Artificial General Intelligence (AGI) is transitioning from fiction to reality, representing a groundbreaking technological frontier with the potential to disrupt industries, reshape economies, and redefine wealth and poverty.

In his Investment Report, Eric Fry, a renowned financial analyst, describes AGI as “America’s final invention,” forecasting massive wealth opportunities for prepared investors and severe economic challenges for those unready.

The report outlines the transformative impact AGI could have on global markets, offering detailed investment strategies to capitalize on this shift while addressing potential risks and rewards of AGI-focused investments.

— RECOMMENDED —

AI’s Jump to Lightspeed is Here

Elon Musk says the ‘point of no return’ may only be 24 months away. Futurist Eric Fry shows you how to target maximum profits and ‘future-proof’ your life while you still can…

Click Here To Get All The Details

The Rise of AGI: What Makes It Unique?

AGI represents a new epoch in artificial intelligence. Unlike current AI systems that excel in specific, narrow tasks, AGI is envisioned as a system capable of reasoning, learning, and performing any intellectual task that a human can do. More importantly, it will continuously improve itself, leading to super intelligence.

Fry outlines that AGI’s far-reaching implications, describing it as a transformative technology that will redefine how businesses operate, how we interact with technology, and how global economies grow. He likens its disruptive potential to previous technological breakthroughs like the internet but at an exponential scale.

AGI’s capabilities will allow it to:

- Solve complex problems across industries, from medicine to space exploration.

- Dramatically increase productivity while reducing costs.

- Eliminate human error from decision-making processes in critical fields.

However, Fry warns that while AGI promises immense economic opportunities, it also poses profound risks, particularly in terms of widespread job displacement.

Economic Implications: A Double-Edged Sword

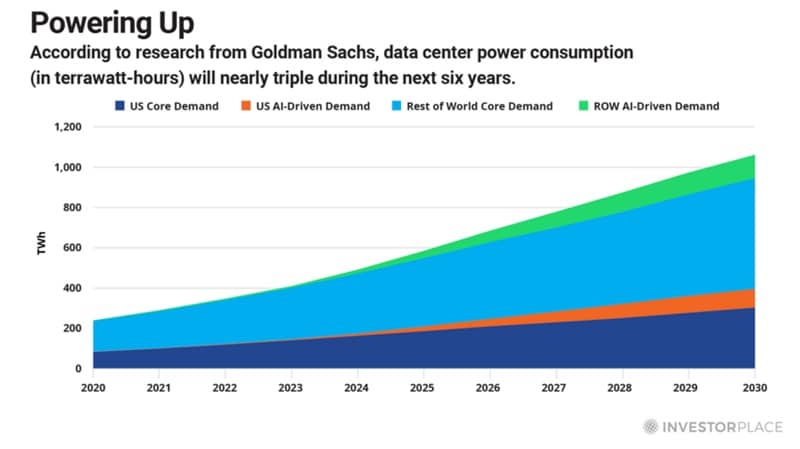

AGI’s potential to create wealth is staggering. Fry highlights projections from leading economists who estimate that AGI could add over $15 trillion to the global economy by 2030. Companies at the forefront of AGI development and those in adjacent sectors—like data storage, semiconductors, and energy—are expected to see significant growth.

Key points from Fry include:

- The Next Billionaires and Trillionaires: AGI could lead to the creation of massive fortunes, potentially producing the world’s first trillionaire.

- Market Acceleration: AGI could accelerate the pace of economic growth to a point where the world economy doubles in just months rather than decades.

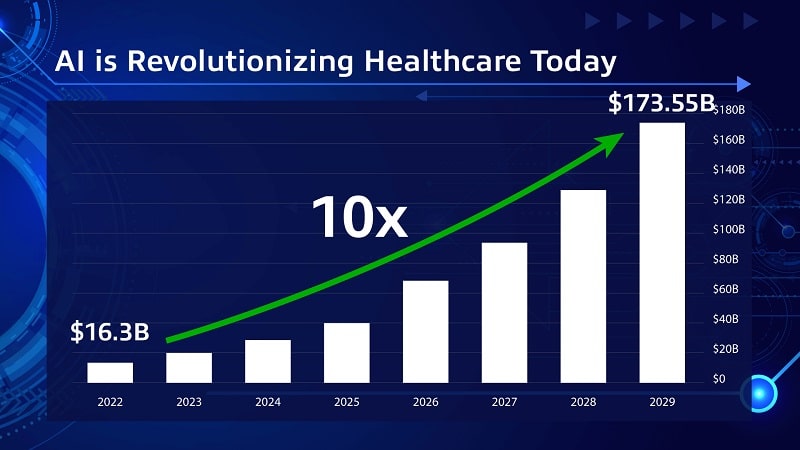

- Sector Winners: Industries such as healthcare, energy, and data infrastructure are poised to benefit disproportionately from AGI’s rise.

