Markets in 2025 are a mess—tariffs, inflation, and wild swings are crushing regular investors. But Jonathan Rose, a 30-year trading veteran, says there’s a way to cash in. His Divergence Trader service spots rare market gaps, like the one in gold right now, that could turn small bets into big wins. He calls it the “Trade of the Decade,” a gold-silver split so extreme it might make headlines. With a $2,000 price tag, a private community, and a 90-day guarantee, is this the key to thriving in chaos? Our review dives into Rose’s strategy, his track record, and whether Divergence Trader is your ticket to big profits in 2025’s stormy markets.

Who Is Jonathan Rose?

Jonathan Rose isn’t your average Wall Street guru. He’s a battle-tested trader with nearly three decades of experience, starting on the Nasdaq’s trading floor during its shift to digital systems in the 1990s. He climbed the ranks to become a partner at a top trading firm, managing 150 employees. His resume is stacked: $800,000 in 2006, $2.3 million in 2007, and $4 million in 2008 when markets tanked.

He even stepped away to train for an Ironman, bringing that same discipline to trading. Now, through his company, Masters in Trading, he’s trained over 100 pros and 30,000 everyday folks. Rose claims his divergence strategy, refined over years, can turn market chaos into cash, especially with the gold market’s current setup.

What’s Divergence Trader?

Divergence Trader is Rose’s subscription service, costing $2,000 a year, designed to help regular people profit from market gaps called “divergences.” These happen when assets that usually move together—like gold and silver—split apart. Rose uses options to bet on them snapping back, promising big gains in days or weeks, not years. The service includes:

-

24+ trade alerts yearly, with clear buy and sell instructions.

-

A four-part video series, High-Probability Options Trading, to teach beginners.

-

Access to a private online community for sharing ideas.

-

A “Divergence Scoring System” tool to spot opportunities.

-

Daily 15-minute live briefings at 11 AM ET, archived for later.

-

A special report, The Trade of the Decade, detailing the gold-silver divergence.

Rose says it’s built for busy people—doctors, chefs, retirees—who want steady income without staring at screens all day. You need just $2,000 to start, and trades take minutes to execute.

The Trade of the Decade: Gold and Silver Divergence

Rose’s big pitch is a massive gap between gold and silver prices in 2025, which he calls the “Trade of the Decade.” These metals usually move together, like best friends, through crashes, rallies, and wars. But now, gold’s soaring while silver lags, creating a rare opportunity.

He compares it to a stretched rubber band ready to snap back. The last time he saw a divergence this big, one follower turned $44,000 into $180,000—a $136,000 profit. Rose ties this to 2025’s chaos: rising inflation, Trump’s tariffs, and shifting global policies. His Trade of the Decade report explains how to use options to bet on silver catching up, potentially in days. He warns the window is closing fast, urging action now.

What Are Divergences?

Divergences happen when assets that normally sync up—like Ford and GM, or Nvidia and AMD—move apart. It’s like two dancers losing step. Rose says these gaps are goldmines because markets eventually correct them. He’s not guessing; he’s spotting patterns on simple charts.

This isn’t new—traders in the 1600s used it with shipping stocks, and Morgan Stanley called it “pairs trading” in the 1980s. Rose learned it on the Nasdaq floor, catching price gaps between floor trades and digital systems. His system doesn’t need complex math or fancy charts—just a keen eye for when assets drift too far apart.

Examples of Divergences

-

Uber vs. Lyft: Ride-sharing stocks usually track each other but sometimes split.

-

Nvidia vs. Taiwan Semiconductor: Chipmakers move together, then diverge.

-

Amazon vs. Alibaba: Big retailers sync, but gaps appear in chaos.

-

Cruise Lines: Royal Caribbean, Carnival, and Viking often align, then break.

When these assets snap back, options can turn small bets into huge wins—100%, 200%, even 500% in weeks.

Why Options?

Rose bets on divergences with options, not stocks. Why? Options let you control big positions with less cash, slashing risk while boosting gains.

For example, buying 100 shares of a $100 stock costs $10,000. An option might control the same for $500-$1,000. If the trade wins, profits soar—sometimes 752% or more. If it loses, you’re out only the option’s cost, not the whole stock price. Rose says options aren’t as scary as Wall Street makes them sound. His strategies are simple, designed for beginners, and don’t need hours of chart-watching. He’s taught retirees and parents to use them, with some reporting gains like 1,100% or 950%.

