In an era where gold prices have shattered records, soaring past $4,000 per ounce, investors are scrambling for the best ways to capitalize on what many experts call the biggest gold bull market in history. Central banks are hoarding gold at unprecedented rates, institutions are piling in, and everyday folks are lining up at Costco to buy bars. Amid this frenzy, one name keeps surfacing as a beacon for serious gold stock investors: Garrett Goggin, CFA, CMT, and his flagship service, Golden Portfolio IV (GPIV).

What Is Garrett Goggin’s #1 Gold Stock?

Goggin claims to have pinpointed his #1 gold stock to own now—a company he believes could deliver 400% gains by May 20, 2026, and potentially 5X or even 10X in the months and years ahead. He’s so convicted that he’d hypothetically put his children’s college funds into it (while stressing diversification, of course). But is this legit? Or just another hyped-up pitch in the wild world of gold investing?

In this comprehensive deep dive, we’ll dissect Goggin’s credentials, his investment philosophy, the explosive gold market backdrop, and why subscribing to Golden Portfolio IV for just $189 could be the smartest move for gold-focused investors today. We’ll base everything strictly on the provided materials—no speculation, no external fluff. By the end, you’ll understand why thousands are flocking to GPIV and how you can secure Goggin’s #1 gold stock pick before the market revaluation kicks in.

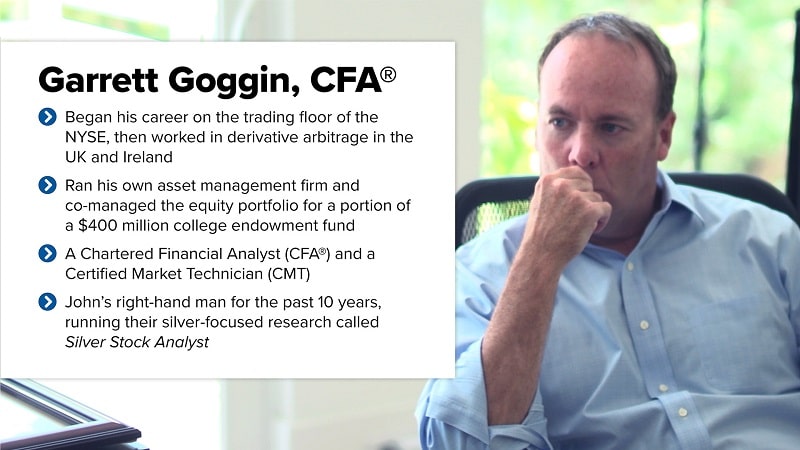

Who Is Garrett Goggin? The Gold Analyst with a 20-Year Track Record

Garrett Goggin isn’t your average newsletter guru peddling generic advice. He’s a CFA (Chartered Financial Analyst)—one of only about 200,000 worldwide—and a CMT (Chartered Market Technician). Earning these designations is grueling: the CFA is often compared to a PhD in finance, harder than a CPA, MBA, or even passing the bar exam. Only 1 in 10,000 candidates complete it.

But Goggin doesn’t just crunch numbers from a desk. He’s a boots-on-the-ground analyst who travels the globe, visiting mines, grilling CEOs, and building industry contacts. He recently returned from the Precious Metals Summit in Beaver Creek, Colorado, where he met over 30 companies and dined with executives. This hands-on approach sets him apart—most analysts rely on reports; Goggin looks CEOs in the eye to separate “sexy narratives” from real deals.

His career highlights? He spent 15 years at Stansberry Research, the world’s largest independent publisher for individual investors, mentored by gold legend John Doody (now over 80). After climbing to the top, Goggin launched independently with one mission: help everyday investors turn small stakes into life-changing gains in gold stocks.

Proof of legitimacy? His live portfolios speak volumes:

- One portfolio averages 469% gains across 5 positions in under 2 years.

- Standouts: 824%, 800%, 806%.

- Historical winners: NewMarket Gold (bought at $1.45, sold at $31 for 2,038% in 3 years); SilverCrest Mines (12 cents to massive heights for 8,358% in under 9 years).

- In 2025 alone, his portfolios are up over 100% on average.

Subscribers rave:

“We got into your recommendations 45 days ago and already five stocks have gained $22,304… You are doing amazing work.” — John

“Outstanding interview… I have followed his research closely for a year and recently became a lifetime subscriber.” — Monica

Goggin’s edge? He combines fundamental analysis (fair value based on cash flows, ore grades) with technicals (cycles, patterns) and real-world intel.

In a short-seller attack on one pick, he had the CEO on a teleconference with readers the next day, debunking claims and stabilizing the stock.

The Explosive Gold Bull Market: Why Now Is the Perfect Time

Gold isn’t just glittering—it’s in a historic bull run. Prices have climbed from $2,500 to ~$4,000 in a year, with forecasts like Goldman Sachs’ $4,900 by 2026. Central banks (China, Turkey, Europe, South America) are buying at record paces. The US Treasury discusses revaluation. Physical gold shipments signal massive shifts.

