Learn short-term trading strategies to navigate the government shutdown this week. Practical insights and options tactics for active investors.

Why Shutdown Weeks Test Traders Like Nothing Else

Every trader knows the markets hate uncertainty. But few events bring chaos into the system quite like a government shutdown. It’s not just about furloughed workers or delayed economic data—it’s about the ripple effects that touch every corner of the market.

And if you’ve traded through one of these before, you know the drill: headlines every hour, volatility in both directions, and plenty of investors either freezing up or overreacting. The question is simple: Do you sit it out, or do you find a disciplined way to trade the swings?

I’ve seen people lose weeks’ worth of gains in a single bad decision during shutdowns. I’ve also seen disciplined traders walk away with outsized profits by treating the chaos as opportunity. That’s what we’re talking about today: how to apply short-term trading strategies that don’t just survive shutdown week, but potentially thrive in it.

I’ve Been in That Seat Too

I remember my first shutdown trade. It was years ago. I was holding a small position in an industrial stock, thinking it wouldn’t be affected much. Then the headlines hit about delayed federal contracts—and my position tanked 12% overnight. I was caught flat-footed.

The mistake wasn’t holding the stock. The mistake was not having a strategy for an event-driven market. Since then, I’ve built playbooks for shutdown weeks that I lean on. They’re not magic formulas. They’re practical tactics rooted in probabilities, risk management, and—most importantly—discipline.

That’s why I trust services like Options360 by Tradesmith, which gives traders frameworks and option strategies designed for short-term market moves. Because I’ve learned the hard way: in times like these, winging it doesn’t work.

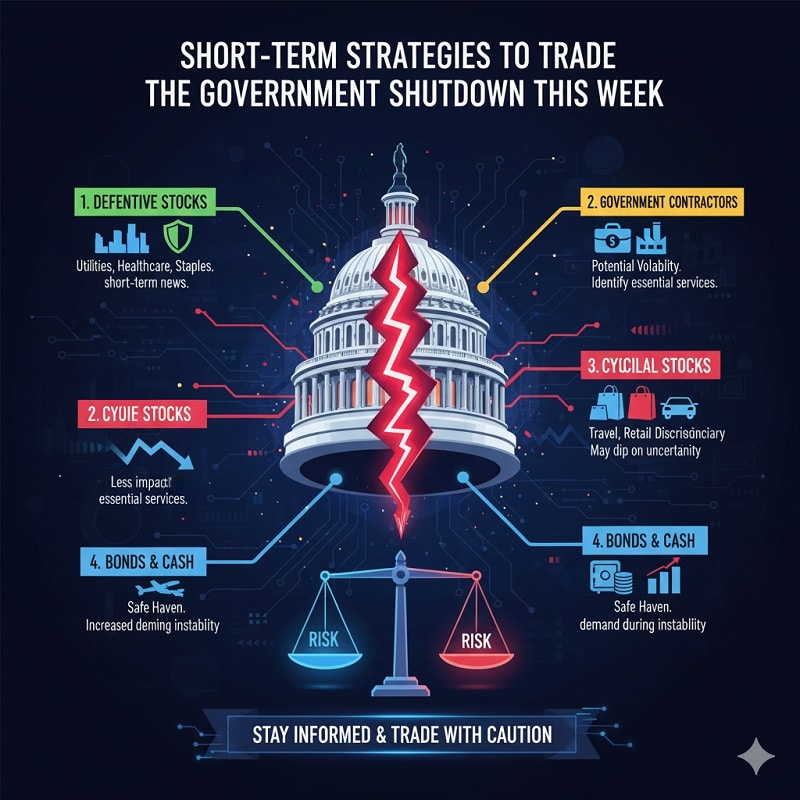

4 Key Short-Term Strategies for Shutdown Trading

Shutdowns aren’t random. They hit predictable sectors hardest and create volatility that can be traded. Let’s break this into four clear strategies:

Focus on Volatility, Not Headlines

Shutdowns create endless chatter. Traders glued to the news ticker tend to overtrade and get chopped up. The better play is to focus on the volatility metrics themselves: VIX levels, implied volatility in options, and sector ETFs that move sharply on policy news (think defense, healthcare, and Treasuries).

