Most of the companies on Wall Street’s Blacklist deserve to be there. But sometimes, the experts punish the wrong stock – and in-the-know investors can make a fortune when they correct their mistake. Now, Joel Litman believes his system has detected another of these rare moneymaking setups…

According to Joel, as Wall Street prepares to take one massively undervalued business off the Blacklist, shares could spike significantly higher virtually overnight. He’s issuing the “mother of all buy alerts” to help you take advantage… Plus, he explains why this story goes much deeper than a single ticker.

Click here for the full details.

Table of Contents

What Is Joel Litman’s Wall Street’s Blacklist?

Wall Street is famous for having a good memory…

When a company makes a mistake, the “pros” rarely forget it.

Hundreds of companies have wound up on Wall Street’s Blacklist as a result. This could be thanks to things like corporate-governance shortcomings, lawsuits, or past bankruptcies.

When a company is designated to the Blacklist, its fate is basically sealed. The largest investment firms rarely backtrack on the decision.

Most blacklisted businesses deserve their place. But Wall Street’s draconic methods mean that plenty of strong companies get ignored because of one or two blips in their histories.

So when a company is wrongly put on the Blacklist, it can be a huge moneymaking opportunity…

Take health care services provider LHC Group (LHCG). The company partners with more than 400 hospitals across 37 states. It specializes in at-home services, reducing the number of hospital readmittances.

How Wall Street’s Blacklist Works?

Here’s where everything went south for LHC…

The company had enjoyed healthy growth from its founding in 1994 through 2010. But in 2011, LHC came into the spotlight for all the wrong reasons.

Medicare filed a lawsuit against the company for violations of the False Claims Act. The lawsuit claimed that LHC had been improperly billing customers for unnecessary services. The company was fined $65 million.

The market swiftly punished LHC. Its stock price fell more than 50% over the course of 2011.

LHC addressed these issues and cleaned up its reporting. But Wall Street was loath to ignore the blemish on its reputation. That’s due to as-reported financials and the distortions caused by generally accepted accounting principles (“GAAP”).

As-reported figures show mixed messages…

When you look at LHC’s GAAP numbers, it seems like the 2011 lawsuit is still holding it back.

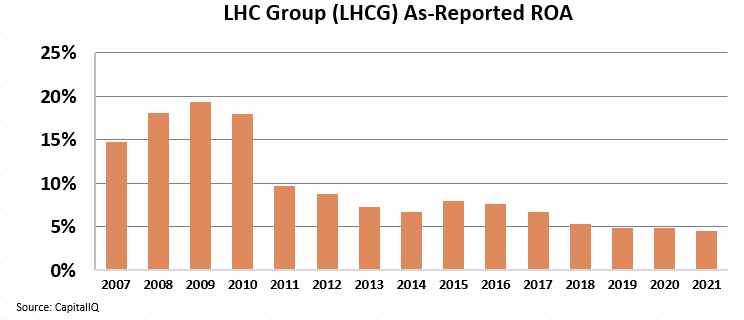

The company’s as-reported return on assets (“ROA”) grew steadily through 2009, when it peaked at 19%. But after the 2011 lawsuit, that number dropped below 10%… and it has continued to fall. As-reported ROA was less than 5% in 2021.

Considering that the corporate average ROA is 12%, you can see why Wall Street kept LHC on its Blacklist for so long…

Thankfully, we have Uniform Accounting to clear up these distortions…

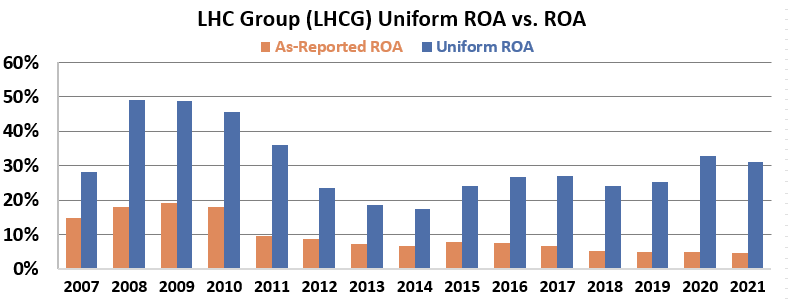

When looking at LHC through this lens, the story becomes clearer.

