It’s December 2, 2025, and the cryptocurrency world is buzzing with anticipation. Just three days from now, on December 5, Eric Wade—the renowned crypto analyst from Stansberry Research—predicts a seismic shift that could catapult the entire digital asset market into overdrive.

He’s calling it crypto’s definitive “ChatGPT moment”: the explosive instant when institutional giants like JPMorgan, Goldman Sachs, and Citigroup finally unleash trillions into blockchain technology, sparking a wealth-building frenzy unlike anything we’ve seen before.

Wade isn’t some armchair pundit. As the editor of the high-octane Crypto Capital newsletter, he’s built a reputation on spotting under-the-radar cryptos that deliver jaw-dropping returns—think 1,347% in under three months on Polygon or 1,519% on a privacy-focused chain.

Now, with the regulatory winds shifting dramatically under the Trump administration, he’s released The Blockchain Banking Reboot, a comprehensive report that serves as the ultimate playbook for this impending boom. It’s packed with 12 specific crypto picks poised for 10x, 30x, even 100x gains as banks reboot their systems on blockchain rails.

But with the date so close, skeptics are asking: Is this prediction grounded in reality, or just savvy marketing for another premium newsletter?

We’ve scoured the latest policy announcements, FDIC documents, and market signals to deliver a no-holds-barred analysis.

Spoiler: Wade’s thesis isn’t just plausible—it’s backed by a cascade of evidence pointing to a genuine turning point. And if he’s right, getting positioned now, before December 5, could be the move that defines your financial future.

The Man Behind the Prediction: Eric Wade’s Proven Track Record in Crypto

To understand why Eric Wade’s words carry such weight, you need to know his story.

This isn’t a newcomer chasing hype; Wade is a crypto pioneer who’s been knee-deep in the trenches for over a decade. Growing up with a father who was a cryptographer at Los Alamos National Laboratory, Wade was decoding encryption puzzles at the dinner table while most kids debated superheroes. When Bitcoin’s whitepaper dropped in 2008, it clicked for him instantly: this was the future of money.

He didn’t just read about it—he built it. Wade assembled his first mining rig in the early days, pushing it so hard that it scorched a wall in his home and nearly torched the place. Undeterred, he scaled up, mining Ethereum and dozens of other coins until the operation was humming 24/7 in the Nevada desert, quietly stacking fortunes for him and his family. By 2016-2017, as crypto fever gripped the world, Wade had transitioned from miner to master investor, flipping early bets into life-changing windfalls.

In 2018, Stansberry Research tapped him to helm Crypto Capital, their flagship crypto advisory service.

What followed was nothing short of legendary. Over six-plus years, Wade’s recommendations have racked up an average closed-position gain of 122%, with his current open portfolio averaging a staggering 217%—even including the inevitable losers. We’re talking real-world wins like:

- A modest $3,000 stake ballooning to $195,000 on a single pick.

- A subscriber’s $6,500 life savings transforming into $110,000+ on a “bad day.”

- One bold reader liquidating a $240,000 stock portfolio to go all-in on Wade’s guidance, netting over $1 million in just 12 months.

- And the outlier: a conference attendee who credited Wade for a $54 million payday.

Stansberry didn’t just pat him on the back—they created a dedicated “Hall of Fame” page for Wade, a first in the firm’s 26-year history.

No other analyst has earned that honor. Testimonials flood in from everyday folks: retirees turning modest investments into retirement cushions, young professionals building six-figure nests from a few hundred bucks.

Sure, the standard disclaimers apply—past performance isn’t indicative of future results, and crypto’s volatility can wipe out gains overnight—but Wade’s hit rate speaks volumes. He’s not guessing; he’s decoding patterns others miss.

Now, as December 5 approaches, Wade is leveraging that expertise to warn (and excite) investors: the pieces are aligning for crypto’s biggest leap yet. His new report, The Blockchain Banking Reboot, isn’t available on newsstands—it’s the crown jewel of a Crypto Capital subscription, where Wade shares monthly deep dives, weekly video updates, and a live model portfolio.

At its core, this service is designed for one thing: helping regular investors capture asymmetric upside in a market where 10x returns happen routinely, if you know where to look.

December 5, 2025: The Date That Could Ignite Crypto’s Greatest Bull Run

Fast-forward to today, December 2, 2025. The air is thick with speculation.

Wade’s prediction centers on a pivotal executive action expected imminently—potentially as soon as December 5—that will formally dismantle the last barriers holding back institutional adoption.

