Navigating the realm of AI startup funding in 2025 offers investors an intriguing mix of opportunities and challenges. As artificial intelligence continues to disrupt industries, understanding emerging trends and key funding developments is crucial for making informed investment decisions. This comprehensive guide delves into the latest insights, shedding light on the hottest sectors, investment patterns, and strategies to maximize returns. Whether you’re a seasoned investor or just starting your journey in AI investments, this page is designed to equip you with the knowledge you need to stay ahead in the fast-evolving landscape of AI funding.

Key Highlights

- AI investment in 2025 is marked by substantial growth opportunities across various industries due to increased market demand.

- Venture capital plays a crucial role in AI sector growth, providing necessary funds for innovation and technology scaling.

- AI startups with machine learning and autonomous systems expertise attract significant venture capital interest due to high growth potential.

- Elevated valuations present both lucrative opportunities and risks, requiring careful analysis and strategic investment decisions.

- Investors should anticipate a surge in AI funding rounds as startups expand their technological capabilities and market applications.

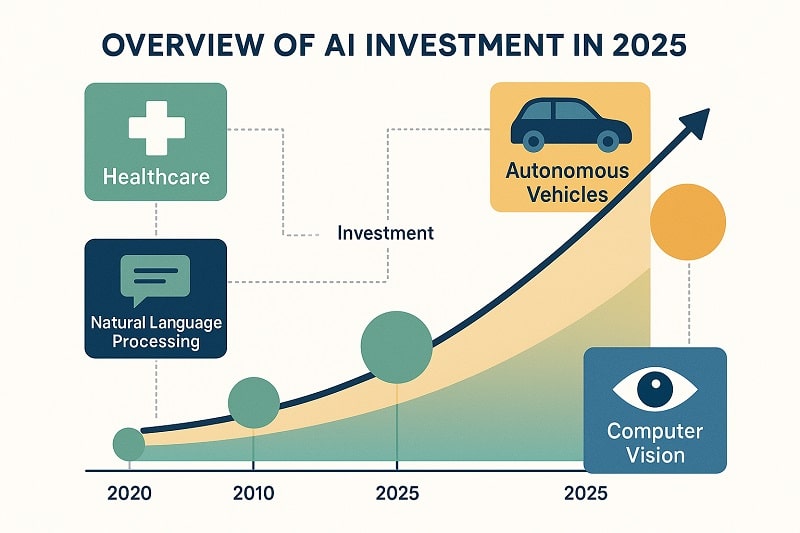

Overview of AI Investment in 2025

Investment in AI has rapidly evolved, with 2025 marking a significant milestone. Investors are increasingly attuned to the diverse roles of artificial intelligence across industries, recognizing its potential as a cornerstone of modern tech investment strategies. The market is fueled by a myriad of factors, including substantial data invigoration and increasing market demand. This overview will cover the importance of AI in shaping investment strategies and examine the key drivers propelling the growth of AI markets. As AI continues to challenge norms, investor confidence, and interest in AI startups reach unprecedented levels, paving the way for substantial financial returns.

The Role of AI in Modern Investment Strategies

The year 2025 sees artificial intelligence solidifying its indispensability in crafting forward-thinking investment strategies. Investors are reallocating their portfolios to favor AI-driven companies, integrating artificial intelligence as a core component in decision-making processes. This shift not only accelerates growth but also provides a competitive edge in predictive analysis and risk management. Through tools like the AI index, investors can gauge market fluctuations and identify prime opportunities with enhanced precision.

AI startups are particularly appealing, presenting early-stage opportunities that venture capitalists find enticing. The allure stems from the potential for exponential returns as these startups scale and adapt innovative tech toward solving real-world problems. Moreover, the transparency and enhanced analytics offered by AI solutions ensure data-driven decisions, further instilling investor confidence. Venture capital is flowing into AI markets as investors vie to back innovations that propel the tech frontier.

Moreover, AI-enhanced algorithms allow investors to simulate market conditions and evaluate potential outcomes more accurately. These tools provide a granular insight into market dynamics that were previously unattainable, allowing a balance between analytical rigor and creative investment approaches. There’s a growing trend among tech investors to prioritize data and algorithms over gut feelings, shifting investments to sectors where AI shows the ability to disrupt traditional models. The narrative in 2025 is clear: integrating AI into investment strategies is transforming conventional perspectives, pushing boundaries, and offering new pathways for sustainable growth.

