If you have been influenced in any way by high-quality investing research, I promise you’ll want to know what Brad Thomas has to say how he built back his fortune. He made it with a handful of insights, that anyone can put to work, from his network of ultra-wealthy friends and contacts.

Here you will read the most important details from the most recent interview with Brad. We also reviewed in detail his research called Wide Moat Confidential. At Wide Moat, from 2016-2021, Brad built a model portfolio that had annualized gains of 44% over five years, which is almost three times what the S&P 500 recorded during that time.

Who Is Brad Thomas?

Brad’s personal story is both captivating and motivating.

He grew up in Greenville, South Carolina, raised by a single mother in an industrial town focused on textiles. After college, he ventured into real estate by developing shopping centers and industrial complexes. And by 2008, he had built up quite a substantial empire. A few years earlier, his equity reached approximately $25 million.

Unfortunately, he later lost it due to a partnership that went wrong. Brad faced a challenge of providing for his five kids while teetering on the edge of bankruptcy.

Since then, he’s managed to rebuild a similar fortune, largely as a stock investor, thanks to connections with billionaires and other ultra-wealthy individuals who have introduced him to deals and opportunities that few others on the planet will ever encounter. During the interview he said he focused his energy to stocks because everything he could do in real estate and entrepreneurship he could do more quickly and effectively in stocks.

Brad started sharing world-class investment insights from his kitchen table, despite having almost NO audience. He has written four books on real estate investing, including The Intelligent REIT Investor, a book about Donald Trump’s real estate empire. And most recently, the popular guidebook REITs for Dummies.

He has now written more than 5,000 articles and became the No. 1 author on Seeking Alpha. By the way, he published another investing letter that merged with Forbes. He was also an adviser to a U.S. president. However, the most significant and exciting chapter of his remarkable transformation is the one unfolding right now.

Brad Thomas REIT-focused ETF

Last year, he launched a REIT-focused ETF on the New York Stock Exchange. The acronym REIT stands for real estate investment trust. Anyone can purchase this kind of stock, which was created by Congress over 60 years ago to provide investors with access to real estate that generates revenue. To put it briefly, by law REITs receive a few federal tax benefits in return for distributing 90% of their taxable revenue to shareholders, usually in the form of quarterly or monthly payments. And if you understand how they’re valued, you could see tremendous capital appreciation.

If high-quality, market-beating investing was simple, everyone would do it and would build multimillion-dollar fortunes. Brad has achieved this on two separate occasions. While he can’t simply pass on that wealth to you, he can offer you a strategy that may yield significant returns. Here’s more about his research.

What Is Wide Moat Confidential?

This is Brad’s brand-new small-cap stock research letter called Wide Moat Confidential. It includes a model portfolio of a specific group of stocks with at least triple-digit upside – and 5 times to -10 times upside in a few cases – over the next few years, based on the knowledge and experience Brad gained from his network of billionaire and multimillionaire friends. All of Brad’s recommendations are going to be exclusively available to people who sign up for this research letter.

He believes even a modest allocation to a handful of his ideas could account for 70% or 80% of the total gains you could see over the next few years.

Wide Moat Confidential is about targeting triple-digit gains or higher, every time, in small stocks across the entire market with Brad’s favorite wide-moat characteristics. It is not focused on a specific sector; it is looking for asymmetrical market opportunities.

Where You’ll Find The Wildly Asymmetrical Market Opportunity Today?

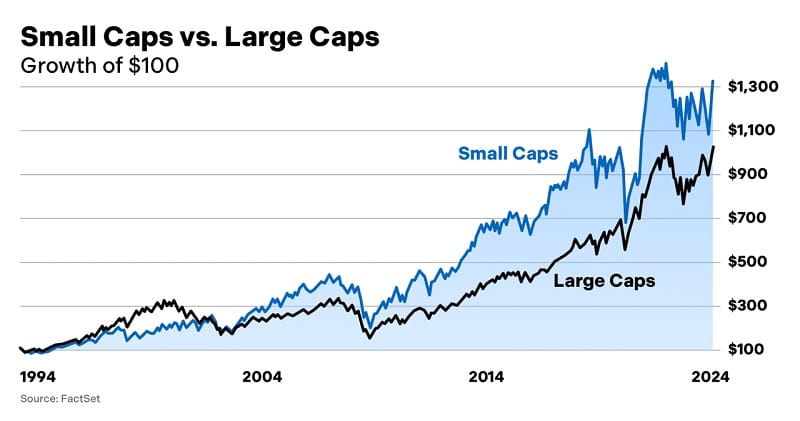

Brad sees once in a generation opportunity coming on the market in small-cap stocks. Small caps are the cheapest they’ve been in 25 years. He sees potential for small caps no matter the economic environment.

What will be the trigger? Answer is short: rate cuts are the rocket fuel for small-cap stocks.

Smaller companies tend to rely more on borrowing than larger ones, so lower interest rates directly reduce their costs, boosting their earnings.

Additionally, rate cuts provide access to cheaper financing in the future, enabling these companies to invest in their growth. They can expand operations, construct new facilities, and enhance their capabilities—all of which drive further growth.

On the other side small caps have dramatically outperformed large caps over the long term. Here’s a 30-year chart.

Truth is small caps are more volatile, and that’s a real drawback for some people.

But Brad’s strategy is focused on income, which is a way to get paid while you wait for big potential gains. He is focused on the ideas he has developed thanks in part to his billionaire network – and tied to the unbelievable sums of wealth that they’re investing and spending, a lot of which is flowing back into the markets today.

What Is Included With Wide Moat Confidential?