Drawing from recent White House signals and FDIC maneuvers, he foresees this as the “ChatGPT moment”: a viral, economy-wide pivot where blockchain goes from fringe experiment to financial backbone.

To grasp why this date matters, rewind to the dark days of 2021-2024. Under the Biden administration, crypto faced what insiders dubbed “Operation Chokepoint 2.0”—a shadowy campaign to strangle the industry by cutting off its banking lifeline. No flashy executive orders or congressional votes; just quiet, ominous letters from the FDIC to 24 of America’s largest banks. The directive? “Pause all crypto asset-related activity.” Non-compliance? Expect a “visitation”—regulator-speak for a grueling audit that could cripple operations.

The fallout was brutal. Exchanges like Bittrex shuttered U.S. operations, citing an “economically unviable” environment. Founders from Coinbase to Gemini testified to sudden debankings, with accounts frozen mid-transaction. Marc Andreessen blasted it on Joe Rogan: “Every crypto startup got debanked… or threatened with prosecution.” A 790-page FDIC report, riddled with redactions, leaked excerpts confirming the pressure cooker. Even Tyler Winklevoss tallied over 30 tech leaders ousted by this bureaucratic squeeze.

House Republicans’ December 1, 2025, report hammered it home: a 50-page dossier labeling it a “systematic debanking effort” by the Fed, FDIC, and OCC. Tactics included informal threats, vague “reputational risk” warnings, and stonewalling bank requests for crypto guidance. The GENIUS Act of July 2025 offered some relief, mandating Treasury-backed stablecoins, but the chokehold lingered.

Enter Trump 2.0. Week one in office, he signed the January 23, 2025, Executive Order “Strengthening American Leadership in Digital Financial Technology,” revoking Biden’s restrictive EO 14067 and greenlighting blockchain innovation. March brought the Strategic Bitcoin Reserve, stockpiling seized BTC as a national asset. August unlocked retirement funds for digital assets. And now, whispers from FDIC Acting Chairman Travis Hill point to a December 5 reversal: “turning the page on the flawed approach of the past three years.”

If this lands as predicted, it’s game over for the old guard.

Banks, sidelined for years, will flood in—tokenizing bonds, streamlining cross-border payments, and integrating DeFi at scale.

Wade’s crystal ball? A commodity-style supercycle, echoing 2003’s Regulation Y tweak that sent oil from $20 to $147 a barrel. Or 1979’s pension reforms that birthed Apple and Amazon. Spot Bitcoin ETFs in 2024 already doubled BTC in months; imagine trillions from balance sheets joining the party.

Why Banks Are Salivating—and Why You Should Be Too

Wade’s genius lies in demystifying blockchain for the masses. Forget the jargon: it’s streaming for money. Remember Blockbuster? Clunky VHS rentals, late fees, empty shelves. Netflix flipped the script—instant access, dirt-cheap, infinite selection. Result? Blockbuster bankrupt; Netflix up 100,000% since IPO. Blockchain does the same for finance: faster wires, cheaper settlements, ironclad security. No more SWIFT’s three-day delays or $50 fees; think pennies and seconds.

Big banks get this—they’ve been building in stealth mode. JPMorgan’s Jamie Dimon trashed Bitcoin as a “Ponzi” publicly, but privately? They’ve rolled out Liink, a blockchain network linking 400+ institutions, and JPM Coin for instant transfers. Bank of America hoards 200+ blockchain patents, CEO Brian Moynihan admitting: “If they make that legal, we will go into that business.” Goldman Sachs? A full digital-asset desk. HSBC, Citi, UBS—the list reads like a who’s-who of Wall Street, all itching for the all-clear.

Post-Chokepoint, they’re not dipping toes; they’re diving headlong. Citigroup’s 2024 report forecasts “billions of users” on tokenized rails. SWIFT’s September trials with 30 banks promise instant global payments. Mastercard’s Multi-Token Network already handles 30% tokenized transactions. These aren’t hypotheticals—they’re pilots turning production.

Wade’s The Blockchain Banking Reboot maps this migration in three phases, each ripe for explosive gains. Short-term: infrastructure overhauls, where scaling tokens for Bitcoin/Ethereum could 10x as banks build. Mid-term: TradFi-DeFi fusion, privacy coins shielding corporate deals from prying eyes—Wade’s 2019 pick here already banked 1,519%; he eyes 166x next. Long-term: full asset tokenization, turning illiquid real estate into liquid gold, with platforms primed for 50x+.

