In a world increasingly dominated by artificial intelligence (AI), financial markets are experiencing a transformation unlike any seen before. Luke Lango, a Silicon Valley insider and renowned stock picker, has introduced a concept called the “AI Income Challenge,” promising investors the opportunity to generate significant cash payouts by leveraging AI-driven market events.

Hosted by Chris Hurt, Lango’s presentation claims that anyone can use his strategy to potentially earn enough in six months to fund a sabbatical, travel, or achieve financial freedom without worrying about their next paycheck. But is this challenge legitimate, or is it just another overhyped investment scheme? Our comprehensive review dives deep into Lango’s claims, his methodology, and the viability of his AI Income Challenge.

What Is AI Income Challenge?

The AI Income Challenge centers on what Lango calls “AI Income Events”—specific market phenomena where companies integrating AI experience rapid stock price surges, often yielding 200%, 400%, or even 500% gains in just months.

Lango asserts that these events are driven by human behavioral patterns, which his proprietary Nexus system identifies to predict explosive stock movements. With a promise of generating up to $30,000 in six months from a modest $5,000 investment, the challenge is bold.

Let’s evaluate the legitimacy of Lango’s claims, the mechanics of his strategy, the credibility of his track record, and the risks and rewards of joining his Breakout Trader service.

Who Is Luke Lango?

Luke Lango is presented as a tech-savvy investor with a strong background in leveraging technology for financial gain. A graduate of the California Institute of Technology (Caltech), one of the world’s leading science and technology universities, Lango has a history of applying advanced technology to various fields, from social media startups to sports franchise recruiting. His passion for technology extends to his personal life, where he reportedly uses AI-driven driverless cars in Phoenix and saved $50,000 by using AI to plan a home remodel. This hands-on experience with AI underscores his credibility in identifying tech-driven investment opportunities.

Lango’s investment track record is impressive, with past recommendations yielding extraordinary gains. He recommended stocks like Advanced Micro Devices (AMD) for 6,149% gains, NIO for 3,682% gains, PLUG for 2,596% gains, and Chegg (CHGG) for 2,554% gains. These figures represent maximum gains, and the disclaimer notes that past performance is not a guarantee of future results. In 2020, TipRanks, an independent finance company, ranked Lango as the #1 stock picker out of over 15,000 analysts, lending further credibility to his expertise. However, the question remains whether his past success in picking tech stocks translates to the reliability of his AI Income Challenge.

Understanding AI Income Events

What Are AI Income Events?

At the core of Lango’s AI Income Challenge is the concept of “AI Income Events.” These are rapid, significant stock price increases driven by companies successfully integrating AI into their operations, leading to exponential business improvements. Unlike traditional income sources like dividends or bonds, which provide steady but modest returns, AI Income Events are characterized by explosive capital gains. Lango argues that these gains are so substantial and occur so quickly that they function as income, providing cash payouts that can significantly impact an investor’s financial situation.

Lango provides several examples to illustrate this phenomenon:

-

Aeva Technologies: A company developing AI sensors for industrial automation saw its stock soar 460% in two months after launching a new line of high-precision sensors.

-

AppLovin: After upgrading its AI-driven AXON algorithm for mobile advertising, the company’s stock surged nearly 500% in five months.

-

Palantir: Following the launch of its AI-powered AIP platform, the stock skyrocketed 290% in five months after being added to the S&P 500.

-

DeFi Development Corp: An AI-powered online marketplace for commercial real estate led to a 4,000% stock surge in weeks.

-

Sezzle Inc.: Incorporating AI to prevent cyberattacks and fraud, its stock rose 534% in three months.

-

Aerovironment: After unveiling an AI capability kit for drones, the stock gained 78% in a few months.

-

SoundHound AI: Major deals to integrate voice AI into vehicles resulted in a 300% stock increase in a few months.

-

BigBear.ai: A new AI platform for national defense led to a stock doubling in weeks.

-

Super Micro Computer: As demand for AI data center servers grew, the stock rose 233% in two months.

These examples demonstrate the potential for massive gains, with hypothetical $10,000 investments yielding payouts ranging from $7,800 to $400,000. Lango emphasizes that these are not anomalies but part of a broader market phenomenon driven by AI’s transformative impact.

Why Now? The AI Growth Phase

Lango attributes the frequency and magnitude of AI Income Events to the current stage of AI’s technological lifecycle. He describes a four-phase lifecycle for all technological innovations—introduction, growth, maturity, and decline—citing examples like the television, internet, and smartphone. Each phase is characterized by different levels of adoption and market impact, with the most significant gains occurring during the growth phase (Phase 2).