Job Displacement and the Growing Wealth Gap

On the flip side, Fry warns of AGI’s disruptive impact on employment. Current AI models are already eliminating millions of jobs through automation, and AGI’s more advanced capabilities could escalate this trend. Goldman Sachs estimates that 300 million jobs could be lost globally in the coming years due to automation—a trend Fry describes as inevitable.

Here are some of the key risk factors:

- White-Collar Vulnerability: While automation has traditionally affected blue-collar jobs, Fry highlights research showing that AGI could disproportionately impact white-collar professionals earning up to $80,000 annually.

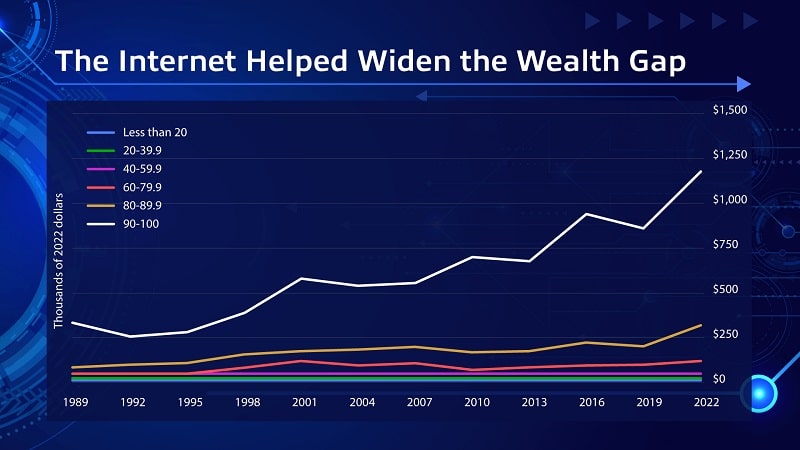

- Income Inequality: The rise of AGI could exacerbate the already growing wealth gap, creating a stark divide between those who can leverage AGI for wealth creation and those left behind.

Fry draws parallels to historical disruptions, such as the Industrial Revolution and the internet boom, where technological advancements benefited a select few while sidelining millions of workers.

Fry’s Investment Strategy: Profiting from the AGI Revolution

Fry lays out a three-step investment framework designed to help individuals capitalize on the AGI revolution while mitigating risks.

Step 1: Focus on Indirect AGI Investments

Fry emphasizes investing in companies that indirectly support AGI’s growth rather than betting solely on the technology’s direct developers. This approach mirrors past investment successes, such as Netflix’s pivot to streaming or Amazon’s dominance in e-commerce.

Three key sectors highlighted by Eric Fry are:

- Data Infrastructure: AGI requires vast amounts of data to function, creating demand for data centers, cloud storage, and high-speed internet infrastructure. Fry identifies companies involved in building and managing data centers as prime investment opportunities.

- Energy Solutions: Running AGI models consumes enormous amounts of power, making energy a critical component of the ecosystem. Fry singles out nuclear energy as a particularly promising area due to its efficiency and scalability.

- Semiconductors and Hardware: The demand for specialized chips and hardware, such as GPUs, will only increase as AGI development accelerates.

Step 2: Identify Future AI Dominators

Fry advises against investing in already dominant players like Microsoft and Nvidia, instead urging investors to focus on smaller, undervalued companies that could emerge as the “next big thing.” These include:

- A “Nvidia-like” company with untapped potential in AI hardware.

- An emerging e-commerce platform positioned to follow in Amazon’s footsteps.

- A fintech disruptor aiming to reinvent traditional banking through AI.

Step 3: Avoid “Portfolio Killers”

Fry also stresses the importance of avoiding companies likely to be negatively affected by AGI’s rise.

AGI in Action: Examples and Case Studies

To underscore AGI’s transformative power, Fry references several real-world examples:

- ChatGPT and GPT Models: Current AI models, like OpenAI’s GPT-4, have already demonstrated remarkable capabilities, such as coding, reasoning, and creative writing. Fry predicts that the next generation of these models will further blur the line between human and machine intelligence.

- Healthcare Advancements: AI is revolutionizing healthcare through applications in diagnostics, robotic surgeries, and drug development. Fry sees this sector as particularly ripe for growth.

- Energy Efficiency: Companies pivoting to renewable and nuclear energy sources to power data centers are poised to benefit from the rising demand for sustainable energy solutions.

While Fry is bullish on AGI’s potential, he acknowledges the inherent risks of investing in disruptive technologies. These include:

- Market Volatility: Early-stage technologies often experience boom-and-bust cycles, making timing critical.

