Feeling overwhelmed by stock picking? Learn how data-driven investing and Whitney Tilson’s N.E.W. System simplify smart portfolio decisions.

The Challenge of Modern Stock Picking

Why So Many Investors Feel Stuck

In today’s investing world, the biggest challenge is not a lack of information — it’s having too much. Every day, investors are bombarded with data: price charts, earnings reports, analyst opinions, news headlines, tweets, and macroeconomic forecasts. The noise grows louder, and making decisions becomes harder.

For many, the question isn’t whether they should invest in a stock. It’s whether they should trust themselves at all. Too often, the result is hesitation, missed opportunities, or impulsive trades driven by fear rather than strategy.

This overload is not new — but it’s magnified by today’s technology. With real-time data accessible at your fingertips, decisions happen faster. That can be good, but it can also create paralysis. Investors now face a new reality: too much choice and too little clarity.

What’s Changed in the Investing Landscape

Ten or twenty years ago, the process of stock picking was simpler. Investors relied on quarterly reports, a handful of analyst calls, and printed research. Now, algorithms, social media chatter, and endless news cycles have disrupted the pace of investing.

The stakes are higher. Technology allows prices to change in seconds, and information flows faster than ever. While this presents opportunities, it also introduces risks — especially for investors without a disciplined method. Without a framework, it’s easy to confuse noise with signal.

Whitney Tilson has spent decades studying this challenge. His The N.E.W. System was designed to address it. Instead of drowning in data, it helps investors focus on meaningful indicators and reduce the noise — a topic we’ll revisit later.

Lessons from Experience — When Information Becomes the Enemy

Why More Data Doesn’t Always Mean Better Decisions

I’ve been investing for decades, and I’ve seen a consistent pattern: the more information investors have, the harder it is for them to act decisively. It’s not just about finding the right stock anymore — it’s about filtering through endless streams of data without losing sight of the big picture.

Think about it: each earnings report comes with dozens of metrics. Social sentiment analysis spits out scores for thousands of companies. Analysts publish recommendations hourly. For many investors, it becomes overwhelming — and that leads to one of two problems: analysis paralysis or impulsive decision-making.

I’ve personally faced this dilemma. Early in my career, I’d spend hours poring over every possible data point, thinking the more I knew, the better my results would be. But I learned something important: clarity often comes from simplification, not accumulation. That’s why frameworks like Whitney Tilson’s The N.E.W. System matter — they strip away distractions and help investors focus on what really matters.

Examples from Real Markets

Consider two examples from recent years:

-

The Dot-Com Era Rebound: Many investors in the early 2000s were drawn in by hype, chasing every tech stock that doubled overnight. Without a disciplined system, they often bought too late, missing the bigger gains or entering before a sharp decline.

-

The 2020 Pandemic Spike: During the early months of COVID-19, certain stocks surged dramatically. Some investors, inundated by data and headlines, waited for “perfect” confirmation before investing — only to miss opportunities entirely. Others jumped in blindly and faced steep losses when the momentum reversed.

These examples illustrate a key truth: having a lot of information isn’t enough. You need a system to interpret it correctly. That’s what Whitney Tilson’s approach offers — a structured framework for assessing stocks without getting lost in the noise.

Information is essential, but clarity is more important. Investors who master the ability to filter relevant signals from noise will make more consistent, confident decisions.

That clarity begins with a proven system — and The N.E.W. System is built on exactly that principle.

