Study how bond premiums and discounts work and then decide which works better for what you hope to achieve with your bonds. A clear and straightforward bond comparison guide.

What Are Premium Bonds?

A premium bond is a bond that sells for more than its face value. Investors are paying a premium for these bonds, often because the coupon rate is higher than what’s offered elsewhere.

Why Do Bonds Sell at a Premium?

Bonds are usually sold at a higher price when:

- The coupon rate is greater than what you can find in the current interest rate market.

- Because the issuer has strong credit, the bond becomes more attractive.

- Many investors are willing to spend more for a reliable source of high income.

If the market interest rate is 4% and a bond pays 6%, investors will pay more than the bond’s face value to get the higher return.

Example of a Premium Bond

Suppose a corporate bond is issued for $1,000 and pays interest of $60 each year (6%). When market interest rates fall to 4%, new bonds have lower interest rates. As a consequence, investors could be ready to buy the older bond for $1,100 or more which makes it a premium bond.

What Are Discount Bonds?

A discount bond is one that is being traded at a price less than its face value. So, investors can buy these bonds at a lower price than they will receive when the bond matures. The discount is usually caused by a lower coupon rate than the rates being offered in the market today.

Why Do Bonds Sell at a Discount?

Bonds are offered at a discount when:

- The coupon rate is less than the current interest rates.

- It is a bond that carries risk of default or is nearly due, so its returns are minimal.

- Because of the better choices available in the market, older bonds are becoming less appealing.

People buy these bonds in the hope that they can earn profit when the bond is redeemed at its face value.

Example of a Discount Bond

For example, a bond that is worth $1,000 on paper is being sold for $950 in the market. This may occur if the bond offers 4% interest, but new bonds are giving 6%. Since the older bond pays out less, investors get it at a lower price which is why it is called a discount bond.

A zero-coupon bond is a typical example—you get no interest, but it sells for much less than its face value and repays the full amount at the end.

Key Differences Between Premium and Discount Bonds

Learning the main differences between premium and discount bonds is necessary for making good investment choices. Because they differ in pricing, yield, taxation and risk-return, bonds can affect your portfolio’s overall results.

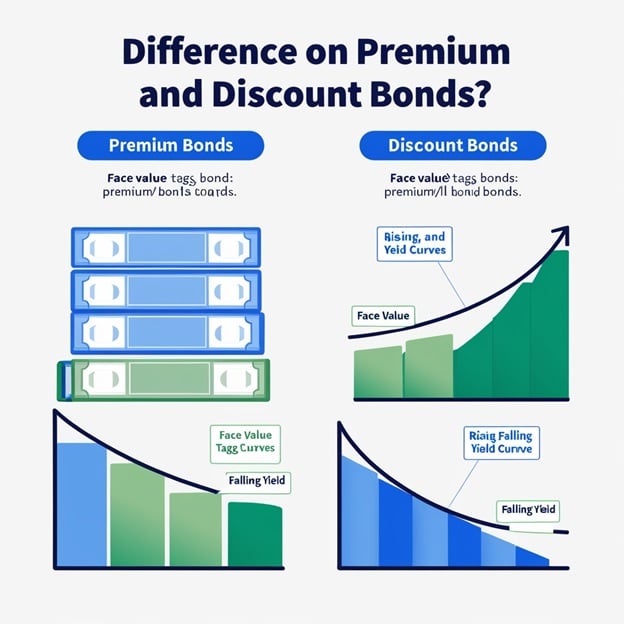

Pricing: Above vs Below Face Value

- When you buy premium bonds, you will pay more than the value printed on the bond.

- Discount bonds are sold below their actual maturity value, so you pay less for them.

Interest rates in the market and the coupon rates on bonds are usually what cause the difference in bond prices.

Yield Comparison

- Premium bonds tend to have a lower YTM, as the investor pays more at the start.

- Since discount bonds are bought below face value, they usually have a higher YTM when they mature at face value.

This difference is crucial in a bond yield comparison, especially when evaluating long-term returns.

Tax Implications

- When you have premium bonds, some of the premium may be written off which reduces your taxable income.

- If the discount on a bond is big, selling or redeeming it may result in capital gains tax.

Because tax laws vary from one region to another, you should understand how bonds are taxed.

Risk and Return Profiles

- Premium bonds give you more reliable income, but their prices do not increase much.

- Discount bonds involve a bit more risk, but you can gain more if you keep them until maturity or interest rates decrease.

The selection between the two depends on how much risk you can handle and what strategies you use for earning higher returns.

When Should You Choose Premium Bonds?

Premium bonds may be the right choice for some investors and depending on market conditions. Their higher coupon payments make them reliable for income and help to lower risks in unpredictable markets.

Situations Where Premium Bonds Are Suitable

Consider purchasing premium bonds when you want to:

- Rates in the market are going down, so you want to secure a higher income.

- You’re putting your money into a tax-friendly account where the cost of the premium doesn’t affect your returns.

- Your goal is to earn consistent returns instead of hoping for appreciation.

They are most valuable when the main goal is to protect capital and have a steady income, rather than seeing capital grow.

Investors with Steady Income Preference

Premium bonds are best suited for:

- People who have retired or are conservative and want a steady stream of income.

- People who choose the security of regular interest over the chance of higher growth.

- Investors who want to generate income over time build a bond ladder.

The higher coupon covers the premium and gives you a steady income every month or quarter.

Risk Mitigation Through High Coupon Payments

Premium bonds help you avoid some risks.

- When interest rates rise, the higher coupon rate helps to lessen the effect.

- They are more stable than other assets when prices are unpredictable.

- When early redemption or sale happens, the price of the bond may not fall as much as that of a discount bond.