Goggin calls it “the rhyme of history.” Every ~100 years, fiat systems falter, and gold restores order. We’re there now. Inflation, debt, geopolitics—gold is the hedge.

But don’t buy bullion or ETFs, Goggin warns. Mining stocks amplify gains. In bull markets, top miners outperform gold 5X-10X. His GPIV portfolio is already up 5X since early 2024, and it’s “just getting started.”

Why miners? Leverage. At $4,000/oz, a high-grade mine’s profits explode. Goggin’s picks target deeply undervalued companies ignored by Wall Street.

Garrett Goggin’s #1 Gold Stock: The Criteria for a 5X-10X Winner

Goggin’s #1 pick isn’t random. It meets his three ironclad criteria for outsized returns:

Goggin’s #1 pick isn’t random. It meets his three ironclad criteria for outsized returns:

1. Superior Ore Grade (Grade Is King)

In bull markets, high-grade mines dominate. Low grades mean slim profits amid inflation/costs.

This stock? Nearly 5 million ounces of high-grade, near-surface, oxide gold—easy to process (“run of the mine”). Independently audited, government-filed.

- All-in sustaining costs (AISC): ~$1,125/oz (vs. Barrick/Newmont at $1,600+).

- Mining cost: $16/tonne (vs. $250/tonne underground).

- At $3,500 gold: $2,375 profit/oz (68% margin).

Lowest-cost profile globally. Even if gold drops to $2,500, fair value is $1.664 billion (177% upside from ~$500M market cap).

2. Stage of Production (The Lassonde Curve Sweet Spot)

Per the Lassonde Curve, mines peak at first production. Pre-production: discounted potential. Post-first ounce: cash flow re-rates valuation.

This company? Production starts January 2026. Current market cap: ~$500M. Goggin’s fair value: $3.03 billion ($7.20/share vs. ~$1.14 now)—5X upside.

- Initial: 182K oz/year average.

- Expansion: To 80K t/d, 272K oz/year, $5.9B after-tax profits ($13.90/share)—886% potential.

- Self-funded growth: No dilution—early cash pays for 4X ramp-up.

- Milestones: Recent facility announcement jumped stock 10%. More updates incoming.

First ounce triggers 34% FCF revaluation. Earnings in Spring 2026 accelerate it.

3. Massive Discount to Fair Value

80% undervalued. $500M cap vs. $3B+ NAV. Conservative (assumes $3,500 gold; rises with prices).

Why cheap? Small cap—ignored by big funds. Only one analyst covers it (besides Goggin). Wall Street misses the value.

Executive Chairman: Proven operator, owns 4%. Sold similar mine for $1.1B at $1,200 gold (2015). This one? Bigger potential at $4,000+ gold. Targets 200K oz/year, possibly 10M ounces total.

Goggin’s exclusive interview: Grills Chairman on quadrupling production, revaluation, simplicity vs. past projects. (Subscribers get instant access.)

Past Winners: Proof Goggin Delivers Monster Gains

Goggin’s track record isn’t hype:

- NewMarket Gold: $1.45 → $31 (2,038%, 3 years).

- SilverCrest Mines: $0.12 → explosive (8,358%, <9 years). $5K → $417K.

- Recent call: Newmont at 48% discount, 20% FCF yield → 100%+ since February.

- GPIV gains: 215%, 257%, 336%, 419%, 638%, 800%, 806%, 824% (most <2 years).

Lowest current: 11% (his new #1 addition).

In 2025: All portfolios >100% average.

“Garrett, thanks for… buy this stock a long time ago. I never would have known.” — Don

Why Subscribe to Golden Portfolio IV? Full Benefits Breakdown

For $189 (normally $500—lowest ever), GPIV isn’t just one stock. It’s a complete gold wealth system:

- Immediate Access to #1 Gold Stock + Chairman Interview: Full report, valuation math, video Q&A.

- Four More Top Picks: All discounted, various Lassonde stages.

- Under $2/share → $4.80 target (3X+).

- Under $2.50 → $6.90.

- $0.78 → $11.20 (10X+ potential).

- $5 → $8.30 (already +240% in 2025, +829% since added).

- Quarterly Issues: Full reports, lead articles on precious metals.

- Live Model Portfolio: 5 recommendations, real-time pricing, targets, fundamentals (market cap, EV, revenue by metal).

- News & Analysis Alerts: Breaking updates with Goggin’s expert take.

- Free Starter Guide: “Why Golden Portfolio IV is Your Ultimate Gold Investment.”

- 10,800% returns in explorers.

- 10X gem criteria.

- Royalty companies.

- Decline-proof picks.

- Largest new US deposit.