Why 2025 Is Perfect for Divergence Trading

Markets in 2025 are a storm—Trump’s tariffs, inflation, and global shifts are shaking things up. Rose calls it the “Age of Chaos,” echoing Stanley Druckenmiller’s warning of a “lost decade” for stocks, where returns could flatline or drop for years, like the Dow’s 70% real-value loss from 1966-1982. Traditional buy-and-hold investing struggles here. Rose’s divergence strategy thrives because:

-

Volatility Creates Gaps: Wild swings make assets like gold and silver split, setting up big trades.

-

Short-Term Wins: Instead of waiting years, trades can pay off in days or weeks.

-

Any Market Works: Up, down, or sideways, divergences happen, unlike buy-and-hold, which needs rising markets.

Rose cites past crises—2008, 2000 dot-com, 2020 pandemic—where short-term traders made fortunes while others panicked. Energy stocks fell 60% in early 2020, then some soared 700% by year-end. Zoom jumped 475% in 2020, then crashed 86%. Divergence trading catches these moves fast.

How Divergence Trader Works

Here’s the nuts and bolts of Divergence Trader:

-

Trade Alerts: Rose sends 24+ emails yearly with clear instructions: which options to buy, price ranges, and when to sell. Average hold is 38 days, with a 35.8% average gain.

-

Video Training: Four short videos break down options, explain mistakes to avoid, and teach divergence spotting. No jargon, just practical tips.

-

Community: A private chat lets members swap ideas and discuss markets. Rose says it’s a favorite for members like chefs and doctors.

-

Divergence Scoring System: A tool built with data scientists scans thousands of stocks daily, ranking divergences to boost your research.

-

Daily Briefings: Rose goes live at 11 AM ET weekdays for 15-minute market updates, archived for later. Members can ask questions, though he avoids personal advice.

-

Trade of the Decade Report: Details the gold-silver setup, with steps to trade it.

You need a brokerage account and as little as $2,000 to start. Rose says it takes less time than picking a Netflix show.

Rose’s Track Record

Rose’s history is impressive:

-

2006: $800,000 in profits.

-

2007: $2.3 million.

-

2008: $4 million during the financial crisis, when most lost big.

-

Follower Wins: One turned $44,000 into $180,000. Others report 1,100%, 950%, 400% gains on single trades.

His average closed trade in Divergence Trader yields 35.8%. Not every trade wins—losses happen—but Rose says his system stacks the odds in your favor with disciplined risk management. He’s trained everyone from pilots to a former Philadelphia Eagles VP, showing it’s not just for Wall Street pros.

The Gold-Silver Divergence: Why It Matters

Gold and silver have moved in sync for decades, like twins. But in 2025, gold’s outpacing silver, creating a massive gap. Rose says it’s driven by:

-

Inflation: Prices are rising, pushing gold up as a safe haven.

-

Trump’s Policies: Tariffs and monetary shifts are shaking markets, boosting gold.

-

Global Tensions: Trade wars and debt piles make gold a go-to, leaving silver behind.

This divergence is rare—Rose has seen it only a few times in 30 years. The last time, a follower made $136,000. He predicts the snap-back could happen in days, fueled by $6.6 trillion market moves from Trump’s April tariff speech. His report, The Trade of the Decade, lays out how to use options to bet on silver catching up.

Benefits of Divergence Trader

Here’s what you get for $2,000:

-

24+ Trade Alerts: Clear, actionable emails with buy/sell details.

-

Video Series: Four quick videos teach options and divergences, beginner-friendly.

-

Community Access: Chat with other traders, share tips, and stay motivated.

-

Divergence Tool: A high-tech scanner finds gaps faster than you could.

-

Daily Live Briefings: 15-minute market updates, archived for flexibility.

-

Trade of the Decade Report: Step-by-step guide to the gold-silver play.

