Eric Fry’s predictions about the American Supercluster Event are turning heads in investing circles. But is he really on to something? I’m putting Fry’s Investment Report’s latest presentation and package under the microscope to find out.

Eric Fry’s Investment Report: The Revenge of the Heartland – Click Here to watch the presentation

Table of Contents

- 1 What Is Eric Fry Prediction?

- 2 Who is Eric Fry?

- 3 Eric Fry Prediction Details

- 4 What Exactly is the Cluster Effect?

- 5 Cluster Effect in U.S. History

- 6 Where will emerge the next cluster?

- 7 How Eric Fry sees the future of American innovation?

- 8 Eric Fry’s Action Plan

- 9 What Is the track record of Fry’s Investment Report?

- 10 How much is Fry’s Investment Report?

- 11 What is included in Fry’s Investment Report?

- 12 Final Words

What Is Eric Fry Prediction?

There’s one big reason there’s a great divide in our country. It has nothing to do with our political differences, our education gap, or our income gap, as you’ve been told to believe. It comes down to the fundamental – geography.

Eric Fry took the advice from the great hockey player Wayne Gretzky, who used to say that you have to skate “to where the puck is going to be.” Otherwise, you’ll be late and miss it.

The same theory applies to business.

Self-made millionaires simply figured out where to find the next opportunity.

In this presentation, Eric is sharing with his audience that he can show us where the smart money is going next.

Read further to learn his new prediction, including his #1 recommendation for the upcoming boom. You will also get details on five more moves, each with 10X potential.

Who is Eric Fry?

For almost 20 years, Eric Fry has specialized in foreign stocks. He worked as a professional portfolio manager for over ten years, specializing in short-selling and global investment strategies.

Eric is respected in the professional community for his exceptional long-term track record.

In 2016 he participated in the most prestigious investment competition in the sector, where his recommendations were up against 650 of the top names in the field. People like Joel Greenblatt, David Einhorn, and Bill Ackman. And he outperformed them all, averaging a 150% annualized return.

That was twelve times better than the S&P’s performance in the same year.

As a result, they named him “America’s Top Trader”.

He has analyzed markets now for over 30 years.

His analysis was published in Time Magazine, Barron’s, The Wall Street Journal, BusinessWeek, USA Today, the Los Angeles Times, Money magazine, and many others.

Eric shared with his audience that he has reasons to believe that you’ll soon have another chance to make money right here in America.

— RECOMMENDED —

Wall Street titan Marc Chaikin predicted February’s sell-off… AND the recent run on banks way back in November. Now, he’s sounding the alarm on what’s coming next for the stock market… “Folks are about to do some very dangerous things with their money in the coming weeks, unless they understand what’s coming next.”

Click here for details (and a free recommendation).

Eric Fry Prediction Details

Eric’s analyses are pointing towards something so significant that it has the power to transcend politics, revolutionize the US economy, and perhaps even alter the direction of American history… exactly as it has occurred at least seven times before.

If you get in early enough, you might have numerous opportunities to increase your wealth over the coming years and even decades.

On the other side, as this shift takes hold, you could see millions of jobs disappear from one of America’s most iconic industries.

You could see skills that were perfected over decades become obsolete.

So… What Exactly IS Going On?

Eric began his explanation with the key wealth-building phenomenon that you need to understand first. It is called the “Cluster Effect”. It is a term economists use to describe why and where booms will happen.

What Exactly is the Cluster Effect?

It’s called a “cluster” event because those booms typically occur when several connected businesses “cluster” in one place.

They quickly begin connecting to one another.

That network draws in experts…

That encourages innovation.

Which draws money in turn…

It brings in more talent and encourages innovation…

They can force not only technological changes but also social changes.

“Supercluster” booms can be quite disruptive. While some become extremely wealthy, others may be left behind.

Cluster Effect in U.S. History

Eric gives few examples of clusters developed in America so we can get better picture of what is expected in the close future.

- The Automotive Supercluster – Detroit early 1900.