According to Lango, AI entered its growth phase around 2023, following the introduction of ChatGPT in November 2022. This phase is marked by rapid adoption as businesses shift from skepticism to enthusiasm, integrating AI to enhance productivity, reduce costs, and drive profits. Lango argues that AI’s growth phase is uniquely compressed due to its ability to integrate seamlessly into existing business models, unlike previous technologies that required extensive infrastructure changes. For instance, AppLovin and Palantir enhanced their platforms with AI without overhauling their operations, leading to immediate improvements and stock price surges.

However, Lango warns that this growth phase is temporary, estimating a window of 12 to 18 months before AI enters the maturity phase (Phase 3). At that point, AI will become a standard business tool, and the explosive stock moves associated with AI Income Events will diminish. This urgency forms the basis of his AI Income Challenge, encouraging investors to act quickly to capitalize on these opportunities.

The Nexus System: Predicting AI Income Events

How Nexus Works

Lango’s AI Income Challenge relies on his proprietary Nexus system, a sophisticated algorithm designed to predict AI Income Events by analyzing human behavioral patterns rather than the AI technology itself. The system is built on the premise that stock price movements are driven by investor psychology—specifically, emotions like greed, fear, and fear of missing out (FOMO). By identifying when a stock is transitioning from the introduction phase (Phase 1) to the growth phase (Phase 2), Nexus aims to pinpoint opportunities for significant gains.

The Nexus system analyzes millions of data points across thousands of stocks, focusing on five key metrics that indicate a stock is poised for a Phase 2 breakout. While Lango reveals only one metric—Expanding volume, defined as a stock’s weekly trading volume being 1.4 times or more the average volume of the prior four weeks—he keeps the other four proprietary. These metrics collectively measure psychological shifts, such as:

-

Expanding Volume: Indicates excitement and FOMO, as high trading volume reflects widespread investor interest.

-

Confidence: Tracks when investors shift from skepticism to optimism.

-

Impatience: Detects when investors stop waiting for lower prices and buy at current levels.

-

Institutional Behavior: Identifies subtle signs of smart money positioning before retail investors notice.

-

Unnamed Fifth Metric: Presumably another behavioral indicator, kept confidential to maintain the system’s edge.

Stocks must exhibit at least three of these five indicators to be considered for a recommendation. This rigorous filtering process ensures that only high-probability candidates are selected, reducing the likelihood of false positives.

Behavioral Analytics in Action

Lango’s approach is grounded in behavioral analytics, a field that uses data to predict human actions. He compares his strategy to how companies like Netflix, Amazon, and Spotify use algorithms to predict consumer behavior, noting that financial behavior—driven by greed and fear—is even more predictable. Historical market bubbles, such as tulip mania, the dot-com boom, and the housing crisis, followed similar behavioral patterns, reinforcing the reliability of this approach.

The Nexus system’s success is illustrated through several case studies:

-

Blend Labs: Flagged by Nexus with four out of five indicators, the stock surged 197% in less than a year after upgrading its AI underwriting platform, transforming the mortgage industry.

-

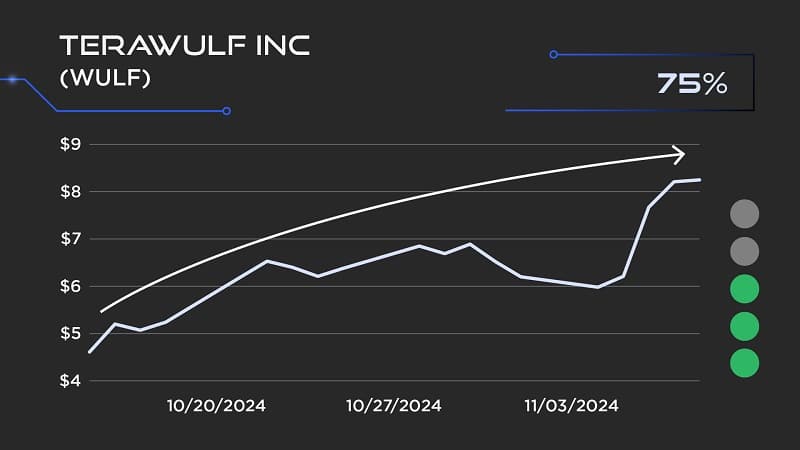

TeraWulf: Identified with three indicators, the stock climbed 75% in a month after expanding into AI and high-performance computing services.