The company’s returns did take a dive in 2011. However, it has consistently been improving since fixing its practices. Despite the downturn, Uniform ROA has never fallen below the corporate average. LHC even earned an impressive 31% return in 2021.

Based on Uniform ROA, we can see that LHC has earned a second chance. After cleaning up its business in 2013 and 2014, Wall Street was slow to pull the company off its Blacklist. That created a huge opportunity for savvy investors…

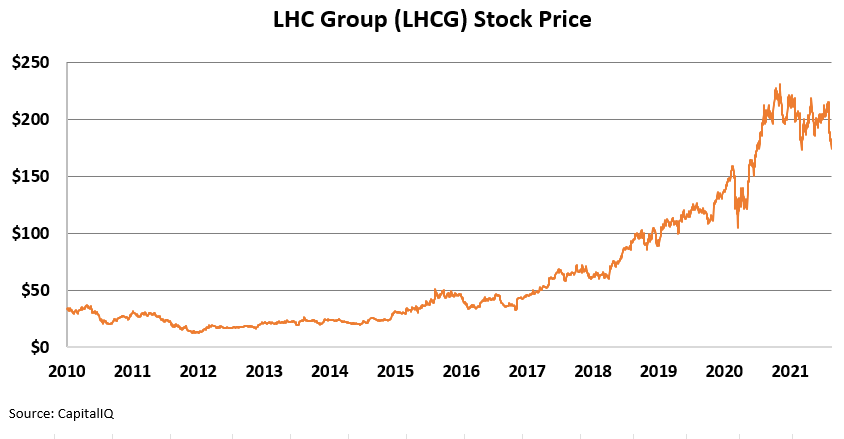

LHC’s stock price fell to about $12 per share in 2011. But since then, it has rocketed higher. In 2020, it reached an all-time high of $231 per share.

LHC is once again focusing on its customers… and riding the at-home health care trend to success. But many investors missed their chance because the company was still stuck on Wall Street’s Blacklist.

How Joel Litman found the Next Wall Street’s Blacklist Mistake Stock?

I just heard an unbelievable story

Joel Litman, the Chief Investment Strategist at Altimetry made $100,000 in one single night.

It didn’t come from trading a stock… a risky options play… or a speculative crypto bet.

Instead, it all started with a mysterious late night summer phone call.

On the other end was one of the most powerful hedge fund managers in the world. I can’t tell you his name, but he manages BILLIONS with a capital B.

You see, one of this client’s largest holdings had just been served papers by the SEC…

And the stock immediately took a 20% hit.

He faced losing millions of dollars if the stock kept tanking.

And he was desperate for information before the next morning’s opening bell.

So, he offered to pay Joel Litman $100,000 to answer one question overnight:

“Which way is this stock REALLY heading??”

Joel ran the company’s numbers through his proprietary stock market rating system The Altimeter…

Digging past what the mainstream media, the SEC, and so called “financial experts” could see…

And found the SEC made a blatant mistake!

In fact, his analysis showed the stock was massively undervalued.

He shot the report over to his client early the next morning… and had a call with the investment team and the fund owner from Billionaire Row.

In the end, they bought even more of the stock.

(Just months later, the truth came out – the SEC withdrew the lawsuit, and the stock rose 156%.)

I’m told that client made something like $20 million from that overnight report.

In short: Stock market “mistakes” can deliver some of the biggest, most explosive profits.

Of course, these huge errors only happen a handful of times every year.

Which is exactly why I’m reaching out to you right now…

Joel Litman’s system just detected the latest “mistake.”

And he says this one might be the biggest no-brainer BUY NOW stock today, regardless of market volatility.

But timing is critical right now, so I urge you not to delay…

Take a look at his latest research to see the proof for yourself.

I know you’ll be glad you did.