Long before Henry Ford began in the automobile era… Detroit was essentially a French fur trade post. After that, it was a little town surrounded by farmland in Michigan.

Then, when the first Model T rolled off the manufacturing line, everything changed…

Money started pouring in…

And so did other car companies…

General Motors… Chrysler… Packard…

Not only did it become America’s richest city, but it was also the car capital of the entire world with over 125 auto companies, headquartered in Detroit.

America’s roadways were remapped because of the car boom.

And it paved the way for a variety of petrol stations, diners, shopping malls, and even suburbs…

- The steel age supercluster – Pittsburgh

Before Pittsburgh was the steelmaker for the world, it was Fort Pitt. During the French and Indian War, this was a British stronghold.

I’m sure no one alive at the time expected that Pittsburgh would produce the steel that gave us railways, skyscrapers, and the weapons that helped us win both World Wars.

At that time Pittsburgh had more millionaires than New York City.

- The American Oil Supercluster – Houston.

In 1901 a Texas drilling rig broke into massive oil deposit and changed Huston from muddy port town to the beacon for the rest of the world. Investors poured in a lot of capital.

These days, in Houston operate over 600 oil exploration and production businesses… There are approximately 1,100 oilfield service businesses… and over 180 pipeline companies.

The “cluster effect” spreads opportunities. It opened the way for Houston’s high-tech industries, engineering firms, healthcare, software, and financial firms… even NASA.

- The Biotech Supercluster – Boston.

Almost 1,000 biopharmaceutical companies around Harvard and MIT call the Boston area home. Some are tiny, others are giants. And many could have made you richer. Companies like Biogen, Vertex, Thermo Fischer Scientific, and more.

- The Big Tech Supercluster – Silicon Valley.

Before Silicon Valley became the world’s tech mecca, it was open countryside covered in fruit orchards.

Today, Silicon Valley and the Bay Area are home to at least 30 of the world’s largest technology enterprises… with another 40,000 fresher startups… and high concentration of wealth.

- The Entertainment Supercluster – Hollywood.

The “cluster effect” is in full force, concentrating on Hollywood. Starting before the Golden Age of Cinema to the present. Along the way Hollywood created widespread prosperity and enormous fortunes.

- The Financial Cluster – Wall Street.

Millions of businesses have money to grow, develop, and rebuild thanks to Wall Street. And millions of Americans have somewhere to put their retirement funds.

It’s also a major reason why New York is the wealthiest city in the planet.

These are just few examples. Eric’s point is that when one of these “supercluster” locations arises, it has the potential to offer new opportunities. This could happen in any economic situation – recession, market crash, even during war.

— RECOMMENDED —

While everyone’s worried about inflation, cryptocurrencies, and a looming recession, professor and forensic accountant Joel Litman just delivered an even more surprising warning when he met with top military brass at the Pentagon last month. Here’s what Joel says will happen to the market over the next 90 days.

Click here to get the full story.

Where will emerge the next cluster?

If you track the clusters on the map, you will realize that they are mostly concentrated on our East and West Coasts.

Eric is predicting the next new epicenter to be in the American Heartland, in the shadow of Lookout Mountain.

Wealthy investors, vast cash-rich corporations, and even some of the world’s largest financial institutions are already paying attention to this shift… Even in this volatile market.

The longer you wait to take action, the less money you’ll have. And the longer you wait, the more you risk falling further behind.

How Eric Fry sees the future of American innovation?