- Golden Guarantee: 30 days, full refund minus 25% “test-drive” fee. Keep the guide.

Annual auto-renew $189 (cancel anytime).

Subscribe to Golden Portfolio IV Now

Risks in Gold Mining (Goggin’s No-Nonsense View)

Mining sucks as a business: political risk, permitting, low grades, overruns, protests. Goggin avoids these by targeting:

- High-grade, low-cost.

- Proven management.

- US/Canada jurisdictions.

- Near-production de-risking.

His #1: Oxide, near-surface, $1,125 AISC—minimal headaches.

The Urgency: Act Before January 2026 Production

Every day delays the 400% surge. Milestones push price. First ounce = revaluation tsunami. Gold rising? Upside explodes.

Wall Street waking up. Only one analyst now—soon, crowds.

“This offer is only available for a limited time… take advantage now.” — Garrett Goggin

Golden Portfolio IV vs. Other Gold Investments

| Aspect | GPIV | Gold ETFs | Physical Gold | Generic Newsletters |

|---|---|---|---|---|

| Leverage | 5X-10X potential | 1:1 with gold | None | Variable |

| Cost | $189/year | Fees + premium | Storage/insurance | $100-$1,000+ |

| Expertise | CFA/CMT, site visits | Passive | None | Hit-or-miss |

| Picks | 5 curated, undervalued | Basket | N/A | Often overhyped |

| Updates | Real-time alerts | None | None | Infrequent |

| Guarantee | 30-day w/ guide | None | None | Rare |

Subscriber Testimonials: Real People, Real Gains

“Excellent discussion… unique visibility.” — @Tumbling Dice

“Access to his research is one of the best opportunities.” — Monica

Thousands agree: GPIV turns gold mania into profits.

Conclusion: Is Garrett Goggin’s #1 Gold Stock Legit? Absolutely—Subscribe Today

Yes, it’s legit. Backed by 20 years, monster gains, rigorous criteria, and a booming market. The #1 stock—high-grade, low-cost, pre-production, 80% discounted—screams 5X-10X.

But you need GPIV. For $189, get the pick, interview, 4 more stocks, portfolio, alerts, guide.

The bull is raging. Production looms. Don’t miss the revaluation.

Join Golden Portfolio IV Now – Secure Your #1 Gold Stock

Act fast. History rhymes—and this stanza could make you rich.

FAQ: Garrett Goggin’s #1 Gold Stock & Golden Portfolio IV

Who is Garrett Goggin and why should I trust his gold stock recommendations?

Garrett Goggin is a CFA and CMT with 20 years of gold investing experience. He spent 15 years at Stansberry Research under legend John Doody and now runs Golden Portfolio IV independently. His live portfolios show average gains of 469% in under two years, with past winners like 2,038% (NewMarket Gold) and 8,358% (SilverCrest Mines).

What is Garrett Goggin’s #1 gold stock right now?

It’s a near-production, high-grade oxide gold miner with ~5 million ounces, starting output in January 2026. Currently valued at ~$500M, Goggin’s fair value is $3.03 billion — implying 5X upside at $3,500/oz gold, with 10X potential as production scales.

When does the #1 gold stock begin producing?

Commercial production is scheduled to start in January 2026. First gold pour triggers immediate revaluation based on cash flow, not just reserves — a key catalyst per the Lassonde Curve.

How much does Golden Portfolio IV cost?

The current promotional price is $189 (normally $500) — the lowest price ever offered. This includes one year of service, all reports, the live portfolio, and instant access to the #1 stock and Chairman interview.

Is there a money-back guarantee?

Yes — a 30-day Golden Guarantee. Cancel within 30 days for a full refund minus a 25% “test-drive” fee. You keep the free Starter Guide regardless.

What else do I get besides the #1 gold stock?

- Exclusive video interview with the Executive Chairman

- 4 additional undervalued gold stock picks

- Quarterly in-depth reports

- Live model portfolio with real-time pricing and targets

- Breaking news alerts with expert analysis

- Free Starter Guide: “Why Golden Portfolio IV is Your Ultimate Gold Investment”

Will the subscription auto-renew?

Yes — it renews annually at $189 unless canceled at least one business day before the renewal date. Easy cancellation via account or support.

How do I contact support if I have questions?

Call toll-free at 1-833-780-3479 (U.S.-based in Florida) or email support@goldenportfolio.com.

Why is this gold stock still undervalued?

It’s a small-cap company (~$500M) with only one analyst covering it. Wall Street ignores it due to size, but Goggin’s research reveals an 80% discount to fair value — a classic inefficiency he exploits.

Should I wait or act now?

Goggin warns: act before January 2026 production. Each milestone (construction updates, first pour, earnings) drives revaluation. Gold rising toward $4,900+ (per Goldman Sachs) amplifies upside. The $189 offer is limited-time — secure access now here.