As a result, premium bonds are a good choice for portfolio income.

When Should You Choose Discount Bonds?

Investors who want to build their wealth slowly over the years may find discount bonds to be a good option. Since they are sold for less than their face value, these bonds allow you to earn interest and also profits if you sell them for more or if they mature.

Long-Term Growth Potential

Investors who use discount bonds are those who:

- You can hold your bonds for a longer period and wait for them to mature.

- You should aim for your money to grow steadily, not just collect interest every so often.

- Are able to keep bonds in your portfolio through different market conditions.

You can buy these for less than face value and still get the full face value when you redeem which offers the chance for more growth.

Capital Appreciation Focus

Unlike premium bonds which are meant to generate income, discount bonds are popular among people who want:

- Take advantage of value investing in the fixed income market.

- Bonds that could see their market price rise when interest rates fall.

- Investments that allow you to earn interest and also gain capital.

As a result, they are a good choice for investors aiming for growth.

Suitable Market Conditions

It is a good idea to look at discount bonds when:

- Because market interest rates are increasing, bond prices are going down.

- You are sure that the bond issuer has the ability to repay the full debt.

- If you believe interest rates will fall in the future, the bond’s value in the market will rise.

In these cases, buying discount bonds can help you improve your total returns.

Tax Considerations

The way taxes are handled is very important when picking between premium and discount bonds. People who invest should know how interest, capital gains and bond premium amortization influence their taxes.

Tax Treatment of Premium vs Discount Bonds

- If you have premium bonds, you may spread the premium payment over the bond’s life which can decrease your taxable interest each year.

- If you purchase discount bonds and especially those at a large discount, you may earn capital gains at maturity or when you sell them and these gains are taxed differently than interest.

Knowing about these bond tax rules allows investors to make better plans.

Amortization of Bond Premium

When you purchase a bond at a premium, you may have to gradually reduce the premium from the interest you receive for tax purposes. This process:

- Make less of your interest income subject to tax.

- In many cases, tax-advantaged accounts require you to take required minimum distributions (for example, under the U.S. tax code).

- Helps make up for the extra cost of premium bonds.

Investors should consult tax guidelines or a professional to follow the correct amortization method.

Tax on Bond Interest vs Capital Gains

- The interest you earn from bonds is generally taxed as regular income.

- Profits from selling a bond or using a discount bond at the end of its term are usually taxed at the lower capital gains rate.

Because of this, your after-tax return can be affected, mainly when you are in higher tax brackets.

Real-Life Examples

To see how premium and discount bonds work, let’s look at two real examples. The aim is to point out how interest rates, the price you pay and the total return matter.

Comparing Two Bonds: One at a Premium, One at a Discount

Imagine two 10-year bonds, both issued by stable companies, each with a face value of $1,000.

| Feature | Bond A (Premium) | Bond B (Discount) |

| Coupon Rate | 6% | 3% |

| Market Interest Rate | 4% | 4% |

| Purchase Price | $1,100 | $950 |

| Annual Interest Payment | $60 | $30 |

| Yield to Maturity (YMT) | -4.2% | -4.6% |

Case Study: Impact of Interest Rates and Prices

- Bond A (Premium Bond):

The bond’s coupon of 6% is more than what the market rate offers (4%). For this reason, it sells for a higher price ($1,100). Because they paid more at the beginning, investors receive a lower yield to maturity but higher annual income. - Bond B (Discount Bond):

The coupon on this bond is 3% lower than the current market rate. For this reason, the stock is trading at a discount ($950). The low annual income is made up for by the large capital gain you receive when the policy matures.

The case makes it clear that price and yield are linked and that whether you want steady income or capital growth should guide your choice.

Pros and Cons Summary

– Potential capital gains tax on maturity or sale.- Requires longer holding period to realize gains.

| Feature | Premium Bonds | Discount Bonds |

| Advantages | – Higher periodic interest payments (coupon).

– Stable and predictable income. – Less price volatility. – Suitable for conservative investors. |

– Purchased below face value, potential capital gains.

– Higher yield to maturity (YTM). – Opportunity for long-term growth. – Attractive in rising interest rate environments |

| Disadvantages | – Paid more upfront than face value.

– Lower yield compared to discount bonds. – Amortization of premium may complicate taxes – Limited capital appreciation potential |

– Lower periodic interest payments. – More price volatility and interest rate sensitivity. |

Which Type of Bond Is Right for You?

Your choice between premium and discount bonds will be influenced by what you want to achieve, the market situation and your personal risk tolerance. Knowing these factors allows you to match your bond investments with your financial goals.

Investment Goals

- Premium bonds are a good fit if you want your money to grow and remain safe.

- Those aiming for capital appreciation and steady growth over the long term usually find that discount bonds give them more opportunities because they can be purchased at a lower price and may increase in value.

Market Outlook

- The value of premium bonds increases when interest rates go down, because their fixed high coupon payments are important.

- When interest rates are predicted to rise, discount bonds can give better returns and greater chances of growth, as their prices are more strongly affected by rate changes.

Personal Risk Tolerance

- People who like their investments to be stable and reliable usually choose premium bonds.

- Those who want the chance for bigger gains and are ready for changes in bond prices may choose discount bonds.

Looking at these points will allow you to choose the bond type that fits your finances and aims best.

Final Thoughts

You should understand the main differences between premium and discount bonds to invest wisely. With premium bonds, you get regular coupon payments, but with discount bonds, you can earn more when they trade above their face value.

When investors understand bond pricing, yield and taxes, they can select bonds that fit their investment plans, expectations for the market and their comfort with risks.

If you wish to know more about bond investment strategies or want to learn deeper, you can check reliable financial websites or speak with a financial advisor.