Jeff Clark, a seasoned trader and options expert, has developed a unique strategy to profit from gold’s volatile market movements by focusing on simplicity, precision, and speed. His “One Gold Stock Retirement Blueprint” has garnered attention for its ability to leverage options trading on a single stock – VanEck Gold Miners Exchange Traded Fund (GDX) – to achieve significant gains. Here’s an in-depth look at Jeff’s methodology and the principles behind its success.

The Power of Specialization

Jeff’s reliance on GDX reflects his commitment to specialization. This focus aligns with the Pareto Principle, which states that 80% of results come from 20% of efforts. By concentrating on GDX, Jeff has mastered its patterns and behavior, allowing him to anticipate market movements with precision.

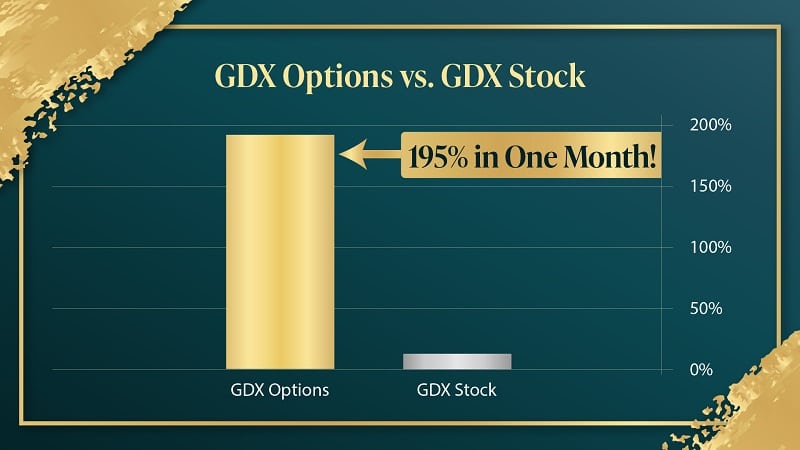

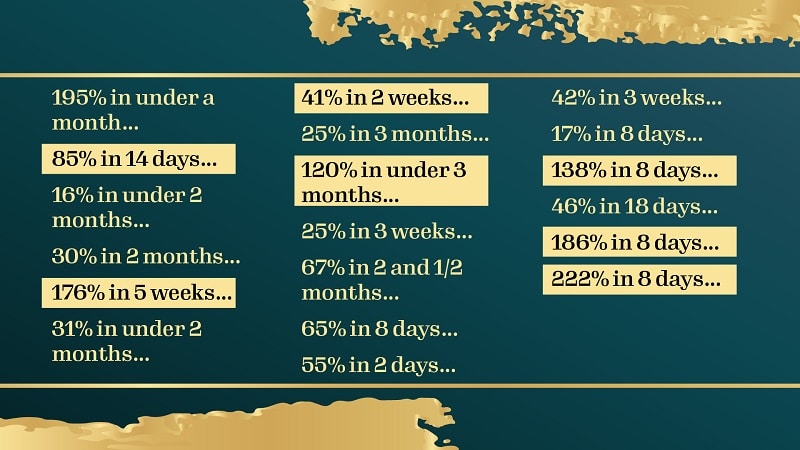

Jeff cites examples from his trading history to illustrate the effectiveness of this approach:

- In May 2019, GDX rose by 13% over a month, but an options trade Jeff recommended soared by 195%.

- During the COVID-19 market turmoil in 2020, while GDX dropped by 11%, his options trade yielded an 85% profit in just 14 days.

These examples underscore the advantage of trading options on a single, well-studied stock. The methodology eliminates the complexity of diversifying across numerous assets while maintaining a high potential for profit.

Options Trading: Amplifying Gains with Lower Risk

Options trading is central to Jeff’s methodology. Unlike buying stocks outright, options require less capital and can generate outsized returns relative to small underlying stock movements. For example:

- An 8-day options trade on GDX in early 2024 yielded a 138% gain, compared to a mere 6% increase in the stock price itself.

- Similarly, another trade on GDX in the same year delivered a 222% return within 8 days, while the stock rose just 12%.

These examples highlight the leverage that options provide, enabling traders to risk less money while achieving higher rewards.

Additionally, Jeff dispels the myth that options are inherently riskier than stocks. By putting less capital at stake and benefiting from both upward and downward market movements, options can be a less risky alternative when executed with discipline and expertise.

The Role of Market Conditions

Jeff’s strategy thrives in chaotic market conditions. Gold, often regarded as a safe-haven asset, experiences significant price swings during times of global uncertainty. Events such as geopolitical tensions, economic instability, and Federal Reserve decisions on interest rates can cause sharp movements in gold prices.

For instance, Jeff anticipates a major event in 2025, when the Federal Reserve is expected to make a significant announcement regarding interest rates. Such events often lead to gold price volatility, creating ripe opportunities for options trading.

The Mechanics of Jeff’s Strategy

Jeff Clark’s trading methodology is built around a few foundational principles that emphasize simplicity, efficiency, and adaptability:

- Focus on One Stock: Jeff’s exclusive focus on GDX allows him to deeply understand its market dynamics, historical trends, and reaction to external factors.

- Options Trades on Market Movement: Whether GDX moves up or down, Jeff positions trades to capitalize on any significant price movement. This flexibility makes the strategy profitable in both bullish and bearish markets.

