If you’ve spent any time watching financial markets, it’s clear that gold is back in style. Investors—institutional and retail—are searching for ways to protect purchasing power and grow wealth in the face of persistent inflation and dollar debasement. But not all gold investments are created equal.

One name stands above the crowd: Garrett Goggin, CFA, CMT. With decades of boots-on-the-ground mining analysis and a proven track record, Goggin has now released what may be his most critical compilation yet: Garrett Goggin’s “Golden Anomaly” Gold Miner Picks. In this guide, we break down the thesis, showcase the picks, and show you why now is the time to subscribe to Golden Portfolio IV.

The Making of a Gold Analyst: Why Garrett Goggin Is Different

When you talk about elite gold investing, Garrett Goggin stands apart as one of the most trusted and original minds in the business. What sets him above the standard newsletter crowd? The answer starts with his rare combination of real-world experience, analytic rigor, and a suite of specialized services—each tailored to a different kind of gold investor.

Unlike many “advisors,” Garrett isn’t a financial pundit hiding behind a screen. He’s earned both CFA and CMT designations, giving him a deep grasp of market cycles, technical setups, and true asset value. More importantly, he takes a “boots-on-the-ground” approach—personally touring mining operations, interviewing geologists, and stress-testing management teams worldwide. This hands-on diligence means he isn’t just repeating industry headlines—he’s discovering and verifying gold anomalies before the mainstream even notices.

But it’s not just his method—it’s the diversity of his research offerings that has made Garrett a go-to name for every kind of gold investor:

Gold Royalty “Retirement Portfolio”: The Ultimate Income Machine

For investors seeking safe, inflation-proof income, Goggin’s Gold Royalty “Retirement Portfolio” is nothing short of revolutionary. He highlights why royalty companies—firms that finance mines in exchange for perpetual royalty streams—are “almost magical” when it comes to capital efficiency and compounding returns.

-

No mining risk: Royalty companies don’t dig or operate mines, so they avoid inflation, cost overruns, fraud, or nationalization.

-

Gold income for life: Their profits are paid in physical gold, giving you a hedge against currency devaluation and economic shocks.

-

Unmatched returns: According to Goggin, a basket of top gold royalty firms has compounded at 34% per year for two decades—outperforming Buffett and the S&P 500 by over 150x.

-

Minimal effort, maximum gain: His portfolio’s track record (18,657% returns since 2007) shows how “boring,” dividend-paying royalties can quietly turn modest investments into millions, with some yielding $44,000 monthly.

If you want “the last investment you’ll ever need”—steady, compounding, inflation-resistant income in a chaotic world—nothing comes close.

Golden Portfolio 10X: High-Octane Asymmetric Wealth

If explosive growth is your style, Garrett’s Golden Portfolio 10X service is the sector’s gold standard. This is his “anomaly miner” portfolio, designed for aggressive investors seeking potential 1,000%+ returns. He handpicks 30 breakthrough gold and silver stocks, cherry-picking the “10% that don’t bleed you dry.”

-

Audited outperformance: The GP10X basket posted a 298% gain since 2024—crushing both gold ETFs (like GDX) and the S&P 500, and trouncing physical gold by 5x.

-

Legendary wins: From 2,200% on Newmarket and 8,358% on SilverCrest to over 300% on multiple plays in 2025, his picks are validated by results, not hype.

-

Built for bull runs: When investors rotate back to value and tangible assets, these anomaly miners—leveraged to both gold and sentiment—are poised to rocket.

Each subscription offers live portfolio access, quarterly updates, starter guides for maximizing returns, and audited results so you always know what’s working.

Research for All Market Environments

Of course, Garrett’s flagship Golden Portfolio IV service captures the best of both worlds—the “anomaly” picks most likely to surge as gold demand and the valuation gap close. But it’s this mix of offerings—retirement income, wild asymmetric upside, and expert research—that truly set him apart.

Bottom line:

Whether you crave reliable compounding income, dream of scoring 10x wins, or want a balanced approach, Garrett Goggin’s reputation and actionable results speak volumes. His forensic diligence and proven returns make him the most credible guide to gold’s next supercycle—earning the trust of everyone from lifelong gold bulls to everyday new investors seeking real wealth in a changing world.

Leading financial voices like Porter Stansberry echo the sentiment: “There’s nobody better in the entire world to explain exactly how to profit from gold’s next supercycle than Garrett Goggin.”

Global Monetary Chaos: Why Gold Is Set to Explode

Gold is again becoming the ultimate store of value. After 50 years in the wilderness, gold is eclipsing US Treasuries on central bank balance sheets. China, the world’s largest buyer, now adds more gold than the Central Bank of China itself. This is no market cycle—it’s a structural shift away from the dollar and toward monetary sanity.