Key Drivers of AI Market Growth

The AI market’s growth in 2025 is driven by several vital catalysts, positioning it at the forefront of revolutionary tech landscapes. One of the primary drivers is the astounding increase in processing capabilities, which allows AI to analyze vast volumes of data with unprecedented speed and accuracy. This data-centric approach empowers AI to uncover insights, automate complex tasks, and foster innovations across various sectors, from healthcare to finance.

Investor enthusiasm is further fueled by the promising reports indicating AI’s potential to unlock trillion-dollar valuations, thus marking it as a beacon for venture capital. A profound shift towards AI is also evident in consumer behavior, with tech-savvy users demanding more personalization and efficiency, pushing industries to adopt AI solutions. Additionally, government policies fostering a supportive environment for tech adoption contribute to the robust growth atmosphere.

Early-stage funding for AI startups has surged, spurred by a combination of technological advancements and market necessity. Investors recognize the value in funding early, aiming to capitalize on future profitability as these startups mature. Collaboration between AI firms and traditional industries has produced synergistic benefits, creating a harmonious blend of technology with traditional industry acumen. As venture capitalists focus on scaling up these endeavors, the AI sector is poised for a growth trajectory that breaks conventional ceilings.

Looking ahead, it’s clear that AI’s integration into the market is not just a trend but a strategic evolution. Investors who harness this opportunity early are likely to reap significant rewards, riding the wave of innovation that defines this new era. As AI continues to permeate every facet of the market, its capacity to propel unparalleled technological growth remains undeniable, solidifying its role as a keystone of modern investment strategies.

Startup Funding Trends in the AI Sector

Funding trends in the AI sector are evolving rapidly as investors recognize the immense potential within AI startups. With venture capital channels widening and substantial amounts of financial backing being funneled into disruptive technologies, the landscape is rich with opportunities. Insightful data from recent funding rounds reveal emerging patterns, impacting both the market dynamics and startup investment strategies. Investors are keen on these trends to forecast future valuations and capitalize on AI’s unprecedented growth. In understanding these shifts, anticipation for AI’s impact on funding patterns is crucial for keeping pace with innovation.

Emerging Patterns in AI Startup Funding

The landscape of AI startup funding is witnessing a transformative phase marked by several notable trends. Emerging patterns indicate a heightened focus on niche AI technologies, drawing substantial interest from venture capitalists eager to leverage advanced AI’s capabilities. Specifically, there’s a notable surge in fundraising activities directed towards AI startups specializing in machine learning, autonomous systems, and AI-driven cybersecurity solutions. This targeted approach allows investors to concentrate their resources on sectors that exhibit the highest growth potential, propelled by market demand and technological advancements. As investors navigate this new territory, comprehensive market reports and wealth of data play pivotal roles in decision-making processes.

Venture capital is more selective than ever, channeling investments towards companies demonstrating clear paths to profitability and sustainability. Investors scrutinize AI startups for their scalability and adaptability in a rapidly changing landscape. This shift is underscored by the rise of early-stage funding rounds that emphasize strategic growth and innovation over rapid expansion. As AI startups progress through subsequent funding rounds, maintaining a strong trajectory of product development and market penetration is essential. Investors can capitalize on these opportunities by aligning themselves with AI companies that are not only equipped with groundbreaking technologies but also have robust business models that address real-world needs.

Moreover, AI-driven tools are reshaping how investors evaluate startup potential. Predictive analytics and data-backed insights empower investors to make informed decisions and optimize portfolio performance. This analytic rigor enables the identification of nascent trends within the AI sector, offering investors a competitive edge in capturing emerging opportunities. With AI facilitating enhanced precision in market analysis and startup evaluation, investors are better positioned to allocate capital intelligently. Therefore, staying attuned to these emerging patterns is vital for investors looking to unlock the immense potential within the AI sector, ensuring they are at the forefront of transformative technology financing.

Impact of AI on the Funding Landscape

AI’s influence on the funding landscape is both profound and multifaceted, fundamentally altering how investment decisions are made. The integration of AI technologies within financial ecosystems enables more nuanced and precise analyses of market conditions, leading to informed and strategic investment choices. Investors now rely on machine learning algorithms to scrutinize vast datasets, discerning market trends that were previously inaccessible. This evolution marks a significant pivot from traditional investment approaches, empowering investors with a deeper understanding of market dynamics and startup viability.