- Short Time Frames: Most of Jeff’s trades are designed to play out within days or weeks, minimizing capital commitment and allowing for frequent opportunities to realize profits.

- Risk Management: By trading options, Jeff ensures that less capital is at risk compared to traditional stock trading. This approach provides a safety net while still offering high return potential.

Jeff Clark Trader: A Comprehensive Guide to the Subscription Plan

Jeff Clark Trader is a premium financial publication tailored to help traders harness the power of options and achieve significant financial gains. Helmed by Jeff Clark, a seasoned options trading expert, this service offers unique insights into the market and strategies that simplify complex trading concepts. Here’s everything you need to know about the subscription plan and the value it delivers.

>> Sign up now and save 80%! <<

What Does the Subscription Include?

Jeff Clark Trader subscription offers a comprehensive package designed to provide access to Jeff’s proprietary options trading strategies. The focus is on minimizing risk while maximizing potential gains. Here’s what the subscription includes:

Ongoing Trade Recommendations

Subscribers receive 1-2 trade recommendations per month, focusing on high-potential options trades. Each recommendation features:

- The specific stock Jeff is targeting.

- The exact option contract to trade.

- A detailed explanation of why the trade is expected to be profitable.

- Insights on expected profit-taking windows or potential loss-cutting points.

Jeff ensures that his recommendations include clear, actionable instructions, making them accessible even to novice traders.

Up-to-the-Minute Alerts

To keep subscribers informed, Jeff provides timely updates about active trades, including:

- Notifications on when to buy or sell.

- Updates on changing market conditions.

- Alerts for locking in profits or minimizing losses.

The One Gold Stock Retirement Blueprint

This exclusive report details Jeff’s flagship strategy using the VanEck Gold Miners ETF (ticker: GDX). Subscribers gain:

- A step-by-step guide on trading GDX options.

- Insights into indicators Jeff uses to predict significant market movements.

- An understanding of why GDX is an excellent vehicle for leveraging gold market volatility.

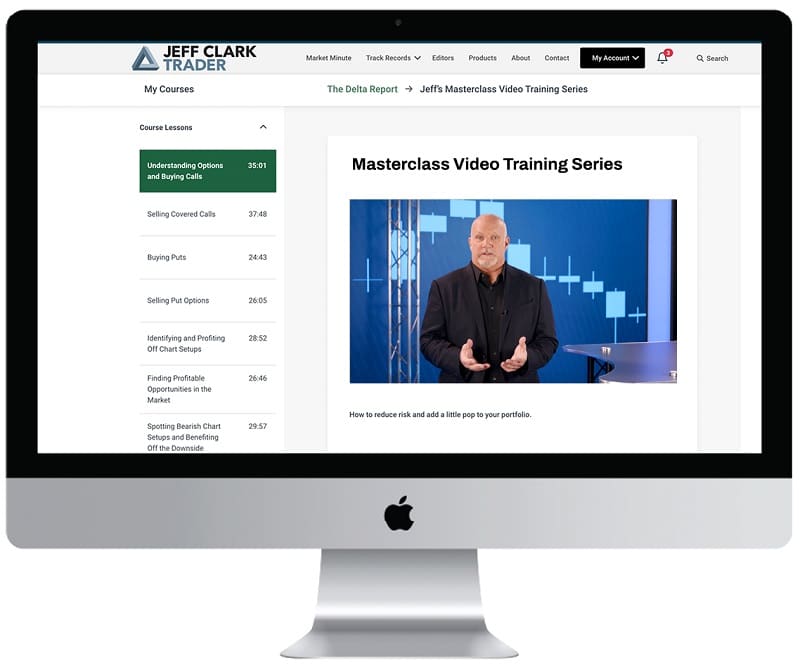

Options Trading Masterclass

A comprehensive 8-part video series designed for traders of all experience levels. This masterclass covers:

- Basics of options trading.

- Strategies for profiting in both bull and bear markets.

- Risk management techniques.

- Indicators and tools for identifying trading opportunities.

This resource ensures that subscribers can fully grasp and apply Jeff’s trading methodologies.

Model Portfolio Access

Subscribers gain full access to Jeff’s model portfolio, which tracks:

- All open trades.

- Historical trades and their performance metrics.

- Real-time updates on trade statuses.

60-Day Satisfaction Guarantee

Jeff offers a risk-free trial period. If you’re not satisfied within the first 60 days, you can cancel your subscription and receive a full refund. This guarantee ensures peace of mind for new subscribers.

Pricing and Value

The subscription is available at an exceptional value:

- Annual Cost: $99 for the first year (a significant discount from the regular $499/year price).

This pricing reflects the service’s commitment to making professional-grade trading strategies affordable to a broader audience.

Final Thoughts

Jeff Clark’s options trading methodology represents a departure from traditional gold investing strategies, which often involve buying physical gold, coins, or mining stocks. By focusing on a single stock and leveraging the power of options, Jeff has created a system that is both simple and effective.

In today’s volatile markets, where uncertainty reigns supreme, Jeff’s approach offers investors a unique opportunity to profit from gold’s movements without the complexities of traditional investing. Whether you’re an experienced trader or a novice looking to learn, Jeff’s methodology provides a clear, actionable path to potentially substantial financial gains.