-

Unnamed Software Company: Flagged with four indicators, the stock gained 112% after integrating AI-enhanced data management products and partnering with Microsoft.

These examples highlight Nexus’s ability to detect behavioral shifts before mainstream investors, allowing subscribers to position themselves for significant gains.

The Breakout Trader Service

What Is Breakout Trader?

Breakout Trader is Lango’s research service, designed to deliver AI Income Event recommendations to subscribers. The service includes:

-

Weekly Buy and Sell Alerts: Issued two to four times per month, these alerts provide clear instructions on which stocks to buy, at what price range, and when to sell, based on Nexus’s analysis.

-

The Breakout Trader Masterclass: A video training program that teaches subscribers how to recognize AI Income Events, understand Nexus’s behavioral analytics, and execute the trading strategy.

-

The Breakout Trader Owner’s Manual: A detailed guide covering the same content as the masterclass, ideal for those who prefer written materials.

-

Trading Room Access: Weekly briefings where Lango shares the latest Nexus findings, including sector trends and upcoming AI Income Events.

-

Special Report: “Three AI Income Events for Massive Cash Payouts,” detailing three stocks poised for immediate breakouts.

Lango emphasizes that Breakout Trader is user-friendly, requiring only five minutes a week to follow the alerts. The strategy avoids high-risk instruments like options or penny stocks, focusing solely on buying and selling stocks to capture capital gains.

The $30,000 Challenge Roadmap

Lango’s AI Income Challenge aims to generate $30,000 in six months using a $5,000 investment. The roadmap involves:

-

Identifying 9–12 AI Income Events: Lango expects 18–24 events over the next 12 months, with half occurring in the next six months.

-

Capturing Modest Gains: By investing $5,000 in each event and achieving gains of 50–75% (e.g., TeraWulf’s 75%, Blend Labs’ 197%), investors can pocket profits while reinvesting the initial capital.

-

Compounding Profits: For example, three events yielding 75%, 50%, and 60% gains would generate $9,250 in profits. Five additional events with gains of 40%, 65%, 35%, 55%, and 45% could add $21,000, totaling over $30,000.

This approach minimizes risk by recycling the same $5,000 investment, extracting profits after each successful trade. Lango stresses that these gains are achievable without relying on a single massive winner, making the strategy systematic rather than speculative.

Cost and Guarantees

The standard annual fee for Breakout Trader is $5,000, justified by the potential to recoup the investment with a single successful AI Income Event. However, Lango offers a discounted one-time payment of $1,799, a $3,201 savings, to make the service accessible during AI’s critical growth phase.

To mitigate risk, Lango provides two guarantees:

-

Performance Commitment: If Breakout Trader fails to identify at least eight AI Income Events with 50% or greater gains within 12 months, subscribers receive another year free.

-

90-Day Satisfaction Guarantee: Subscribers can request a full refund within 90 days if unsatisfied, allowing them to test the service risk-free.

These guarantees enhance the service’s appeal, addressing concerns about the inherent risks of investing.

Evaluating the Legitimacy of the AI Income Challenge

Strengths of the AI Income Challenge

-

Credible Track Record: Lango’s history of successful recommendations (e.g., AMD, NIO, Chegg) and his #1 TipRanks ranking in 2020 provide evidence of his stock-picking prowess. His ability to identify tech-driven opportunities before they become mainstream is well-documented.

-

Innovative Approach: The Nexus system’s focus on behavioral analytics is a novel approach to stock picking. By analyzing human psychology rather than technical AI breakthroughs, it leverages predictable patterns, increasing the likelihood of identifying high-probability trades.

-

Real-World Examples: The presentation provides concrete examples of AI Income Events, with verifiable stock gains for companies like Aeva Technologies, AppLovin, and Palantir. These examples lend credibility to Lango’s claims.

-

Low-Risk Strategy: The roadmap emphasizes modest, achievable gains (50–75%) rather than speculative home runs, reducing reliance on outliers. The use of standard stock trades avoids complex derivatives, making the strategy accessible to retail investors.

-

Risk Mitigation: The performance commitment and 90-day refund guarantee minimize financial risk for subscribers, demonstrating confidence in the system’s effectiveness.

-

Timely Opportunity: Lango’s argument that AI is in a temporary growth phase aligns with current market trends, where AI adoption is accelerating across industries. The urgency to act within 12–18 months is plausible given the lifecycle of past technologies.