For example, when shutdown headlines flood the tape, the SPDR S&P 500 ETF (SPY) often sees surging options premiums. That’s where short-term option spreads come into play. Instead of gambling on “up or down,” disciplined traders use structures like iron condors or straddles to capture volatility itself.

This is the type of approach you’ll see explained inside Options360, where the framework isn’t about guessing headlines—it’s about structuring risk around volatility.

Identify Shutdown Winners and Losers

Shutdowns aren’t blanket selloffs. They create relative winners and losers. For instance:

-

Losers: Government contractors, travel-related industries, small-cap financials waiting on federal data.

-

Winners: Safe-haven plays like gold, defense ETFs on the assumption of delayed budget fights being resolved with more spending, and sometimes even big tech as liquidity piles into fewer “safe growth” names.

Short-term traders should look at pairs trades: long a potential winner, short a likely loser. This neutralizes broad market risk and lets you profit from relative moves.

When I traded the last shutdown, I paired a long in GLD (gold ETF) against a short in an airline ETF. It wasn’t a home run, but it was a steady gain in an otherwise messy tape.

Trade Short-Term Options With Tight Risk Controls

This is not the week to get “cute” with naked calls or puts. The move is to use defined-risk trades: vertical spreads, calendar spreads, or debit spreads. That way, if the market gaps on a wild headline, you don’t get blown out.

I’ll give you an example. During a past shutdown, I used a simple SPY put spread: buying a near-term put, selling a further out-of-the-money put. My max risk was known up front, and the position profited when volatility spiked even though the market only dipped slightly.

This is the heart of why I point traders toward Options360 by Tradesmith: it’s all about designing trades with asymmetric payoffs while keeping losses defined.

Keep Timeframes Ultra-Short

Shutdowns rarely drag markets in one straight line. Moves come in bursts. That means your trades need to be shorter than usual. Instead of holding for weeks, think in days—or even intraday swings.

One framework I use is:

-

Enter when volatility spikes on a headline.

-

Exit partials quickly when the market digests the news.

-

Roll profits into tighter risk trades for the next round of headlines.

It’s a rinse-and-repeat cycle, but it works because you’re treating the shutdown as a volatility machine, not a long-term trend.

“What If I Get Whipsawed?”

This is the number one fear traders have in shutdown weeks. And it’s valid. Headlines can reverse the market in minutes. The key is this: don’t try to predict every move. Instead, structure your trades so that whipsaws hurt less and volatility itself is profitable.

That’s why short-term spreads, pairs trades, and defined-risk options matter so much here. You’re not betting on perfect timing—you’re putting yourself in position to benefit from the market’s behavior.

When people tell me shutdowns are “too dangerous” to trade, I ask them: is it dangerous, or is it undisciplined? With the right framework, shutdown volatility isn’t something to fear—it’s something to harvest.

Why Now Matters

Shutdown weeks don’t come around often, but when they do, they create compressed windows of opportunity. That’s why sitting on the sidelines can actually be riskier—you risk missing short, sharp moves that can add meaningful returns to your account.

Here’s the truth: you don’t need to reinvent the wheel this week. The Options360 by Tradesmith service already provides the playbook: real-time trade alerts, risk-managed option strategies, and a framework for trading event-driven volatility without guessing.

If you want to stop reacting emotionally to shutdown headlines and start trading with a plan, this is the moment to check out Options360. Because by next week, the window may have already closed.

Final Word

Shutdowns are messy. But messy markets are where short-term traders make their mark. The difference is whether you go in blind—or go in prepared. With volatility high, sectors diverging, and options premiums elevated, this is a rare chance to trade with leverage and discipline.

I’ve learned the hard way not to fear shutdown weeks but to respect them. And with the right tools, they can be some of the most profitable weeks of the year.

So the only question left is: are you ready to trade this shutdown, or are you going to let the headlines trade you?

Frequently Asked Questions: Trading the Shutdown

What typically happens to the stock market during a government shutdown?

Shutdowns rarely crash the entire market outright. Instead, they create pockets of volatility and uncertainty. Certain sectors tied directly to government spending—like defense contractors, small-cap financials, or airlines—often stumble. Meanwhile, safe-haven assets like gold or Treasury ETFs sometimes rise.