The numbers are staggering:

-

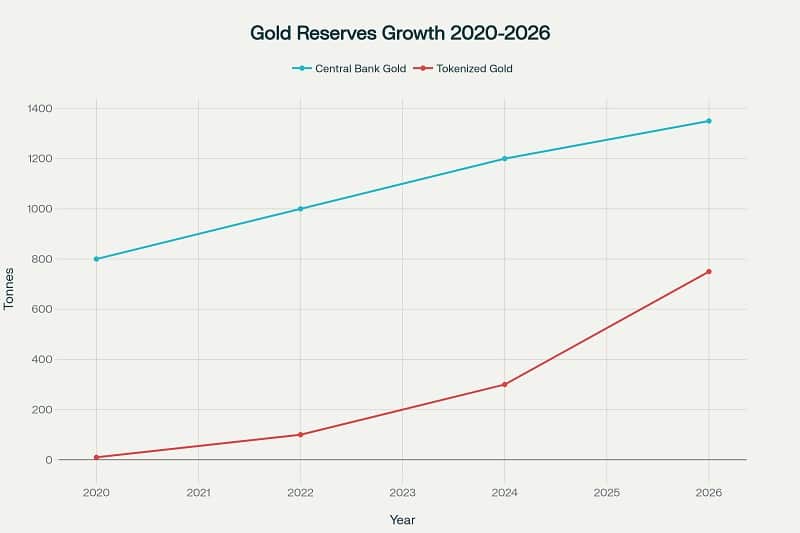

Central banks bought more than 1,000 tonnes of gold in 2024, and they’re on track for another record in 2025.

-

Private buyers like Tether are taking delivery of two tonnes of gold a week, over 100 tonnes per year.

-

With 340 trillion in worldwide debt and US government debt skyrocketing past $38 trillion, trust in the old monetary system is evaporating.

As social security obligations mount and fiat currencies erode, gold is returning as the world’s true anchor—and Goggin believes this sets up the last, biggest gold bull market of our lifetime.

Tokenized Gold: The Most Disruptive Innovation in 5,000 Years

A key theme of the “Golden Anomaly” presentation is the rise of tokenized gold. Powered by giants like Tether, tokenized gold lets investors buy, sell, and store gold instantly and securely, often at zero physical storage cost. It’s not just an ETF—it’s physical gold, backed by blockchain, transactable with the click of a button. Millions of new global investors are about to flood gold markets in 2026 and beyond, sending demand, supply, and prices to new heights.

Yet, as Goggin points out, the leverage is in Gold Miner stocks—not just bullion or tokens. Tokenization boosts demand and price discovery, but miners and royalties offer real anomaly profit.

What Is the Golden Anomaly?

The “Golden Anomaly” is simple, powerful, and unique to Goggin’s method. Most gold miners trade at deep discounts to their net asset value (NAV)—often just 18 cents on the dollar. Retail investors have ignored the sector for years, even as gold hits new highs. This disconnect between market cap and true asset value is the “anomaly profit variable.” When momentum returns, the gap closes fast—potentially turning small investments into generational fortunes.

Goggin’s model filters out the 90% of miners who will never be profitable and hones in on the elite few with:

-

Superior ore grades,

-

Sweet-spot production timing,

-

Actual, proven free cash flow,

-

Strategic advantage as “anomaly profit” closes.

The Four Golden Anomaly Gold Miner Picks: Exclusive Detail

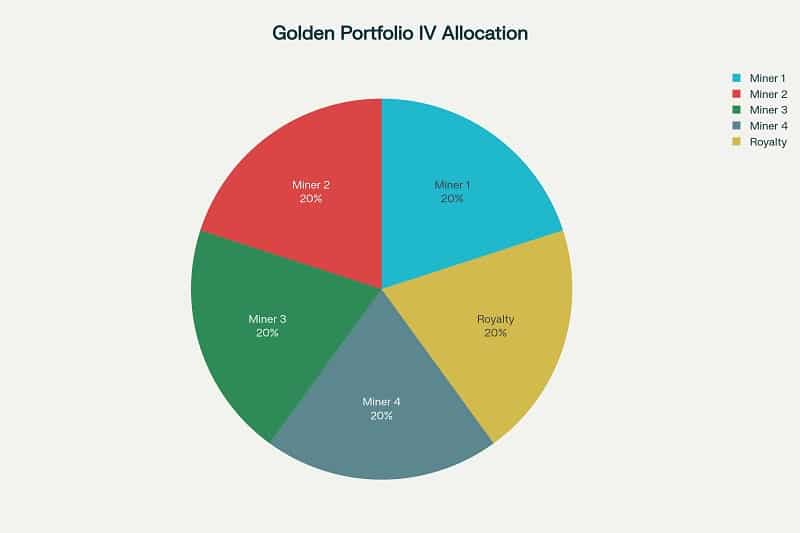

Goggin’s Golden Portfolio IV offers four high-conviction picks, each with distinct advantages and deep discounts:

Pick 1: Holds one of the highest ore grades in history (up to 74 g/t), sixth-ranked trophy asset globally, and a market cap of $730 million vs. NAV of $4.4 billion—a discount of 83%, like buying gold at $680/oz.