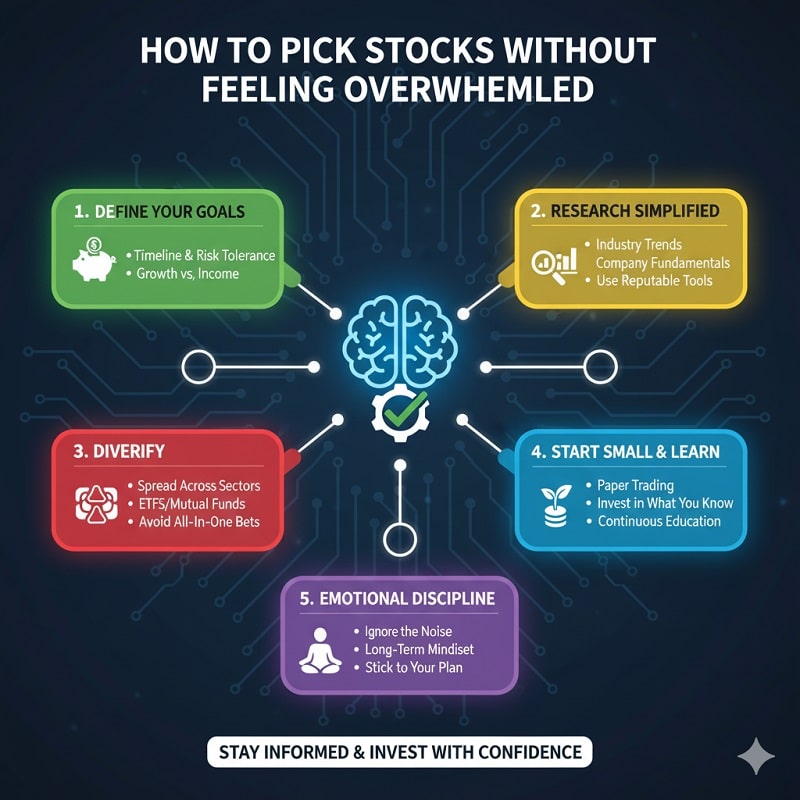

Investors Guide: How to Pick Stocks Without Feeling Overwhelmed

Focus on What Truly Matters

When you’re staring at hundreds of stock charts and endless data points, it’s tempting to treat every number as equally important. But in reality, not all metrics matter equally. Successful investors learn to focus on a few key factors that reliably indicate a stock’s potential.

Whitney Tilson’s The N.E.W. System teaches a method to identify those high-priority signals without drowning in detail. For example, it emphasizes factors like earnings growth, market positioning, and cash flow — rather than chasing fleeting buzz.

Here’s why that matters: focusing on fewer, meaningful metrics lets you avoid distraction and make faster decisions. It’s like reducing a complex map into just the key landmarks you need to navigate.

Use a Proven Framework

A solid framework gives structure to your research and reduces the mental load. Without a framework, every new piece of information feels like an urgent puzzle piece — leading to decision fatigue.

The N.E.W. System provides such a framework. It doesn’t just tell you to “look at earnings” or “watch market trends” — it gives a structured way to assess them. This consistency matters. Over time, a framework builds confidence because you know the process you’re following has worked before.

I’ve seen investors transform their approach when they adopt structured systems like this. Instead of feeling lost every time the market moves, they have a playbook to follow — which creates discipline and clarity.

Avoid Emotional Traps

Emotions are the enemy of consistent investing. Fear and greed can push even experienced investors into irrational choices.

One common trap is the “FOMO” (Fear of Missing Out) — chasing a stock after it’s already risen sharply, without a solid strategy. Another is panic selling during a downturn.

The way to overcome these emotional traps is to rely on a repeatable decision-making system. The N.E.W. System helps by giving you criteria to stick to, even when markets are noisy and emotions run high.

From my own experience, the most successful investing decisions happen when emotion is removed from the equation. That’s where a system adds real value.

Make Small Experiments and Learn

Another powerful habit of successful investors is experimentation. You don’t need to bet the farm every time — testing your ideas in small amounts helps you learn without risking too much capital.

This is where tools like The N.E.W. System shine. They allow you to identify potential candidates and test your judgments on a smaller scale. Over time, this builds both skill and confidence.

Think of it like training. You wouldn’t enter a championship match without practice. In investing, your “practice” is small-scale trades guided by a disciplined system.

In my own investing, I recall a situation where a stock had doubled in just six months. Most traders around me were jumping in because of hype. I decided to apply my structured approach — checking fundamentals, evaluating cash flow, and reviewing competitors. That led me to discover significant warning signs. I held off, and the stock later lost half its value.

That’s a clear example of how a system can prevent costly emotional mistakes.

Picking stocks without overwhelm is possible when you use a proven framework, focus on essential factors, and manage emotions. Whitney Tilson’s The N.E.W. System is designed to do exactly that — turning chaos into clarity for traders and investors.