For short-term traders, that’s less about panic and more about opportunity. By using option spreads or relative trades, you can position around the expected “winners and losers” rather than guessing the broad market’s next move. Services like Options360 help frame those opportunities with actual trade setups rather than leaving you to guess.

Is it risky to trade during a shutdown?

Yes—if you’re trading without a plan. Shutdown weeks are headline-driven, and markets can swing in opposite directions multiple times a day. That makes it easy to get whipsawed if you’re chasing every move.

The smart approach is to use defined-risk option strategies where your maximum loss is known upfront. Think spreads, not naked calls or puts. That way, you can take advantage of volatility spikes without putting your entire account on the line.

Should I just sit out the shutdown instead of trading it?

That depends on your style. Long-term investors who don’t want to bother with short-term volatility might sit out. But active traders often find shutdowns to be some of the richest short-term environments of the year.

If you have a framework like the one inside Options360 by Tradesmith, you don’t need to sit on the sidelines. Instead, you can participate in the volatility with positions designed for short holding periods and clear risk management.

How do options traders benefit from shutdown volatility?

When shutdown uncertainty ramps up, implied volatility in options usually spikes. That means option premiums get more expensive. Traders who understand spreads—like iron condors, straddles, or verticals—can actually profit from that volatility pricing without needing the market to make a huge directional move.

It’s less about being “right” on the headline and more about being positioned to take advantage of the market’s behavior. That’s exactly the kind of approach Options360 teaches and executes with live alerts.

Which sectors are most sensitive to shutdowns?

Historically, the most sensitive areas include:

- Government contractors (delayed payments, contract risks)

- Airlines/travel (reduced government travel, TSA delays)

- Financials (lack of federal data releases slows lending/forecasting)

- Consumer confidence plays (retail, small caps)

On the other hand, safe-haven sectors like gold, Treasury ETFs, or sometimes even mega-cap tech attract flows. The key for traders is not to bet blindly on one outcome but to look for pairs trades—long the relative winner, short the likely loser.

What’s the best short-term strategy to use this week?

The “best” depends on your risk tolerance. For many traders, the safest approach is to use short-term option spreads—vertical spreads, debit spreads, or straddles on high-volume ETFs like SPY or GLD. These setups define your risk, limit your exposure, and let you profit from volatility whether the market jumps or dips.

If you’re looking for guided, actionable strategies, that’s where something like Options360 by Tradesmith becomes valuable—it lays out real trades you can follow, with entries, exits, and the risk already calculated.

What if the shutdown ends sooner than expected?

That’s always the wildcard. If lawmakers cut a deal faster than markets anticipate, you might see a relief rally and volatility collapse. For option traders, that’s where defined-risk trades help: if volatility collapses, your losses are limited and known upfront.

Disciplined traders plan for both scenarios—shutdown dragging on and shutdown ending early. Without a plan, you risk being on the wrong side of the surprise. That’s why structured strategies are so important this week.

Do shutdowns have any lasting impact on markets?

Historically, not much. Markets often rebound quickly after shutdowns end, and long-term trends take back over. But in the short term, shutdowns can distort pricing, delay key data releases, and trigger temporary dislocations.

For traders who specialize in short-term moves, that’s the sweet spot: trade the dislocations now, while they’re hot, then step back when the market normalizes.

Can shutdown volatility be traded multiple times in the same week?

Absolutely. Shutdown headlines don’t just hit once. They drip out: negotiations failing, partial funding deals, procedural votes, or even statements from policymakers. Each headline can spark intraday moves.

This is why short-term frameworks (enter on spike, exit on digestion, repeat) work so well here. You’re not just trading “the shutdown.” You’re trading each burst of volatility it creates.

Closing Thought

Shutdowns bring chaos, but they also bring rhythm if you know where to look. Volatility spikes, sector divergences, option premiums inflating—these are all patterns you can trade. The difference between frustration and profit is whether you approach it with discipline.

And if you want to skip the trial-and-error of building your own shutdown playbook, Options360 by Tradesmith already has one. The setups are live, the risk controls are in place, and the strategies are designed for traders who want to seize this week’s volatility without letting the headlines seize them.