The ripple effects of AI on venture capital funding extend beyond technical analysis. By offering enhanced clarity and visibility, AI facilitates better forecasting of funding needs, enabling investors to allocate resources more efficiently across various stages of startup development. Investors are consequently shifting their focus toward AI startups that demonstrate tangible financial success and long-term stability. AI’s capacity to streamline due diligence processes and mitigate investment risks presents a compelling case for increased capital deployment within the sector.

Furthermore, AI’s role in fueling innovation cannot be overstated, as it accelerates the development of groundbreaking technologies that continuously redefine market expectations. This innovation drives a competitive funding landscape, with venture capitalists vying to invest in startups poised to be market disruptors. The strategic embedding of AI in investment frameworks offers unparalleled insights, steering capital towards ventures with sustainable and profitable growth trajectories. For investors, embracing AI means not just adapting to technological advancements, but also recognizing the broader implications for the funding landscape.

By appreciating AI’s impact on investment strategies, investors can leverage this cutting-edge technology to optimize their portfolios. The strategic adoption of AI tools fosters a dynamic interaction between technological innovation and financial growth, providing a robust foundation for the next wave of investment opportunities. As AI reshapes the funding landscape, the challenge and the opportunity lie in navigating these changes to capitalize on the unprecedented potential for growth and transformation.

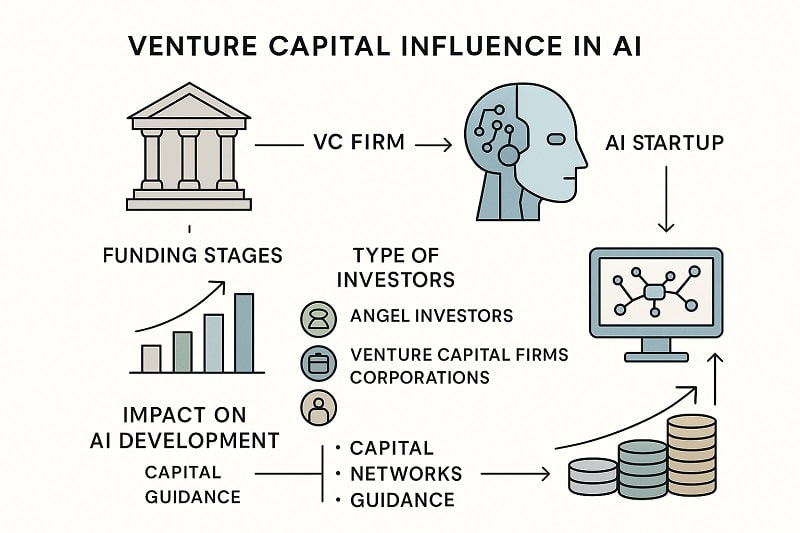

Venture Capital Influence in AI

The role of venture capital in artificial intelligence is pivotal, driving innovation and market growth as we stride into 2025. Investors are keenly aware of the significant influence these capital injections have on AI development, looking to exploit emerging funding trends that determine the trajectory of AI startups. Through strategic investments, venture capitalists wield substantial power in shaping the future landscape of technology. This section explores the significance of venture capital in AI’s progression and offers strategies for investors to successfully navigate AI ventures, leveraging data, market insights, and report analyses for maximized returns.

Significance of Venture Capital in AI Development

Venture capital is not just a financial catalyst for AI startups but a cornerstone that underpins the expansive growth and development within the sector. The influx of capital not only accelerates the maturation of nascent technologies but also fosters an ecosystem where innovation thrives. This capital injection is crucial as it allows AI startups to scale rapidly, address diverse market needs, and reinforce their positions competitively. With the AI market growing exponentially, the significance of venture capital lies in its ability to provide the necessary funding to meet increased demand for cutting-edge solutions.

The concept of series funding rounds becomes critical in this context, as these stages help startups strategically mature while mitigating risk. Initial seed funding establishes foundational growth, while later rounds such as Series A and B offer opportunities for scaling operations and enhancing technological capacities. As highlighted in various market reports, these stages substantiate the significance of venture capital by transforming innovative ideas into tangible market solutions, providing a roadmap for sustained growth and innovation.