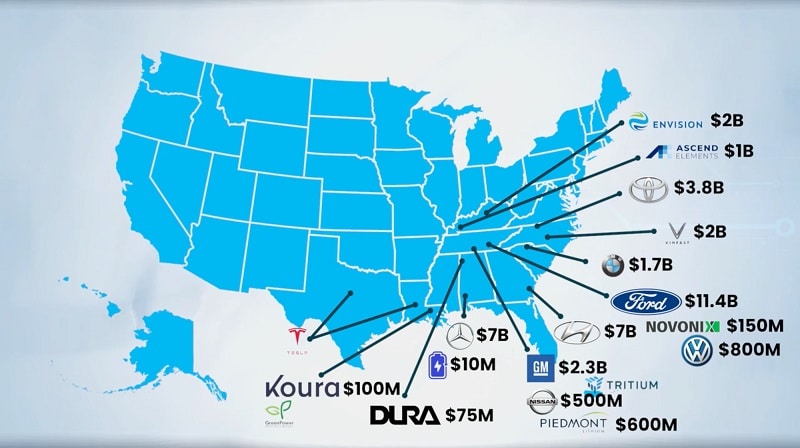

Eric is talking about the seven U.S. states you can see from Lookout Mountain. This is the area where the new economic “supercluster” of innovation and investment taking shape:

Tennessee… Kentucky… Virginia… Georgia… Alabama… and both Carolinas…

In this area you will find around 28 distinct companies, each dedicated to laying the groundwork for the future of electric vehicles and the batteries that power them. These companies are investing in the kickstart of a new era of American prosperity. Eric calls it “Made in America, 2.0”.

In 2022, high gas prices helped double EVs’ share of new car sales. Now battery-powered cars make up the fastest-growing segment of the auto market.

Billions of dollars are already flooding into building EV sites in this area. Look at the map.

This means thousands new jobs, talent concentration and innovation in the area.

Eric is confident that America’s EV Supercluster is just beginning.

Building EVs will require innovations in many other technologies like computer vision, advanced battery chemistries and miniaturization, next-generation semiconductors, smart power grids, mass-energy storage technology, LiDAR sensors… and 5G-enabled everything.

You need to take action now if you don’t want to miss this.

Eric Fry’s Action Plan

- STEP #1: Own The Future Of America 2.0 With Just One Stock.

This is Eric’s #1 stock pick recommendation. The name is Freeport-McMoRan… with the ticker “FCX.”

It is a U.S. based mining giant. The reason is simple. EVs need batteries. Batteries need raw minerals.

Did you know that the average EV contains up to 10 times the copper of a gas-powered car?

Without copper, power grids, solar, EV charging stations, and even wind energy cannot function.

Freeport is America’s largest copper supplier. Five of the six largest copper mines in the United States are owned and operated by Freeport… Furthermore, the corporation produces more than half of our country’s overall supply.

Freeport is also the world’s largest producer of the metal molybdenum… which is a critical component of every renewable energy technology imaginable, from wind and solar to nuclear energy, geothermal, wind, and hydro, including EVs.

Freeport’s annual revenues have risen from $2 billion to $10 billion in the last two years as a result of increased output and record high copper prices.

Aside from Eric’s top pick, FCX, he has identified two more stocks that could benefit from rising demand for battery metals.

And because all three stocks pay dividends, you can profit from the next “supercluster” boom as well.

All three of these additional recommendations can be found in a report called American Building Blocks: Three Resource Plays for the New Revolution.

You’ll learn everything you need to know about these three “building block” techniques.

Each could provide you with consistent, reliable returns for many years to come.

After you do this, move to the next step.

- STEP #2: Buy The Companies That Could 10X Your Money…

-

- The first company uses AI to run “smart” EV-charging grids.

This company has an AI-powered system to manage that energy flow. It’s also already partnered with Fortune 500 companies across the US. This is the first pure smart-energy-network play to go public in the US. And you can still get shares for under $10.

-

- The second company makes synthetic graphite.

You can’t make lithium batteries without graphite. And this company cuts battery costs by making that graphite synthetically instead of mining it. It has partnered with Honda, Panasonic, Samsung, and Bosch. And it’s just won a huge $150 million grant from the U.S. government to build a brand-new plant in Chattanooga.

-

- The last company Eric is recommending specializes in micro sensors.

To keep the vehicle running properly, EV batteries require constant monitoring.

Eric’s recommendation specializes in fiber-optic technology, which is perfect for the project.