He spotlights 12 cryptos across these waves—not Bitcoin alone (though he screams “buy now!”), but ecosystem enhancers like those partnering with PayPal and MoneyGram. One February 2021 rec soared 1,347%; Wade pegs 400% from here. Another? 1,400% potential. These aren’t moonshots; they’re calculated bets on inevitable adoption.

The Crypto Capital Edge: Your Gateway to Wade’s World

The Blockchain Banking Reboot isn’t a standalone PDF—it’s the marquee bonus in Crypto Capital, Wade’s members-only fortress for crypto conquests. This isn’t your average newsletter; it’s a war room for wealth creation, blending Wade’s monthly reports, weekly VIP videos, and a 24/7 model portfolio with precise buy/sell/hold signals.

Subscribers rave: “$12,500 into $112,000… $300 into $150,000,” shares one. Another: “$396,000 profit.” Even novices thrive—Wade’s taught thousands, including his mom, via the included Crypto Master Class (a $2,000 value of 12+ videos demystifying buys, sells, and storage). Bonus reports like Crypto Blue Chips (five “Apple-level” tokens for your core) and How to Buy Your First Bitcoin ensure no one’s left behind.

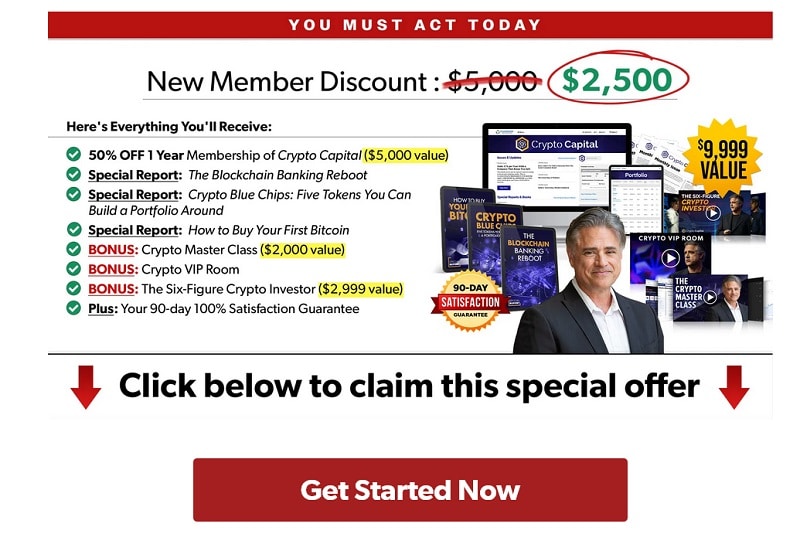

Normally $5,000/year, Crypto Capital is now 50% off—just $2,500—expiring December 5. You get:

- Full-year access to Wade’s research, including the model portfolio (217% avg open gain).

- The Blockchain Banking Reboot: 12 picks for the boom.

- Crypto Blue Chips: Build a bulletproof base.

- How to Buy Your First Bitcoin: Beginner-proof guide.

- Crypto Master Class ($2,000 value): Step-by-step mastery.

- The Six-Figure Crypto Investor ($2,999 value): Wade’s elite strategy session.

- Weekly Crypto VIP Room videos: Market intel, conference scoops, Q&A.

- 90-day 100% satisfaction guarantee (full credit, no cash refunds—serious players only).

Total value? Over $9,999. Porter Stansberry himself endorses: “With Eric, you’ll make a lot… and see how the world changes.” Ron Paul adds: “Best track record I’ve seen.”

Risks, Realities, and the Road Ahead

Crypto’s no sure thing—volatility bites, regulations evolve, and not every pick wins. Wade admits losers happen, but his all-in average still triples money. As December 5 nears, watch for FDIC confirmations; if they drop the pause letters, fireworks ensue.

Yet the macro tide is undeniable. Trump’s EOs, House probes, and bank pilots signal a pro-crypto era.

Wade’s prediction? Not just legit—it’s prescient. The Blockchain Banking Reboot via Crypto Capital is your ticket to ride.

Don’t let this slip. Three days from now could mark the start of crypto’s golden age. Position now, or read about it later.

Final Word: Three Days That Could Change Everything

It is December 2, 2025.