Moreover, venture capitalists contribute more than just money, they offer strategic guidance that is invaluable for steering AI startups toward long-term success. This guidance often includes leveraging extensive industry networks and market insights to optimize growth strategies. These elements constitute a symbiotic relationship where AI startups benefit from capital influx and experiential knowledge, while investors gain equity stakes in potentially lucrative opportunities. Such dynamics underscore the strategic significance of venture capital within AI development, illustrating its pivotal role in propelling startups from groundbreaking concepts to market-ready solutions. For investors, understanding these dynamics is essential in harnessing the full spectrum of opportunities that AI development presents, ensuring that their portfolio diversification aligns seamlessly with future market trends and growth trajectories.

Strategies for Investors in AI Ventures

Navigating the bustling realm of AI ventures requires investors to adopt strategic approaches that not only capitalize on market dynamics but also anticipate future technological shifts. A keen understanding of funding trends becomes paramount, as these patterns offer vital clues into where substantial growth and innovation are most likely to occur. Investors seeking to optimize their involvement in AI ventures should prioritize engagement with startups that exhibit clear scalability and adaptability. Such traits ensure resilience against fluctuating market conditions and highlight potential paths toward profitability.

Investors are increasingly looking towards data-driven decision-making processes as AI offers tools that enhance precision in market evaluations. Leveraging advanced analytics, investors can now simulate various market conditions, scrutinize funding rounds, and strategize around potential returns. These insights allow investors to frame their approaches around factual, comprehensive market reports, minimizing risks while maximizing the prospect for returns. Moreover, aligning investments with AI ventures that exhibit a robust alignment between technological prowess and market needs is crucial. By focusing on startups with strong business models and clear value propositions, investors can better ensure that capital injections translate into measurable growth.

A modern investor’s toolkit includes staying attuned to the evolving regulatory landscape, which can significantly influence the trajectory of AI startups. Understanding these elements can prove beneficial when aligning investment strategies to maximize outcomes in compliance-sensitive markets. Additionally, strategic collaboration with venture capital partners can provide access to broader networks and expertise, fostering more informed and effective investment decisions. These partnerships can exponentially increase the potential for AI ventures to gain a competitive edge in saturated markets.

In conclusion, investing in AI ventures calls for an intricate balance between strategic insight and rigorous market analysis. By cultivating a deep understanding of AI’s potential and leveraging advanced analytical tools, investors position themselves to not only ride the wave of technological innovation but also forecast and mitigate potential risks. Such strategies, rooted in data and foresight, ensure optimal engagement and success in AI ventures, setting the stage for transformative growth in investor portfolios.

Opportunities and Challenges with Elevated Valuations

The landscape of AI startup investments is significantly shaped by the phenomenon of elevated valuations. While these valuations present lucrative opportunities for investors, they also bring a unique set of challenges. Understanding the interplay between the risks and rewards is crucial for those looking to invest in this high-stakes market. As venture capitalists assess the potential of AI startups, comprehending the nuances of growth, funding rounds, and raised capital becomes essential. This section unravels the complexities surrounding elevated valuations, offering insights to navigate these dynamics effectively in the rapidly evolving AI market.

Risks and Rewards of Elevated Valuations

Investing in AI startups at elevated valuations can be a double-edged sword for investors. On one hand, these valuations often reflect the potential for significant returns, fueled by the robust demand in the AI sector. Investors entranced by the promise of growth are keen to engage in these opportunities, hoping to leverage the thriving AI market driven by innovations and breakthrough technologies. Elevated valuations can be an indicator of a startup’s trajectory, aligning closely with strategic series of funding rounds that aim to scale operations and enhance technological capabilities. As venture capital pours into these ventures, the promise of returns appears enticing, bolstered by data suggesting continued market expansion.

However, the challenges can’t be overlooked. Elevated valuations can inflate beyond the actual value, sometimes driven more by competitive pressures and market euphoria rather than intrinsic asset worth. This amplifies the risks for investors, as any market correction can drastically impact returns. Investors must be vigilant, utilizing comprehensive market reports to study each opportunity’s authenticity. An analysis of trends in AI startups, coupled with data-driven insights, provides a clearer picture of a startup’s viability amidst elevated valuations. These efforts mitigate potential risks associated with overvaluation.

Further, despite the inherent risks, the rewards of investing at elevated valuations can’t be underestimated. Savvy investors who meticulously study growth indicators and funding round reports can identify AI startups poised for success. These startups often exhibit a keen ability to adapt and innovate, aligning their offerings with market needs and leveraging AI’s unique capabilities. The well-timed capital influx enables startups to push the boundaries of technology, making them attractive prospects for investors eyeing long-term gains.