-

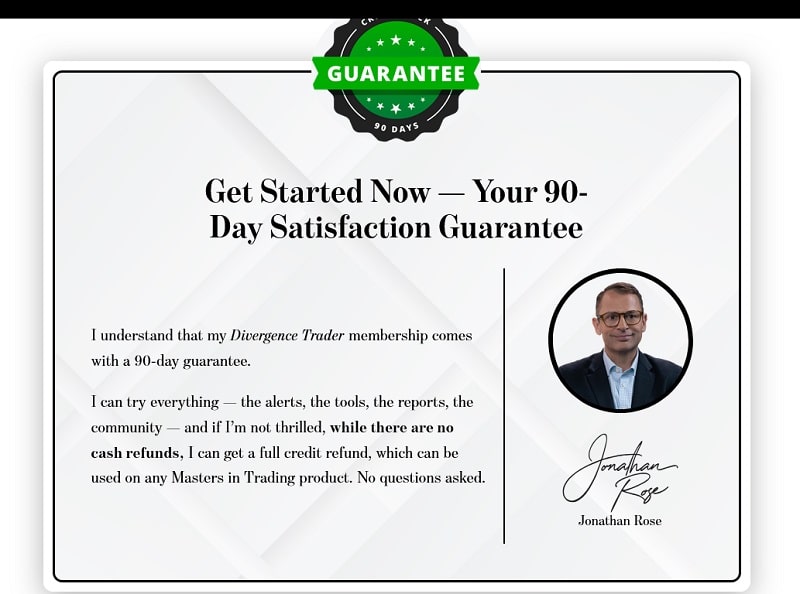

90-Day Guarantee: Try it for three months; get a credit for other Masters in Trading services if it’s not for you.

Rose says it’s built for regular people, not just rich investors. The community and daily briefings add a personal touch, making it more than just alerts.

Risks and Downsides

Trading isn’t a sure thing. Rose is upfront:

-

Losses Happen: Not every trade wins. Options limit losses to what you pay, but you could lose it all.

-

Time Sensitivity: The gold-silver window is closing fast. Miss it, and you’re out of luck.

-

Learning Curve: Options seem tricky at first, though Rose’s videos simplify them.

-

Market Chaos: Volatility helps, but unexpected events can disrupt trades.

-

No Personal Advice: Rose can’t tailor advice to your situation, so you’re on your own for some decisions.

He stresses never betting more than you can lose. Past wins—like 1,046% or $4 million—aren’t guaranteed. The 35.8% average gain is solid but includes losses.

Is It Worth $2,000?

At $2,000, Divergence Trader isn’t cheap—about $5.50 a day. Compare that to $5,000 for similar services or Rose’s old $10,000 coaching fees. You get a lot: 24+ trades, videos, a community, a high-tech tool, and daily briefings.

The 90-day guarantee lowers the risk—try it, and if it’s not your thing, get a credit.

If one trade hits 100% ($2,000 on a $2,000 investment), it pays for itself. Rose’s $4 million in 2008 and follower wins like $136,000 show the potential. For serious investors, it’s a fair deal in 2025’s wild markets.

Why Divergences Work

Divergences aren’t new—they’ve been profitable for centuries. In the 1600s, Amsterdam traders bet on shipping stock gaps. In the 1800s, cotton and wool traders did the same. The Grossman-Stiglitz Paradox backs this: chaotic markets create mispricings, and divergences are mispricings you can spot on a chart.

Rose’s Nasdaq days taught him to find these gaps, like price differences between floor and digital trades. His options approach amplifies gains while capping losses, making it ideal for volatile times.

Who’s It For?

Divergence Trader is for:

-

People worried about market crashes eating their savings.

-

Investors who want quick wins, not years of waiting.

-

Those willing to learn options and divergences (videos make it easy).

-

Folks with at least $2,000 to trade and a few minutes a week.

It’s not for:

-

Buy-and-hold fans happy with 5% yearly gains.

-

People scared of any risk, even with losses capped.

-

Those who won’t spend time learning Rose’s system.

If you’re ready to try something new, this could be your edge.

Step-by-Step: How to Use Divergence Trader

Here’s how it works:

-

Join: Pay $2,000, get instant access to videos, community, and tools.

-

Watch Videos: Four short clips teach options and divergences. Rewatch as needed.

-

Get Alerts: Rose emails 24+ trades yearly with clear instructions (e.g., “Buy this option at $X”).