Pick 2: With grades up to 13.2 g/t and recoverable open-pit ounces, its market cap is just $77 million versus a $2.1 billion NAV. That’s a 96% discount, equivalent to $160/oz gold, with an anomaly variable of 27X.

Pick 3: Owns a nearly 5 million-ounce deposit, heap-leach operation, and a CEO who previously turned $18 million into $1.2 billion. Its market cap: $550 million vs. $3.1 billion—buying gold at $720/oz.

Pick 4: Backed by mining royalty legends, trophy asset de-risked and producing, 20% owned by industry’s most successful family. Market cap of $1.7 billion vs. $5.5 billion NAV. Already up 234% in 2025, 800% since recommendation.

Each stock is selected for sector leadership, cost discipline, and “anomaly profit” potential—as the market wakes up to gold’s new role in global finance, these miners may hand investors life-changing upside.

Bonus: The Best Royalty Play + Blockchain Banking Coup

Goggin doesn’t stop at traditional miners. One bonus pick is a royalty company recently partnering with Tether, poised to benefit as tokenized and institutional gold adoption surge. This firm collects gold royalties for decades—with no mining risk, just upside. Already up 139% this year and soon to list on the NYSE, it offers both safety and explosive growth.

Subscribers also get a special report from Porter Stansberry, unveiling the company most integral to the new “stablecoin banking coup”—a 25X opportunity as digital finance reshapes the world order.

The Urgency: Why 2026 Is a Unique Window for Gold Investors

The “Golden Anomaly” profit gap is closing, fast. Top picks—even after 803% returns—are still undervalued by over 80%.

As tokenized gold, central bank buying, and freelance miners drive demand, early investors still buy dollars for 18 cents. But once gold fever takes hold, the gap will close—potentially forever. With the Genius Act, “Trump’s $102 Billion Backdoor Deal,” and global monetary shifts, the gold supercycle may never be repeated.

Golden Portfolio IV: What You Get When You Subscribe Now

Golden Portfolio IV is more than a newsletter; it’s institutional-grade research made accessible for the everyday investor. Here’s what subscribers enjoy:

-

Garrett’s Top Four Gold Miner Picks

-

A bonus royalty company backed by real gold contracts

-

Porter Stansberry’s “Blockchain Banking Coup” pick

-

Live Model Portfolio access for real-time monitoring

-

Quarterly updates and actionable buy/sell guidance

-

Complete Starter Guide for gold investors

-

Ongoing market commentary, interviews, and exclusive webinars

All for just $189—the insider’s edge at a fraction of hedge fund rates.

Testimonials: What Real Subscribers Say About Garrett Goggin’s Golden Anomaly

“Five stocks gained 22,304% in 45 days. You’re doing amazing work!” — John

“Direct and comprehensive—high value, best opportunities found anywhere.” — Monica

“Lifetime subscriber—Garrett’s research is the real deal.”

“Objective review of industry challenges and success strategies.” — Tumbling Dice

Final Thoughts: The Last, Best Gold Bull Market—A No-Brainer Opportunity

History shows that when global finance shifts, there’s a short-lived “anomaly” for investors who act first. With fiat currencies faltering, buying dollars for cents, and the world’s best gold analysts (and buyers) pounding the table, success means participating before the fever hits.

Subscribe to Golden Portfolio IV and unlock Garrett Goggin’s “Golden Anomaly” Gold Miner Picks. Secure your family’s wealth, turn inflation into profit, and discover the power of gold stocks and royalties as gold returns to global primacy.

Frequently Asked Questions

What makes Garrett Goggin’s “Golden Anomaly” Gold Miner Picks different from others?

Goggin’s rigor eliminates unprofitable miners and hones in on FCF, NAV, production timing, ore grade, and deep discount. His picks are primed for 10X to 100X returns as retail and institutional gold buying converge.

How does tokenized gold affect traditional investing?

It drives up physical gold demand and price. Miners and royalty firms remain the best way to leverage gold’s upside, combining asset appreciation with anomaly profit and operational leverage.

Who is Golden Portfolio IV for?

Anyone wanting high-conviction, actionable gold picks, from beginners to seasoned investors. It’s designed for those ready to capitalize on gold’s new monetary role and supercycle profit window.

Can I invest with limited funds?

Yes—a stake of just $1,000 in each Top Four could generate life-changing wealth as the gold bull market matures.

Why is now the right time to act?

The anomaly gap is closing, global institutions are buying, and macro imbalances (monetary, fiscal, geopolitical) can accelerate gold’s rise at any time. Delay risks missing the move.