For those invested in AI, understanding the complex dance between risks and rewards at elevated valuations is paramount. It’s about balancing the allure of immediate gains against the backdrop of potential pitfalls. Investors need to maintain a nuanced approach, relying on a blend of data-driven decision-making and strategic foresight. This ensures a well-calibrated investment strategy that adapts to the evolving demands and presents a pathway to harness the best of what the AI market has to offer. Engaging with these dynamics carefully will position investors to capitalize on AI’s explosive potential, turning risks into calculated steps toward unprecedented returns.

Future Outlook for AI Investment

The future outlook for AI investment is shaping up to be both promising and transformative, presenting numerous opportunities for investors. As we move towards 2025 and beyond, venture capital is expected to play a crucial role in driving innovation and growth within AI startups. The anticipation of robust funding rounds and substantial market growth fuels optimism. Investors are particularly interested in the data-driven strategies AI offers, allowing them to predict market dynamics and make informed decisions. This outlook promises substantial returns as AI continues to revolutionize investment landscapes and challenge traditional models.

Predictions for AI Funding in the Coming Years

As an investor, forecasting AI funding trends can be akin to reading a complex but rewarding map. The AI investment landscape is expected to evolve significantly in the coming years, with predictions pointing towards heightened activity in various funding rounds. The way AI startups are driving innovation, investors can anticipate a surge in series funding rounds as these companies mature and their technological capabilities expand. Experts predict that AI funding will continue to grow as high demand meets a competitive venture capital market looking to capitalize on the latest AI innovations.

A crucial factor influencing these predictions is the sustained growth of AI markets. Market reports indicate that AI’s integration into sectors like healthcare, finance, and logistics will require expanded investment to fuel necessary technological advancements. Data from recent trends suggests that AI startups will capture more substantial shares in venture capital portfolios, thanks to their promise of long-term growth and scalability.

Moreover, as AI algorithms become increasingly sophisticated, their applications broaden, leading to more startups attracting higher valuation during their funding rounds. This trend is already evident with certain AI sectors outpacing others in raised capital, primarily those involved in machine learning, deep analytics, and autonomous technologies. These sectors show the highest potential for disruption, drawing significant interest from both venture capitalists and individual investors.

The coming years will likely see investors placing a premium on AI startups’ ability to leverage data for unique, market-ready solutions. This will steer funds towards AI companies that not only innovate but do so with a clear path to revenue generation. Investors should thus keep a keen eye on these evolving dynamics, recognizing that the landscape will require not just quick adaptation but also strategic foresight. By anticipating these changes now, investors position themselves at the forefront of an AI-driven future, ready to capitalize on its boundless opportunities. The message is clear: those who invest strategically in AI today are setting the stage for substantial returns as the technology matures and solidifies its role as a pillar of the modern economy.

As we approach 2025, AI startup funding is anticipated to present unprecedented opportunities for investors who stay ahead of trends. With the integration of AI into diverse industries, the potential for high returns cannot be overstated. Understanding these evolving funding landscapes and leveraging expert insights can ensure informed investment decisions. Whether you’re a seasoned investor or new to AI, capitalizing on the latest funding trends is crucial. Stay proactive by downloading our comprehensive guide on AI investment strategies and join our network to engage with innovative projects set to transform the future. Seize the AI investment wave today!

FAQ: AI Startup Funding Trends for Investors

What are the primary growth opportunities for AI investments in 2025?

In 2025, AI investments see substantial growth opportunities in machine learning and autonomous systems, driven by increased market demand and technological advancements.

Why is venture capital crucial in the AI sector?

Venture capital is crucial in the AI sector as it provides necessary funds for innovation, technology scaling, and startup expansion. This financial backing supports AI companies in developing pioneering solutions and achieving scalability.

What challenges do investors face with elevated valuations in AI startups?

Investors face both opportunities and risks with elevated valuations. While they promise significant returns due to AI’s high growth potential, they also pose risks if valuations outpace actual market value without clear profitability and sustainability paths.

How is AI reshaping investment strategies?

AI is reshaping investment strategies by enhancing predictive analysis, risk management, and decision-making. Machine learning algorithms and AI-driven insights allow investors to make data-driven decisions, optimizing portfolio performance and uncovering opportunities.

What are the key trends affecting AI funding in 2025?

Key trends include a surge in AI funding rounds, a focus on AI-driven cybersecurity, machine learning, and autonomous systems, and increased interest from venture capitalists in AI’s potential for disruption and long-term growth in various industries.