-

Trade: Log into your brokerage, buy the option, and wait for the sell alert (average 38 days).

-

Use the Tool: Check the Divergence Scoring System for extra trade ideas.

-

Join Briefings: Tune into 11 AM ET live calls or watch archives for market insights.

-

Read the Report: Follow The Trade of the Decade for the gold-silver play.

It’s simple—Rose does the heavy lifting, you just follow along.

Real-World Results

Rose’s followers show what’s possible:

-

$44,000 to $180,000: One turned a gold divergence into $136,000 profit.

-

Chris P., Chef: Went from losing money to 1,100%, 950%, and 400% gains.

-

Anonymous Trader: A college kid Rose trained now runs a million-dollar trading firm.

-

Others: Gains like 1,046%, 474%, and 134% in months, not years.

The average closed trade yields 35.8%, with holds around 38 days. Losses happen, but Rose’s system aims to make winners outweigh them.

Why Options Beat Stocks for Divergences

Options shine for divergences because:

-

Less Cash: Control $10,000 in stock for $500-$1,000.

-

Capped Losses: Lose only what you paid for the option, not the whole stock.

-

Big Gains: A 10% stock move can mean 100-500% for options.

-

Flexibility: Profit whether markets go up, down, or sideways.

Rose’s strategies avoid complex math, focusing on simple trades anyone can learn.

The Age of Chaos: Why Now?

Rose says we’re in the “Age of Chaos,” with:

-

Tariffs: Trump’s policies shake markets, like April’s $6.6 trillion drop.

-

Inflation: Rising prices push gold up, leaving silver behind.

-

Global Shifts: Debt and trade wars create volatility.

-

Tech Changes: Fast-moving tech disrupts old patterns.

Druckenmiller’s “lost decade” warning suggests stocks could stall for years. Divergence trading thrives here, catching quick moves while others wait.

Community and Support

The Divergence Trader community is a big draw. Members—doctors, pilots, even a former Eagles exec—share tips and cheer each other on.

Rose’s daily 15-minute briefings at 11 AM ET (or archived) give market updates and trade ideas. The Divergence Scoring System, built with data scientists, scans thousands of stocks daily, ranking gaps to boost your trades. It’s like having a pro trader and a high-tech tool in your corner.

Comparing to Other Strategies

-

Buy-and-Hold: Needs rising markets, risks big losses in a “lost decade.”

-

Shorting Stocks: Risky, needs perfect timing. Options cap losses.

-

Bonds: Safe, but 2-3% yields can’t match 100%+ option gains.

-

Crypto: High risk, big swings. Divergences are steadier.

Rose’s system works in any market, with quicker, bigger wins than traditional methods.

Is It Legit?

Rose’s $4 million in 2008 and follower wins like $136,000 prove his system works. The Grossman-Stiglitz Paradox supports divergences as real opportunities. His Nasdaq experience and 30,000 subscribers add credibility. The 90-day guarantee and clear videos make it accessible. Risks exist—losses, time limits, learning—but Rose’s transparency and track record suggest it’s no scam.

Getting Started

-

Sign Up: Pay $2,000 via secure form, get instant access.

-

Learn: Watch the four-part video series to understand options.

-

Trade: Follow Rose’s 24+ yearly alerts in your brokerage.

-

Connect: Join the community to swap ideas and watch briefings.

-

Use Tools: Check the Divergence Scoring System for extra trades.

-

Try the Big One: Use The Trade of the Decade for the gold-silver play.

Start with $2,000 and a few minutes a week. If it’s not for you, get a credit within 90 days.

The Bottom Line

Jonathan Rose’s Divergence Trader is a solid bet for 2025’s chaotic markets. For $2,000, you get 24+ trade alerts, videos, a community, a high-tech tool, and daily briefings, plus the Trade of the Decade report for the gold-silver play.

Rose’s $4 million in 2008 and follower wins like 1,100% show the potential. Options make it accessible, with capped losses and big upside. Risks—losses, learning, timing—are real, but the 90-day guarantee softens the blow. If you’re ready to learn and trade smart, Divergence Trader could turn market chaos into your biggest win yet. Act fast—the gold-silver window won’t last.