Eric Fry, a renowned investment strategist with over 40 years of experience, has built a reputation as a master of leveraging small stock moves into outsized gains through a unique approach combining fundamental analysis, macroeconomic insights, and a strategic use of financial tools. His methodology offers a blend of risk mitigation and aggressive growth potential, appealing to investors looking for substantial returns without unnecessary exposure.

Here, in our Eric Fry’s Leverage Review, we’ll explore Fry’s investment philosophy, his focus on long-term options (LEAPS), and the principles underlying his success, encapsulated in his C4 Method. This deep dive aims to provide a comprehensive understanding of his strategy plus all the details about Eric Fry’s Leverage subscription service.

Eric Fry’s Leverage Service Overview

Eric Fry’s Leverage service is designed to help investors harness the power of long-term options (LEAPS) to amplify small stock movements into substantial gains. It is a comprehensive, investor-focused research advisory service that combines strategic insights, detailed recommendations, and educational resources, making it an excellent choice for those looking to take their investing to the next level. Below are the key features of this service.

A Risk-Managed Approach to Leverage

Eric Fry’s Leverage investment strategy revolves around leveraging small stock movements into exponential gains through the use of long-term options, specifically LEAPS (Long-Term Equity Anticipation Securities).

Unlike traditional options, which are short-term and expire within weeks or months, LEAPS have expiration periods of one to three years. This extended timeline provides several advantages:

- Greater Margin of Error: LEAPS allow time for market conditions and stock fundamentals to align with the investor’s thesis.

- Amplified Gains with Lower Risk: While LEAPS use leverage, they cap potential losses to the premium paid for the option.

- Flexibility in Trade Management: Investors can take partial profits as gains materialize, locking in returns while maintaining exposure to potential upside.

Fry emphasizes that LEAPS mitigate the pitfalls of short-term options, such as rapid time decay and the need for precise timing, making them ideal for long-term trends.

The Power of Leverage

Central to Fry’s strategy is the concept of financial leverage, which amplifies potential gains from modest stock price movements. He likens leverage to a mechanical lever, enabling a small amount of capital to control a much larger financial asset. For example, a $5,000 investment in a LEAPS trade might generate gains exceeding $20,000, provided the underlying stock moves as anticipated.

Fry underscores that leverage, when applied responsibly, is a powerful wealth-building tool. Unlike speculative short-term trading, his methodology focuses on careful stock selection, risk management, and long-term horizons to enhance returns without exposing investors to catastrophic losses.

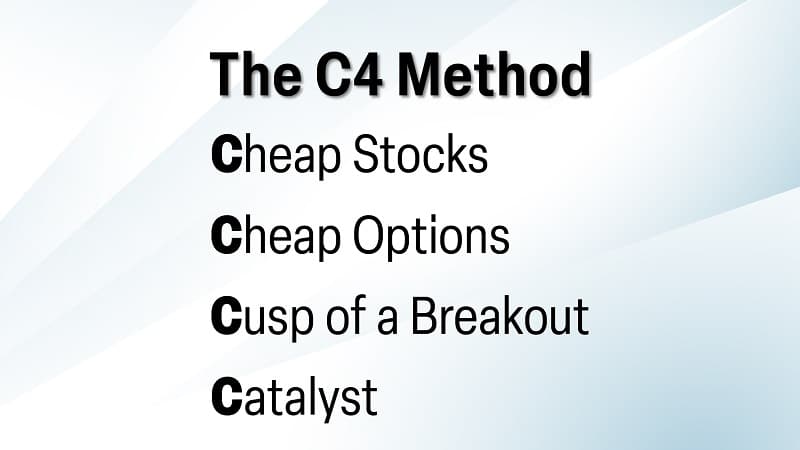

The C4 Method: Fry’s Secret Sauce

Eric Fry’s stock selection process is guided by what he calls the C4 Method, a framework designed to identify high-potential opportunities with manageable risk. The four pillars of this method are:

- Cheap Stocks: Fry looks for undervalued or out-of-favor stocks using various fundamental metrics. These stocks often trade below their intrinsic value, providing significant upside potential when market sentiment shifts.

- Cheap Options: High-volatility stocks with expensive options are typically avoided. Instead, Fry focuses on stable, low-volatility stocks, allowing for lower-cost LEAPS purchases with greater profit margins.

- Cusp of a Breakout: Fry identifies stocks poised for significant price movements. Using technical and fundamental analysis, he pinpoints entry points where momentum is likely to accelerate.

- Catalyst: Every recommendation must have a clear, identifiable driver for future growth, such as a major industry trend, a product launch, or favorable macroeconomic conditions.

This disciplined approach ensures that each trade is grounded in a strong rationale, reducing reliance on luck or speculation.