Addressing Investor Concerns

“I’m Too Busy to Learn a New System”

A lot of investors think adopting a new investing system means adding more complexity and hours to their schedule. The truth is, the right system should save you time.

Whitney Tilson’s The N.E.W. System is designed to simplify decision-making. Instead of scanning dozens of stocks without a plan, the system filters your options so you only focus on the most promising opportunities. This actually reduces analysis time and helps you make decisions faster.

From personal experience, I’ve found that disciplined systems like this make my investing more efficient. Instead of wasting hours chasing noise, I concentrate on high-value moves — and spend more time with my family. That’s a real benefit, not a theoretical one.

“What if the System Doesn’t Work for Me?”

Skepticism is natural — especially if you’ve been burned by past investing advice. Every market cycle is different. That’s why a system must adapt and be tested across conditions.

The N.E.W. System doesn’t claim to be perfect. What it offers is a structured method rooted in analysis and data. It’s been tested across various markets and adapted to changing conditions. The real value is in building consistent habits, not chasing “one-time” windfalls.

I’ve personally tested similar frameworks. The consistent advantage isn’t in guessing the next big stock every time, but in having a repeatable approach that works over the long term. That’s what separates seasoned investors from amateurs.

“I Already Have a System”

Many investors already have strategies they trust. The question is whether those strategies are working consistently and whether they add unnecessary complexity.

The N.E.W. System isn’t about replacing all your existing tools. It’s about enhancing them. It offers clarity and structure, helping to refine your approach rather than overhaul it.

Think of it as a GPS system for investing — even if you know your general destination, having better navigation can keep you on course and avoid costly detours.

“Markets Are Unpredictable”

Markets are unpredictable — and that’s exactly why a system matters. Emotional decision-making in uncertain markets can lead to costly mistakes. A structured system provides a framework for evaluating opportunities even when volatility spikes.

Whitney Tilson’s The N.E.W. System builds in flexibility to adapt to changing markets while keeping the process disciplined. This helps investors avoid making hasty decisions based on fear or greed.

From my own investing experience, having a dependable system makes navigating uncertainty less stressful. It turns chaos into a set of manageable choices.

The most common objections to adopting a new investing system are about time, fit, and uncertainty. The N.E.W. System addresses these by being structured, adaptable, and designed for efficiency — making it easier for investors to make better decisions with less stress.

What To Do Next?

Why Acting Now Matters

Investing isn’t about waiting for the “perfect moment.” Markets move quickly, and opportunities fade just as fast as they appear. The longer you wait, the higher the chance you miss out on your next big opportunity.

Whitney Tilson’s The N.E.W. System is designed to give investors a framework to act decisively. It’s not just about picking stocks — it’s about knowing when to act and when to wait. That clarity can make the difference between a solid year and a missed opportunity.

From my personal investing journey, the biggest lessons have come from action, not hesitation. Having a tested system in place removes much of the second-guessing that slows decision-making.

How to Get Started with The N.E.W. System

Here’s a practical path forward:

-

Explore the System: Review the details of Whitney Tilson’s The N.E.W. System to understand the methodology and philosophy behind it.

-

Test with Your Portfolio: Apply the concepts to your current holdings to see how the system aligns with your investment goals.

-

Commit to Discipline: Success comes from consistent application, not occasional tweaks.

-

Monitor and Adapt: Use the system to adapt your strategy as markets evolve.

The goal isn’t just to adopt a set of rules — it’s to adopt a mindset that enables smarter investing over time.

Where to Learn More

For investors looking to streamline their stock selection process and reduce overwhelm, The N.E.W. System offers a structured, research-backed approach.

You can learn more about it here: Whithey Tilson’s The N.E.W. System

Final Words

Investing without a proven process is like sailing without a compass — you may move, but you won’t necessarily get where you want. The N.E.W. System gives investors direction, confidence, and a repeatable method to make decisions.

Now is the moment to decide whether to stay in reactive mode or take a step toward intentional, structured investing. If clarity and consistency matter to you, exploring The N.E.W. System today could be the smartest next step in your investing journey.