It also develops 5G network solutions that aid in the development of self-driving cars.

This company is already a market leader.

All details of Eric’s research are included in a report called: “The New 1,000% Portfolio.”

- STEP #3: Grab an Early Stake In America’s Next Great Rebound…

After three years of supply chain chaos and political threats from China, Russia, and other overseas competitors, manufacturing is returning home.

In his third report called “Made in America… Again”, Eric introduces us to three more household names that will develop new solutions for EV manufacturers… and elevate the entire industry.

Inside are companies that you want to own for long term… From high-tech glass for interactive dashboard displays… to next-generation energy storage to help power the nationwide EV-charging network … to an all-American solution for surging semiconductor demand…

- Step #4: Cut Your losses.

This means trim the dead weight from your portfolio. Eric’s fourth report is called The Purge Portfolio.

The first thing you’ll notice inside are the names and ticker symbols of ten well-known corporations owned by millions of People.

Please ensure that you do not own these companies. And don’t buy them no matter how much cheaper they get.

Also included in this research is a simple two-part test that you can and should use to any investment you make, whether it’s now or in the future.

All four reports:

- REPORT #1: American Building Blocks

- REPORT #2: The New 1,000% Portfolio

- REPORT #3: Made in America… Again…

- BONUS REPORT: The Purge Portfolio

Are FREE for you when you sign up for Eric’s financial research letter called Fry’s Investment Report.

I’m sure you’ve seen lots of solicitations for various investment research letters over the years because I get lots of those too.

But Eric’s promise is that you have never seen anything like this.

I know that if you’re going to follow an analyst, you want to follow someone with a proven long-term track record… Read further to get inside details for this service.

What Is the track record of Fry’s Investment Report?

During the last 30 years, Eric said he built what he believes to be one of the strongest track records in the industry… through all kinds of market twists and turns… during variety of disruptive trends.

I doubt a lot of investors have come close to his history of recommending 41 stocks that gained 1,000% or more.

Since the inception of Fry’s Investment Report, their average annual return is 42.6% overall. That’s more than quadruple the average return on the S&P.

Now you are probably wondering: With this incredible track record how much they charge for the service? I have great news for you.

How much is Fry’s Investment Report?

Normally, the access to Fry’s Investment Report is $199 per year. For short time, Eric gives a chance to try his flagship research, risk free, at a huge discount.

Fry’s Investment Report – Click Here to find the best price

If you decide it’s not for you, you can cancel in the next 365 days and get a full refund.

What is included in Fry’s Investment Report?

Here is a list of what is included with current promotion:

- One Year of Fry’s Investment Report (Over 75% OFF)

- FREE Ticker Symbol: plays a pivotal role in this emerging wealth sector.

- REPORT #1: American Building Blocks

- REPORT #2: The New 1,000% Portfolio

- REPORT #3: Made in America… Again…

- BONUS REPORT: The Purge Portfolio…

- Instant Access to my Full Model Portfolio

- 365-Day Money-Back Guarantee for your subscription

- 24/7 access to members-only portal

- And much more

Final Words

You probably know about Moore’s Law. This is the idea that thanks to constant innovation, computer chips double in processing power every two years. This is true for the last half a century.

But there’s another “Experience Curve Effect” you might not know about. It’s called Wright’s Law, after aviation engineer Theodore P. Wright. According to Wright, the more effort and money you put into developing new technology, the faster the underlying technology improves, and the cheaper it becomes for everyone to use.

So, what does this have to do with the Midwest’s unexpected EV sector boom?

As billions of dollars flow in, and as mass production finally picks up, the Experience Curve Effect will take place.

You do not want to miss this!

Most important, Eric will be right there with you, every step of the way. Sharing with you all his research, so you can make informed decisions.

![Eric Fry Prediction: Is American Supercluster Legit? [Fry's Investment Report]](https://e8u6c7p8.rocketcdn.me/wp-content/uploads/2023/03/Eric-Fry-Rebirth-Of-America.jpg)