Real-World Examples of Success

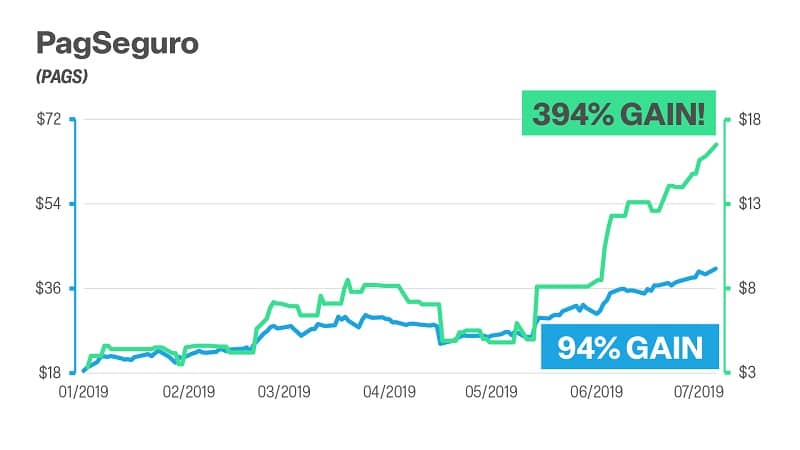

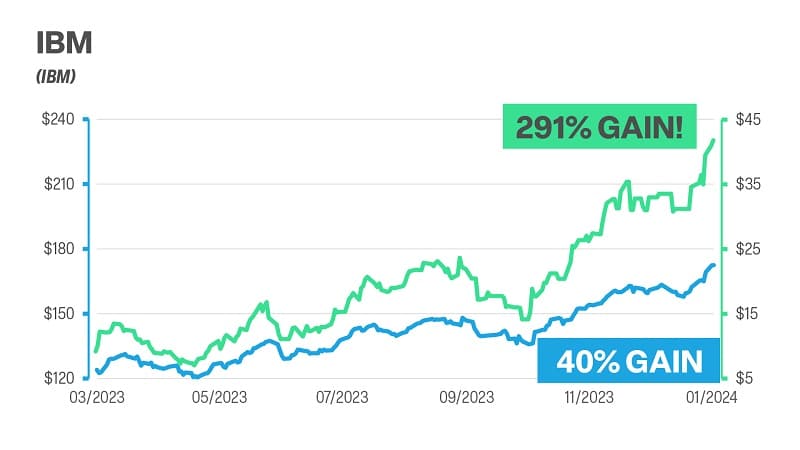

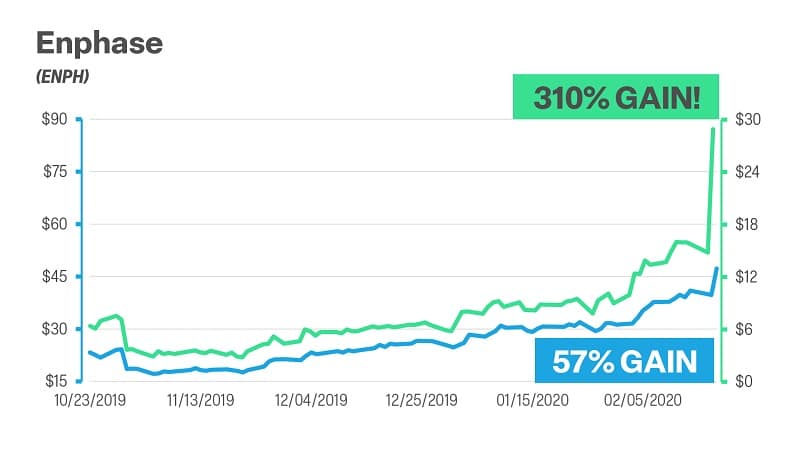

Fry’s track record is peppered with examples of how his strategies have translated into exceptional gains:

- Freeport-McMoRan (FCX): Fry predicted a surge in copper demand due to the electrification boom, including electric vehicles and renewable energy technologies. His LEAPS recommendation on Freeport-McMoRan returned an astronomical 1,506%, turning a $5,000 investment into over $50,000.

- IBM: While IBM’s stock gained a respectable 40% in one year, Fry’s LEAPS recommendation yielded a 291% return. This demonstrates the multiplier effect of leverage when applied to modest stock movements.

- Enphase Energy: A stock gain of 100% was converted into a 400% return through Fry’s LEAPS strategy, showcasing how this approach maximizes potential profits from rapidly appreciating stocks.

The Advantages of Long-Term Options

Fry advocates for LEAPS as a versatile tool for both bullish and bearish scenarios. Whether anticipating a market rally or a decline, long-term options provide flexibility and a high reward-to-risk ratio. Key benefits include:

- Reduced Time Pressure: Unlike short-term options, LEAPS give investors ample time to be right about their thesis, reducing the likelihood of losing due to short-term market fluctuations.