FAQ: Simplifying Stock Picking with Whitney Tilson’s N.E.W. System

What exactly is Whitney Tilson’s N.E.W. System?

The N.E.W. System is a data-driven investment framework developed by veteran investor Whitney Tilson. It stands for Neural, Economic, and Wave — three analytical layers that work together to identify stocks with strong potential for outperformance.

- The Neural component uses AI and pattern recognition to detect early signals in price action and sentiment.

- The Economic layer tracks macro trends and valuation shifts to find industries and companies best positioned for growth.

- The Wave analysis measures market momentum, showing when trends are gaining or losing strength.

The result is a practical, evidence-based roadmap that helps investors make confident decisions without relying on emotion or hype.

Is The N.E.W. System suitable for beginner investors?

Yes. The N.E.W. System was designed to be approachable for investors at any experience level. You don’t need advanced technical skills or Wall Street experience to understand its insights.

Whitney Tilson has always emphasized education alongside analysis. His goal is to give everyday investors a structured process — a way to think like professionals do, but without the complexity.

Beginners benefit from the simplicity, while seasoned investors appreciate the system’s depth and adaptability.

Can the N.E.W. System help during volatile markets or downturns?

Absolutely. In fact, that’s where it shines most.

Volatility exposes emotional biases — fear, greed, hesitation — that cause investors to buy high and sell low. The N.E.W. System filters out those emotions by relying on quantifiable signals.

For example, if a stock’s Wave momentum breaks while its Economic indicators weaken, the system can flag early exit points — before big losses pile up. Conversely, it can highlight hidden opportunities when panic selling drives prices below fair value.

It’s not about avoiding volatility; it’s about navigating it intelligently.

How often does Whitney Tilson update The N.E.W. System’s signals?

The system is updated regularly as new data comes in.

Because it’s built on adaptive analytics, it adjusts dynamically to real-time market conditions — not static quarterly snapshots.

Subscribers receive ongoing updates, trade recommendations, and insights that reflect the current investing climate. You’re never working off stale data or old predictions.

Do I need to be glued to my screen all day to use The N.E.W. System?

No. That’s one of its biggest advantages.

The N.E.W. System isn’t about day trading or chasing micro trends. It’s designed for investors who want to make smart, informed decisions without constant monitoring.

You can use the insights weekly or even monthly, depending on your investment style. The system does the heavy lifting — the scanning, analyzing, and ranking — so you can focus on the big picture.

Does The N.E.W. System predict future prices or guarantee returns?

No system can guarantee results — and any that claims to should be treated skeptically.

What The N.E.W. System does is improve probability.

It identifies the conditions that historically lead to outperformance — when Neural sentiment, Economic tailwinds, and Wave momentum align.

It’s not prediction; it’s precision. And over time, those probabilities compound into stronger, steadier performance.

How does Whitney Tilson’s experience influence the N.E.W. System?

Whitney Tilson isn’t a social media influencer or a speculative trader — he’s a long-time professional investor with a track record of calling major market shifts before they hit the headlines.

His background in hedge fund management and education shaped the N.E.W. System’s structure. It’s rooted in how institutions think, but simplified for individual investors.

That experience ensures the system focuses on what actually drives returns — valuation, momentum, and behavioral signals — not short-term hype.

How much does The N.E.W. System cost, and what do I get?

Subscribers gain access to:

- Regular stock recommendations based on the latest N.E.W. signals

- Exclusive research reports on high-conviction plays

- Market briefings that explain what’s driving the next wave of trends

- Educational materials on how to apply the system confidently

Pricing varies depending on the current offer or promotion, but you can check the latest details directly on the official page for The N.E.W. System

Is now a good time to join The N.E.W. System?

If you’ve been feeling uncertain about how to pick stocks in today’s unpredictable environment, now is the best time to add structure to your approach.

Markets are shifting rapidly — AI, energy, inflation, and rate changes are rewriting the playbook. Having a tested system that adapts to these changes gives you a real edge.

Whitney Tilson’s N.E.W. System was built precisely for times like these — when emotion is high, volatility is rising, and clarity is scarce.