Triple Digit Returns is a weekly service recommending stocks with “triple digit return” potential. Previously edited by Manny Backus and Michael Carr, Ian Cooper took over in 2017.

— RECOMMENDED —

Gold prices just surged to the highest level in a year and could be on the verge of the biggest bull run in half a century. (It gained 1,700% during the high-inflation 1970s.) Now, a top analyst says you can capture ALL of the upside without touching a risky miner or a boring exchange-traded fund. He sees 1,500% potential gains long term with very little risk.

Cooper has helmed several other newsletters in the past, including Triple Digit Options and Pure Asset Trader for Angel Publishing.

Table of Contents

Triple Digit Returns – How it works?

Triple Digit Returns looks for companies with the potential to become tomorrow’s biggest winners.

Triple-Digit Returns is THE best way to…

- Earn big, fast gains – You have to know what’s hot in order to take the market for consistent multibaggers, and this service tells you exactly which stocks are primed to pay out stacks of cash.

- Kill the risk – Small stocks are normally associated with risk… but not when you have a service behind you that specializes in keeping risk out of the equation.

- Keep the money rolling in – The best traders don’t win every trade, but they win most of them. With this service, you’ll be able to join an elite group of traders and have the opportunity to bank large, steady gains along the way.

- Build a bankroll – Small stocks mean one thing… you can start with just a few bucks and turn it into a huge wad of cash. And you can do it quickly.

- Start trading today – No matter your level of expertise, you can start collecting triple-digit returns immediately.

— RECOMMENDED —

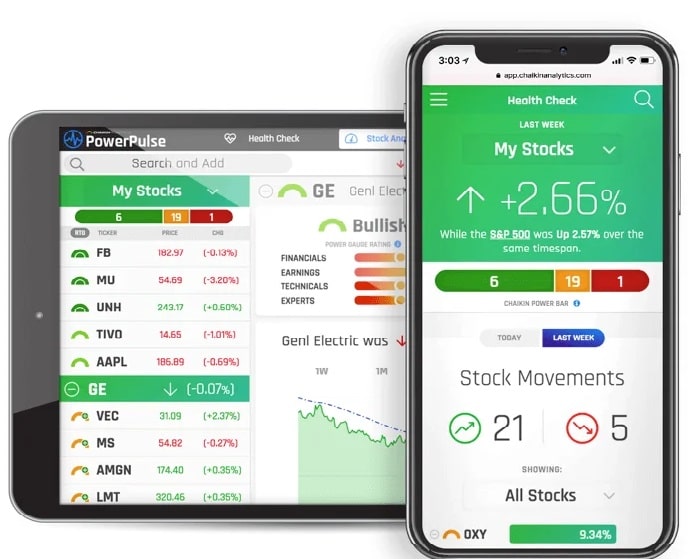

A New Way To See Which Stocks Could Double Your Money

We want to give you FREE access to the Power Gauge system ($5,000 value).

Claim FREE access to The Power Gauge Here

Who the heck is Ian Cooper – the Editor of the Triple Digit Returns Service?

Ian Cooper has been a newsletter pundit for a long time, I’ve mostly noticed him covering options trades and tech, biotech and natural resources stocks… Over the last 20 years, he has leveraged a blend of technical, fundamental and news analysis to succeed with stocks, options, and ETFs.

He was one of the few that called the bottom and top of housing, the top of subprime and Alt-A, the death of Lehman Brothers and Bear Stearns, the collapse of the UK economy, and the Dow’s drop to 6,500.

He even called for gold to rally well above $1,000 when it traded under $850.

He has shown thousands of investors how to exploit “market extremes” for lightning fast, short-term gains.He developed seven proprietary indicators that have led to successful calls on the biggest spikes and dips in the markets.

The single-most important secret to bagging triple-digit gains is by finding THE most undervalued stocks in the market.

There are 5 types of companies Ian looks for when he has triple-digit gains in mind (which is EVERY time when he buys).