- Controlled Risk: The maximum loss is limited to the premium paid, which is typically a fraction of the capital required to purchase the underlying stock outright.

- Enhanced Returns: By using leverage, even small stock gains can generate significant profits.

Managing Trades: A Dynamic Approach

A crucial aspect of Fry’s methodology is his dynamic trade management. He often recommends taking partial profits when LEAPS reach significant milestones, such as doubling or tripling in value. Fry’s strategy also allows for flexibility in exiting trades, whether to cut losses or capitalize on outsized gains.

Macro Trends and Big Picture Thinking

Fry’s ability to foresee major economic trends is a cornerstone of his success. Over the years, he has accurately predicted:

- The dot-com bubble burst in 2000.

- The 2008 housing market crash.

- The COVID-19 market downturn and subsequent recovery.

By aligning his investments with these trends, Fry has consistently identified opportunities that others overlook. For instance, his foresight into the rise of electrification and renewable energy positioned him to recommend trades like Freeport-McMoRan, which benefited from increasing demand for copper.

What’s Included with Your Membership?

Here’s everything that comes with Eric Fry’s Leverage membership:

A Full Year of Trade Recommendations

Subscribers receive 12 to 24 carefully selected trade opportunities annually, providing multiple chances to capitalize on modest stock movements. Each trade is rooted in Fry’s meticulous analysis and his proprietary C4 Method, ensuring that every recommendation has the potential to turn modest stock moves into significant gains.

Exclusive Members-Only Website

The service offers access to a secure, members-only platform where subscribers can view:

- All trade alerts.

- Detailed market updates.

- The model portfolio with active recommendations. This centralized hub ensures subscribers have all the information they need at their fingertips to make informed decisions.

Time-Sensitive Portfolio Updates

Subscribers are notified immediately when there is a new trade opportunity, a recommendation to take profits, or adjustments to the portfolio. These timely alerts ensure that members can act quickly to maximize gains or manage risk effectively.

Bonus Reports

New subscribers receive three valuable bonus reports designed to provide additional insights and actionable recommendations:

- Three LEAPS Trades to Make Today: A $299 value, this report includes specific instructions for three high-potential trades currently recommended by Fry.

- How to Make Your First Options Trade in Minutes: Valued at $99, this beginner-friendly guide simplifies the process of trading options, helping even novice investors get started with confidence.

- LEAPS: The Only Options Strategy Where You Have the Advantage: Another $99 value, this in-depth report dives into the benefits and nuances of LEAPS, providing actionable strategies and tips for maximizing gains.

Eric Fry’s Performance Promise

Fry pledges that the first six trades in the model portfolio will deliver an average gain of 50%. If this benchmark isn’t met, subscribers are eligible for a full refund in the form of a credit applicable to any of InvestorPlace’s premium research services. This commitment underscores Fry’s confidence in his proven strategy and dedication to delivering results.

90-Day Satisfaction Guarantee

To ensure a risk-free experience for new members, the service includes a 90-day satisfaction guarantee. If subscribers are not completely satisfied within the first three months, they can request a full refund in the form of a credit that can be applied toward other InvestorPlace research services.

Educational Resources

In addition to trade recommendations, the service provides a wealth of educational content, including:

- Step-by-step instructions on how to execute trades.

- Guidance on managing winning and losing positions.

- Strategies for leveraging long-term options to maximize returns. These resources ensure that subscribers not only benefit from Fry’s recommendations but also develop a deeper understanding of the strategies behind them.

Customer Support

Subscribers can access a dedicated customer support team via phone or email during business hours (Monday to Friday, 9 AM to 5 PM ET). While the team cannot provide individual investment advice, they are available to answer questions about the service and help with technical issues.

Pricing

Eric Fry’s Leverage service is available at an exclusive Charter Membership price of $1,500 per year, offering a 50% discount from its regular cost of $3,000 annually. This limited-time offer provides an affordable opportunity for investors to access Fry’s premium research and strategies, designed to maximize gains through long-term options (LEAPS).

Get Your Eric Fry’s Leverage 50%OFF Here

Final Thoughts

Eric Fry’s Leverage service stands out as a comprehensive and innovative investment research program designed to help investors maximize their gains through long-term options (LEAPS).

With a proven methodology rooted in his proprietary C4 Method, Fry offers a disciplined, low-risk approach to leveraging small stock movements into substantial profits. For investors seeking a structured, high-reward strategy, Leverage offers a unique opportunity to achieve significant financial growth.

>> That’s it for my review. Don’t miss out – Claim up to 50% discount TODAY! <<