Brad has spotted a once-in-a-generation opportunity, fueled by the upcoming interest rate cut cycle, AI, a market rotation out of big stocks like the Magnificent Seven, and the absurd undervaluation in small caps. He included all these opportunities in the Wide Moat Confidential package. Here is everything you will receive:

- 50% OFF1 year of Brad Thomas’s Wide Moat Confidential ($5,000 value). You’ll receive one full year access at the special price of just $2,500.

- PRIMER REPORT: The Wide Moat Confidential Manifesto.

As a new Charter Member, this report is a good start. Inside Brad will outline his general plan for Wide Moat Confidential. This covers risk management, the process for selecting small-cap equities, and the reasons why tiny businesses have performed better in the long run.

- BRAND-NEW REPORT: The No. 1 Opportunity of My Life: 500% Upside as Landlord to Billionaires.

This is the first opportunity Brad wants you to grab. You’ll receive all the details of Brad’s top recommendation, a company with triple-digit growth potential—emerging at a uniquely opportune moment for high-quality small-cap stocks.

This virtually unknown company is poised for explosive growth, driven by insatiable demand, strong pricing power, and a client base of centi-millionaires and billionaires.

Now, for the first time, you’ll be among the select few with the chance to act on his recommendation.

- BRAND-NEW REPORT: The “Secret” Banking Business that Could Double Your Money or More.

You can start earning an income yield of over 10% as soon as you purchase this stock, and you might potentially double or even triple your investment. Following the billionaire money in markets that few people are aware of or have access to is another excellent strategy to capitalize on that enormous advantage.

- BRAND-NEW REPORT: The Three Best “Wide Moat” Stocks to Buy for the Small Cap Surge.

You’ll learn everything there is to know about the three “wide moat” stocks that are currently worth purchasing.

Brad sees hundreds of percent potential in One, which is arguably the best little business to invest in the future of driverless cars. Another is an energy bet with an immediate dividend yield of around 6 percent or more.

- FREE BONUS: The ‘Virtual Monopoly’ Casino Landlord with 100%-Plus Upside Potential ($2,500 value). At the most recent Alliance conference hosted by Stansberry Research, where attending would have cost you at least $2,500, Brad gave this presentation.

You will learn the name, ticker, and complete analysis of a stock that Brad believes is a very good investment with the potential for both income and capital gains, and it is now trading at a discount. According to him, the price would need to more than double in order to catch up to the S&P 500’s average valuation.

- 1 FREE YEAR of Brad Thomas’s The Wide Moat Letter ($499 value). Additionally, you will receive Brad’s premier scholarly journal, The Wide Moat Letter, for a full year. You will also get a complete access to the model portfolio, issues, updates, special reports, “buy now” opportunities with yields of up to 8%, and a lot more.

- As of right now, readers may see open gains of up to 192%, 296%, and 809%, among many more. Normally, it costs $499 annually, but if you take advantage of this offer now, you may have it for free.

- FREE BONUS REPORT: Wall Street’s Favorite Cash Machine ($1,500 value).

This collection of stocks offers a unique opportunity typically reserved for hedge funds or high-end wealth managers, often needing at least a million dollars to participate. However, anyone can now access these investments through the stock market, regardless of budget.

These stocks possess a remarkably tax-efficient framework similar to REITs and present a simple means to potentially earn double-digit yearly yields, along with the potential for impressive capital appreciation.

Brad strongly advises purchasing three specific stocks as soon as possible.

- FREE BONUS REPORT: Small Cap Growth Engines ($1,500 value).

This is an extremely bullish “watch list” with enormous upside potential that consists ten of Brad’s favorite small stock opportunities in his area of expertise.

These are businesses that Brad knows very well that he has personally investigated in great detail, frequently discussing with management, and that stand to gain greatly from declining rates.

Brad will notify you when he believes it is ideal to take action on each one.

- FREE BONUS:Inside Access: Brad’s No. 1 Small Cap CEO & CFO Interview ($1,000 value).

In this exclusive on-camera interview that Brad held with the CEO and CFO of his top small cap pick, you’ll discover the remarkable potential in this stock valued at under $1 billion. It will illustrate what can be achieved when you have an authentic network of influential individuals and strong company leadership.

- Brad’s full Wide Moat Confidential model portfolio of small cap opportunities that could pay you income with at least triple-digit upside – and 5x-10x upside in a few cases as this opportunity in small cap stocks unfolds.

- Special Updates throughout the month, telling you when to lock-in gains and any new developments.

- 30-day 100% Satisfaction Guarantee. While there are no cash refunds, you can get a FULL credit refund that you can use for any product from Stansberry Research, Chaikin Analytics, or Altimetry. Just get in touch with their Member Services team at any time during the first 30 days of purchase.

Wide Moat Confidential: Pros & Cons

Pros

- Heavily discounted offer. This package of research is worth $11,999 in total, yet it costs just $2,500 to get started today. That’s nearly 80% discount.

- Relatively long-term results. The types of companies recommended have the potential to double in 12 to 18 months.

- Small caps have greater room for financial gain.

Cons

- Small-cap recommendations have lesser brand-name recognition and respect and greater volatility.

- No cash refund.

Is Wide Moat Confidential Worth It?

There are many opportunities to start building your wealth: hedge funds, private-equity deals, or building a small business and selling it to one of these billionaires, etc. But you don’t have to work so hard. You can do the same thing with ordinary, public-market investments that anyone can buy – if you know where to look. Wide Moat Confidential will show you exactly how to find those kinds of opportunities.

Brad Thomas is certainly not known for making risky, speculative bets. He is well known for rigorous analysis of income plays, including a large number based on his deep background in real estate. He also popularized the term “SWAN”, or “sleep well at night” investing. So, you do not need to take high risk to follow his recommendations.