THE MISUNDERSTOOD:

There are tons of companies out there that seem like “bad opportunities” because their share prices are down.But this is one of his favorite type of stocks to look at. Because Ian wants in while others aren’t taking notice. Always remember Apple. As recently as 2009, the company was in the dumps, trading for around $12 per share. Yet, if you’d had the foresight to buy at that time, you’d be sitting on more than 1,200% gains.

THE LOST DARLINGS:

This is similar to the misunderstood stock but with one major difference.These companies are those that have been steady earners for many years but endured a big drop for one reason or another.Based on their long track records, though, you now they’re going to bounce back. Exxon is a prime example. In 2010, share prices tanked, hitting a low of $57. Yet those who realized this was a temporary dip cashed in big time. Months later, shares had rebounded to more than $100 – nearly doubling the stakes of those who got in while the stock was beaten up.

MONEYMAKING MERGERS:

Mergers can be horrendous decisions. But they can also be massive moneymakers if you know what to look for.For instance, when Disney merged with Pixar in 2006, the ordinary investors might have been apprehensive. Disney’s share price was at a modest $27 at the time, and while the merger was a huge deal, some folks were probably scared it could backfire. It didn’t.And those who took notice nailed triple-digit gains as the stock broke the $100 marker over the next few years.

BABY COMPANIES:

These are otherwise known as spinoffs, and they can be a powerful way to make money in short order. For instance, you might remember when Marathon Oil spun off Marathon Petroleum in June of 2011. If you don’t recall it, just keep this in mind: In the two years after the spinoff occurred, shares of Marathon Petroleum steadily rose from $37 to $95. A triple-digit winner and a bona fide moneymaker.

FOLLOW THE FUNDS:

This is one most people never do. Yet it can be one of the best ways to bag triple-digit winners on the regular.Put simply, once you know where the fat cats are putting their money, it’s probably a good idea to follow suit. Of course, you have to know what you’re looking for, but there are many instances where stocks have skyrocketed after the likes of Buffett have sunk their money into a company. Just look at BJ’s Restaurants. They were a penny stock at one point… until the big money poured in.

The result?

The stock went from $1 to more than $50, resulting in 5,000% gains for those who played this opportunity correctly.

As you can see, Ian Cooper has a very specific list of things he looks for and that is a brief version of how you could earn triple-digit gains time and time again.

What You Gonna Get when you invest your money in Triple Digit Returns Service?

Here’s What You’ll Receive:

- Weekly Profit Picks: Every week he will send you a play that he believes is primed for a triple-digit run. Each play will be picked using his proprietary strategy that has proven to nail triple-digit winners with regularity. Even if you only take action on one play per month, that’s still 12 potential triple-digit winners over the course of a year. Imagine what that would feel like.

- Weekly Follow–Ups: At the end of each week, Ian will make sure to send you a summary of the picks he sent out, how they’re doing, and you’ll see how much money you should have made.

- Members-Only Website: Accurate knowledge is crucial to your success as an options trader. That’s why they have a special website to keep you on the cutting-edge. You’ll find archives of past alerts, time-sensitive trading information and special extras as they become available.

- Full Support: Any time you have a question, you can either email or call their support center.

- Premiere Report – The $15 Company Vital to the Future of Apple, Amazon and Samsung: As a premiere Triple-Digit Returns member, you’ll get this report, which Ian will send out to those who are ready to take action today. This report will detail the name ticker symbol and exactly how to take action on this incredibly undervalued $15 tech “enabler”… as well as how soon you could see gains rolling in.

- FREE Bonus Report #1 – How to Identify When a Stock Is Starting to Trend. In this special report, Ian Cooper reveals the details of a highly reliable indicator that tells investors when a trend is starting and then signals when the trend is over.

- FREE Bonus Report #2 – 5 Chart Patterns That Consistently Make Money for Investors. These five patterns have been shown to consistently make money for investors. (A $49 value)

- FREE Bonus Report #3 – 7 Cheap and Good Stocks to Buy Right Now. Cheap and good are usually two competing qualities of a stock. It can be incredibly hard to find a company that offers you both. In this special report we share the reasons these 7 stocks in particular are both cheap AND good right now. (A $197 value)

Tell me more, please