- Ethical Concerns: The rapid development of AGI raises ethical questions around job displacement, privacy, and the potential misuse of superintelligence.

- Overhyped Expectations: As with any emerging technology, there’s a risk that AGI might not develop as quickly or effectively as projected, leading to market corrections.

To mitigate these risks, Fry recommends diversifying investments across multiple sectors and maintaining a long-term perspective.

What Is Fry’s Investment Report?

Fry’s Investment Report is a monthly investment newsletter curated by Eric Fry, a seasoned macro-investment analyst with decades of experience in Silicon Valley and Wall Street. The service focuses on uncovering high-potential investment opportunities, with a particular emphasis on AGI, disruptive technologies, and macroeconomic trends.

Eric Fry is known for his ability to identify early-stage opportunities, boasting a track record of 41 recommendations that yielded 1,000%+ gains. His aim with this report is to guide subscribers toward investments that can deliver exponential returns while preparing them for the potential economic disruptions caused by AGI.

Key Features of Fry’s Investment Report

Fry’s Investment Report comes with a huge number of benefits all available for $99 only. Lets go through some of the key features of the Fry’s investment report.

Monthly Investment Recommendations

Subscribers receive one detailed investment recommendation every month, complete with in-depth analysis and actionable insights. These recommendations are based on Eric Fry’s rigorous global macro strategy, which considers technological breakthroughs, economic trends, and geopolitical events.

Special Reports for High-Growth Opportunities

Members gain instant access to four exclusive reports that provide targeted investment strategies for the AGI era:

- Main Report: My 3 Top AGI Stocks for 1,000% Gains This report identifies three companies poised to benefit indirectly from AGI’s growth. These stocks are selected for their potential to generate exponential returns in the “pre-AGI” market.

- Bonus Report #1: The AI Dominators Fry outlines three undervalued companies that could dominate the AI landscape as AGI evolves, offering significant upside potential.

- Bonus Report #2: The 10 Stocks Insiders Are Dumping Right Now This report highlights stocks that may underperform or collapse due to the AGI revolution, helping investors avoid portfolio risks.

- Bonus Report #3: The 1,000% “Next-Gen” Portfolio Focused on healthcare, this report identifies three companies leveraging AI to revolutionize the $12 trillion healthcare industry.

Access to TradeStops Basic

Subscribers also receive a complimentary one-year membership to TradeStops Basic, a powerful portfolio management tool. This tool includes features such as:

- Real-time portfolio tracking by syncing with brokerage accounts.

- Position sizing tools based on personalized risk levels.

- Volatility Quotient (VQ) technology for setting data-driven exit strategies, helping investors avoid emotional decision-making.

Secure Membership and Renewal

Members can enjoy a full year of access to Fry’s recommendations for an introductory price of $99, significantly discounted from the regular $499 rate. The subscription includes automatic annual renewal at $199, with a flexible cancellation policy.

Why Subscribe to Fry’s Investment Report?

Fry’s Investment Report stands out due to its focus on AGI, one of the most transformative and disruptive technologies of our time. Here’s why this service is particularly appealing.

Prepare for the Economic Impact of AGI

AGI has the potential to generate enormous wealth while displacing millions of jobs. Fry’s report helps investors position themselves on the right side of this economic divide by identifying opportunities in sectors likely to thrive, such as data infrastructure, energy, and healthcare.

Leverage Eric Fry’s Expertise

Eric Fry’s proven ability to predict market trends and identify high-growth investments gives subscribers an edge. His past successes, including long-term gains of 1,622% in Valero Energy and 11,237% in Mint.BK, lend credibility to his recommendations.

Comprehensive Portfolio Strategy

The service doesn’t just recommend what to buy; it also advises on what to avoid. By identifying stocks at risk due to AGI, Fry helps subscribers safeguard their portfolios from potential losses.

Affordable and Risk-Free

At $99 for the first year, Fry’s Investment Report is an affordable way to gain access to professional-grade investment insights. The 90-day money-back guarantee ensures that subscribers can explore the service with minimal risk.

The Verdict: Are AGI Stocks Legit?

Fry’s 2025 report makes a compelling case for the legitimacy of AGI stocks as a long-term investment.

By identifying sectors that support AGI’s development and focusing on companies with growth potential, Fry provides a clear roadmap for navigating this transformative era.

AGI stocks are not just a legitimate opportunity—they could be one of the most transformative investment trends of the 21st century. But success will require careful planning, strategic decision-making, and the foresight to act before the market fully prices in AGI’s potential.

Eric Fry’s Prediction: Get these THREE Road to AGI Stock Recommendation now