Potential Concerns

-

Past Performance Disclaimer: The presentation repeatedly notes that past performance is not a guarantee of future results. While Lango’s historical gains are impressive, there’s no assurance that future AI Income Events will replicate these outcomes.

-

Proprietary Metrics: Lango’s refusal to disclose four of the five Nexus metrics raises questions about transparency. While protecting intellectual property is understandable, it may leave subscribers skeptical about the system’s inner workings.

-

Market Risks: The stock market is inherently volatile, and AI stocks are particularly susceptible to hype and corrections. A broader market downturn could impact the frequency or magnitude of AI Income Events.

-

No Guarantee of Success: Lango acknowledges that not all recommendations succeed, and the average gain since Breakout Trader’s inception is 7.5%, significantly lower than the highlighted 50–500% gains. This discrepancy suggests that blockbuster wins are not guaranteed.

-

Limited Window: The 12–18-month timeframe for AI’s growth phase introduces pressure to act quickly, which could lead to impulsive decisions. If the window closes sooner than expected, opportunities may diminish.

-

Accessibility of $1,799 Fee: While discounted from $5,000, the $1,799 fee may still be prohibitive for some retail investors, especially those unable to allocate $5,000 per trade as outlined in the roadmap.

Is It Legit?

Luke Lango’s AI Income Challenge appears to be a legitimate investment strategy, grounded in a credible track record and a sophisticated behavioral analytics system. The focus on AI-driven stock movements is timely, given the technology’s rapid adoption across industries.

The Nexus system’s emphasis on human psychology, rather than predicting AI breakthroughs, aligns with established behavioral finance principles, adding a layer of intellectual rigor. The inclusion of guarantees and a clear roadmap further enhances its legitimacy, as does the avoidance of high-risk instruments like options or cryptocurrencies.

However, legitimacy does not guarantee success. The strategy carries inherent market risks, and the reliance on past performance raises caution flags, as future results may vary. The lack of transparency about four Nexus metrics and the modest 7.5% average gain since inception suggest that subscribers should temper expectations. The $1,799 fee, while reasonable for the potential returns, requires careful consideration, particularly for those with limited capital.

Who Should Consider the AI Income Challenge?

The AI Income Challenge is best suited for:

-

Tech-Savvy Investors: Those with an interest in AI and technology trends will appreciate Lango’s data-driven approach and the opportunity to capitalize on a transformative market phase.

-

Active Traders: The strategy requires acting on buy and sell alerts, making it ideal for investors comfortable with frequent trading and monitoring market developments.

-

Risk-Tolerant Individuals: While the strategy avoids high-risk instruments, stock market volatility means subscribers must be prepared for potential losses.

-

Investors with $5,000–$10,000: The roadmap assumes a minimum investment of $5,000 per trade, making it more feasible for those with sufficient capital.

Conversely, the challenge may not be suitable for:

-

Conservative Investors: Those seeking steady, low-risk income from dividends or bonds may find the strategy too aggressive.

-

Beginners: Despite Lango’s claim that no technical expertise is needed, the strategy requires understanding and acting on market signals, which may overwhelm novices.

-

Budget-Constrained Investors: The $1,799 fee and $5,000 per-trade requirement may be prohibitive for those with limited funds.

Conclusion

Luke Lango’s AI Income Challenge presents a compelling opportunity for investors to capitalize on the rapid adoption of AI across industries.

By focusing on AI Income Events—explosive stock price movements driven by human behavioral reactions to AI integration—Lango offers a systematic approach to generating significant cash payouts. His Nexus system, rooted in behavioral analytics, provides a novel framework for identifying high-probability trades, and his Breakout Trader service delivers actionable recommendations with robust support materials.

The challenge’s legitimacy is bolstered by Lango’s credible track record, the timeliness of AI’s growth phase, and the inclusion of performance and satisfaction guarantees.

However, investors must weigh the risks, including market volatility, the lack of transparency about Nexus’s metrics, and the upfront cost. While the potential to generate $30,000 in six months is enticing, success is not guaranteed, and subscribers should approach with realistic expectations.

For those intrigued by AI’s transformative potential and comfortable with active trading, the AI Income Challenge offers a structured path to potentially life-changing profits. With a finite window of 12–18 months before AI’s growth phase ends, now may indeed be the time to act. However, thorough due diligence and a clear understanding of personal risk tolerance are essential before committing to Breakout Trader.