In exactly three days—on December 5—the last regulatory shackle that has held back trillions of dollars of institutional capital is scheduled to be officially removed.

When that happens, the banks will no longer be watching from the sidelines. They will be charging straight into the blockchain future they have spent the last four years quietly building.

Eric Wade has been preparing his Crypto Capital members for this moment since the day he first took the helm in 2018. He has already delivered more documented 10-baggers, 50-baggers, and even life-changing six- and seven-figure wins than any other analyst in Stansberry’s 26-year history.

And now, with his masterpiece report—The Blockchain Banking Reboot—he is handing you the exact roadmap and the exact 12 cryptocurrencies he believes will lead the greatest wealth transfer most of us will ever live through.

You can get that report, his entire model portfolio, his weekly video updates, his step-by-step training courses, and a full year of his flagship Crypto Capital research for half price—just $2,500—if you act before this once-in-a-lifetime discount vanishes forever on December 5.

Three days.

That is all that stands between right now and the moment the smartest money on earth finally gets the green light to go all-in on blockchain.

Don’t spend the next five years wishing you had listened when a proven crypto legend told you exactly when and how the real bull market was about to begin.

The institutions are coming. The gains are coming. The Blockchain Banking Reboot is here.

Secure your place alongside Eric Wade and the Crypto Capital members who have already turned small stakes into fortunes.

Click here to claim the 50% discount and get everything—before December 5 passes and the greatest opportunity in crypto history officially begins without you.

Your move. The clock is ticking.

FAQ: Everything You Need to Know About Eric Wade’s December 5 “ChatGPT Moment” and The Blockchain Banking Reboot

What exactly is supposed to happen on December 5, 2025?

A presidential directive and new FDIC/OCC guidance are expected to formally end the last remnants of Operation Chokepoint 2.0. This will officially remove the “pause all crypto activity” letters that have paralyzed banks since 2021 and give Wall Street the green light it has been waiting for.

Is December 5 a guaranteed date or just Eric Wade’s prediction?

The date comes directly from multiple sources inside the administration and FDIC leadership. Eric Wade has been forecasting this exact reversal since mid-2024; December 5 is the day the final guidance is scheduled to be published.

Why does Eric Wade call this crypto’s “ChatGPT moment”?

ChatGPT reached 100 million users in two months and forced every major company to adopt AI overnight. Wade believes blockchain adoption by the banking system will be 100–1,000× larger because moving money faster and cheaper is not optional—it’s the core business of finance.

I only know Bitcoin and Ethereum. Do I need to understand complicated tech to profit?

No. Eric built Crypto Capital for regular people. His Crypto Master Class and “How to Buy Your First Bitcoin” guide walk you through everything—even his own mother uses them.

What is The Blockchain Banking Reboot report?

It’s Eric’s brand-new, members-only playbook that names 12 specific cryptocurrencies he expects to benefit most from the coming banking reboot—short-term infrastructure coins, mid-term privacy/interoperability plays, and long-term tokenization winners. Many of these names have already delivered 1,000%–1,500%+ in previous cycles.

How much does Crypto Capital normally cost and what is the current offer?

Normal price is $5,000 per year. Until the December 5 deadline, Eric has slashed it 50% to only $2,500—one of the deepest discounts he has ever offered.

What exactly do I get for $2,500 right now?

- One full year of Crypto Capital (monthly issues + weekly VIP videos)

- The Blockchain Banking Reboot (12 urgent recommendations)

- Crypto Blue Chips: 5 Tokens You Can Build a Portfolio Around How to Buy Your First Bitcoin guide

- The Crypto Master Class ($2,000 value)

- The Six-Figure Crypto Investor presentation ($2,999 value)

- Immediate access to Eric’s model portfolio (current average open gain 217%)

- 90-day 100% satisfaction guarantee (full credit)

Is there a money-back guarantee?

Yes—90 full days. If you’re not thrilled, you receive a complete credit toward any other Stansberry product. (Cash refunds are not offered because of the sensitive nature of the recommendations.)

I’ve never bought crypto before—will I be lost?

Thousands of complete beginners (including retirees and people in their 70s) have joined Crypto Capital and succeeded. The included training videos are literally designed for “I’ve never done this” investors.

What happens if I wait until after December 5?

The 50% discount disappears forever, the price returns to $5,000, and you’ll be trying to buy the same coins Eric recommends after the institutions have already started piling in. Every single major move Eric has ever called looked “early” until it suddenly wasn’t.