For investors intent on maximizing opportunities, understanding traditional tech’s fundamentals proves invaluable, particularly when harmonizing strategies with innovative, growth-oriented AI counterparts.

In balancing their portfolios, investors often juxtapose traditional tech stocks’ stability against AI’s cutting-edge promise. This strategic alignment ensures a sound investment framework, allowing investors to harness the strengths of both stock types. By intertwining the security of traditional tech with AI’s innovative edge, investors can craft portfolios that thrive across market conditions, optimizing both short-term gains and long-term growth potential. Such investments empower investors to optimize their financial strategies while anticipating broader tech market shifts that influence their portfolios.

In the ever-evolving landscape of tech stocks, iShares and ETFs offer investors robust strategies for diversified investing. By leveraging these investment tools, investors can access opportunities in the dynamic tech sector while minimizing risks. iShares, known for its extensive range of ETFs, enables investors to create diversified portfolios with ease. ETFs, or exchange-traded funds, amalgamate various tech stocks, allowing investors to benefit from the growth of the AI market without investing directly in individual companies. Understanding how to use iShares and ETFs effectively can be a game-changer in navigating tech market trends.

iShares, a leader in the ETF market, provides a plethora of options for investors looking to diversify their portfolios in the tech sector. Through iShares’ extensive offerings, investors can gain exposure to a wide array of tech stocks without the need to research and manage individual company stocks rigorously. This diversification not only reduces risk but also amplifies potential returns on investment. For instance, by investing in ETFs that include a mix of AI and traditional tech stocks, investors can enjoy the dynamic growth of emerging AI companies and the stability of established tech giants in one basket. This strategic blend can be particularly appealing for investors keen on balancing their portfolios to include both innovation and consistency.

ETFs are appealing to investors for several reasons, especially in the realm of tech stocks. They offer the chance to invest in a basket of securities, which diversifies risk compared to buying single stocks. This is crucial in the tech market, characterized by rapid changes and inherent volatility. By investing in iShares ETFs, investors can capitalize on these sector-specific trends with reduced exposure to adverse movements in the stock prices of any single company. This approach simplifies the investment process while providing substantial exposure to high-growth areas within the tech industry, such as AI, data analytics, and software development.

Furthermore, the liquidity of ETFs makes them attractive for trading. iShares ETFs, known for their high trading volumes, offer investors both liquidity and flexibility, enabling them to enter or exit positions with ease. This liquidity is vital in the tech market, where rapid shifts can occur based on emerging trends or technological breakthroughs. Incorporating iShares ETFs into an investment strategy provides a layer of agility that traditional stock investments may lack, allowing investors to quickly rebalance or adjust their portfolios in response to new developments or market conditions.

iShares ETFs also come with professional management, giving investors confidence that their funds are being managed according to prevailing market conditions. Experienced fund managers employ strategic allocation across different sectors, ensuring that funds are optimized for performance while mitigating risk. The convenience of having expert oversight allows investors more freedom to focus on broader market strategies rather than the minutiae of individual stock performance. Moreover, iShares’ fee structure is generally more favorable compared to actively managed mutual funds, which can enhance net returns over time.

For investors new to the tech market or those looking to broaden their investment horizons, understanding the strategic role of iShares and ETFs is paramount. By leveraging these tools, one can efficiently manage risk, optimize returns, and navigate the complex and competitive landscape of tech stocks. As the market continues to evolve, iShares and its ETF solutions will undoubtedly remain instrumental for investors seeking a balanced yet proactive approach to investing in tech and beyond.

As AI technologies continue to disrupt traditional industries, the lines between AI and traditional tech stocks blur, offering promising opportunities for investors. With AI’s rapid advancement, understanding how these shifts impact tech stocks is essential for strategic portfolio management. By keeping abreast of market trends and innovations, investors can leverage these changes to maximize returns. Whether you favor AI pioneers or established tech giants integrating AI, diversifying your investments can mitigate risks while capturing growth potential. Stay informed, utilize analytics, and explore resources to make informed investment decisions in this dynamic market landscape.

FAQs: AI Stocks vs Traditional Tech Stocks

What is the main difference between AI stocks and traditional tech stocks?

AI stocks are focused on companies heavily involved in artificial intelligence, showcasing rapid growth due to innovations in AI technologies. In contrast, traditional tech stocks are rooted in established companies offering consistent performance and stable growth.

What are the potential risks of investing in AI stocks?

AI stocks can be volatile, with risks stemming from rapid technological changes and frequent regulatory adjustments. Investors should remain informed about market trends and have expertise in software and data analytics to identify promising opportunities, mitigating potential risks.

Why might investors choose traditional tech stocks over AI stocks?

Traditional tech stocks offer stability and predictability, with established companies providing reliable revenue streams. They are appealing to risk-averse investors who prioritize steady growth over the high volatility and potential rewards of AI stocks.

How can investors leverage AI’s potential in the tech market?

Investors can capitalize on AI’s potential by diversifying their portfolios to include both AI innovators and established tech giants. Staying informed on market trends and utilizing analytics will help navigate the complexities of AI integration, thus maximizing returns.