Today we would like to talk about one of the new presentations of Stansberry Research.

Bill Shaw, Commodity Supercycles editor is showing the #1 gold play he recommends to his subscribers. He is also presenting his monthly newsletter called Commodity Supercycles.

Many of you have probably noticed already that over the last six months, gold is already quietly outperforming the S&P 500.

Bill Shaw and his team believe that gold is “on the cusp of a major bull market”. According to his research, the price of gold is set to rocket up in the months to come.

Bill Shaw has a plan what to buy today to get rich in gold. You can start for less than $10.

Bill Shaw’s Gold Stock for 2022 – Click Here To Watch the presentation

Table of Contents

- 1 Who is Bill Shaw?

- 2 Bill Shaw’s Prediction: Greatest Precious Metals Bull Market

- 3 Bill Shaw’s way to invest in gold

- 4 Why Shaw Believes Royalties are a Perfect Business?

- 5 Bill Shaw’s Royalty Firm Recommendation

- 6 Bill Shaw’s #1 Way to invest in Gold in 2022

- 7 What is included in Commodity Supercycles?

- 8 How much does Commodity Supercycles cost?

Who is Bill Shaw?

Bill Shaw is hard-asset analyst at Stansberry Research, one of the best financial publishing companies.

For the past 23 years in business, their readers grew to over a million across the world.

Over the past two decades, Stansberry Research has spotted many profitable opportunities in the commodities markets.

Some of their most successful recommendations are precious metals investments which gained 200% or more.

Soon they are expecting to add even more gold and silver investments to their successful recommendations, including the $6 strategy he is presenting in this video.

Bill Shaw’s Prediction: Greatest Precious Metals Bull Market

Many of the most powerful and well-connected people believe that the price of the gold will soar in the months to come. Especially if the government continues with money printing. Some of the world’s smartest investors are jumping in.

Bill Shaw does not hesitate to give an estimate how high will the gold go. He thinks that it will keep soaring, possibly reaching $5,000 or higher leading to the biggest bull market we’ve ever seen in gold.

Most people are not familiar but since the beginning of 2022, gold has outperformed every major investment class.

Everywhere he sees evidence for precious metals bull market.

First: Inflation is at its highest level in 40 years.

Second: Economic and political pressures are reaching a boiling point.

Third: Student loans in US are already $1.6 trillion.

Fourth: Money printing will not end any time soon.

Here is the thing. If you want to buy the same investments everyone else is buying, you might do OK.

But if you want a low-risk way to potentially earn huge gains, you will have to take different approach to different kind of gold investment.

— RECOMMENDED —

“Commodities will be THE trade of the coming decade,” says the senior analyst behind 24 triple-digit winning recommendations. And it’s not just because they’re among the best ways to BEAT out-of-control inflation… but because they’re at the beginning stages of a massive cycle – one that could hand you quadruple-digit gains if you get in now.

He details his No. 1 favorite commodity play, right here.

Bill Shaw’s way to invest in gold

Bill Shaw found a better way to profit from emerging gold boom. It is not connected with bullion, EFTs, or mining stocks.

This incredible investment has an average return of 38% per year for 18 years in a row.

Let’s calculate…. every $1,000 invested turn into more than $300,000!

This unknown gold investment was pioneered by a Canadian named Pierre Lassonde.

He was born in Montreal and came to US to work as engineer.

Lassonde knew Nevada held huge amounts of untapped gold.

If you know Lassonde’s business secret, you could use it to make huge gains in the next few years.

The secret Lassonde discovered was “Mining Royalties”.

For some of you that are not familiar, this is the right to receive a percentage of production of a gold mine.

He and his business partner had previously made a fortune collecting royalties in the oil and gas business. So, they decided to use the same strategy in the gold sector.

They created a company called Franco-Nevada. It is listed on the New York stock exchange with ticker symbol FNV.

In the past 20 years, Franco-Nevada has outperformed nearly every other investment. You might be surprised but this year is not an exception.

If the gold is continuing to soar, Bill Shaw is expecting Franco-Nevada will continue to beat the overall market.

He found a smaller company that’s even better than Franco-Nevada. It is much cheaper with bigger upside. He considers it “The perfect business model”.

Why Shaw Believes Royalties are a Perfect Business?

A mining company has a lot of expenses, before it can begin to produce gold. The entire process to build a mine and produce gold can take over 10 years, and costs millions of dollars.

Royalty companies, on the other hand, have little overhead and require very few employees.

Franco-Nevada has only 35 full-time employees and it is $27 billion company.

Bottom line: Mining royalties are Shaw’s perfect business because of the low risk, low overhead, and HUGE profit margins.

Since Lassonde created this business model, several other firms have copied it, making a fortune for other their investors.

You can take advantage of the $6 royalty investment that Shaw has in mind.

— RECOMMENDED —

Stocks are off to their worst start of a year ever. And with inflation at 40-year highs and geopolitical shock escalating, Chief Technology Analyst Matt McCall weighs in and shares his No. 1 recommendation for your money today.

Bill Shaw’s Royalty Firm Recommendation

One of the most successful companies that followed Lassonde’s footsteps is a Denver-based firm called Royal Gold.

It was founded in 1986 as an oil and gas exploration company.

After one year in business, in 1987 the company shifted its focus to royalties. That’s when the investors started to make profits.

Today, Royal Gold is leading precious metals royalty company and owns around 190 royalties on five continents.

If you are interested, the company is listed on the Nasdaq, and the stock symbol is RGLD.

Over the years, Bill Shaw and his team have recommended Royal Gold and Franco-Nevada to their customers.

You can invest in either company, and you’ll probably do OK. But if you want to become wealthy during this gold boom, read the details below.

Bill Shaw’s #1 Way to invest in Gold in 2022

Shaw believes that there is another company that is by far the best gold royalty investment you could make right now. It gives a realistic chance to make huge gains, thanks to its incredible business model.

It owns royalties on mines in United States, Brazil, Turkey, Argentina, etc.

Over the past five years, Shaw has been focused on precious metals. He found a lucrative way to take low-risk stake in this asset as this brand-new bull market has emerged.

He put all his other projects aside to have the time to research and identify the $6 royalty investment he considers the best gold investment of 2022.

You can find the essential information of his discoveries in his newest special report called The #1 Gold Stock to Buy in 2022.

If you plan to buy gold, this is the best report to start with.

You will receive it when you start a trial subscription Shaw’s monthly investment advisory letter, called Commodity Supercycles.

What is included in Commodity Supercycles?

Commodity Supercycles newsletter includes Shaw’s latest research. It comes with three FREE reports:

- The #1 Gold Stock to buy in 2022 – this report reveals details of Shaw’s ONE gold royalty investment recommendation. Currently it is trading at $6 per share.

- The Silver Trade – in this special report you will learn why silver could outperform gold, and which silver stocks are Shaw’s favorite.

- The Secret Currency: A Secret Gold Strategy Used by the World’s Wealthiest Families to make 500% Gains with Very Little Risk. Here you will learn about a special form of gold and silver that has nothing to do with mining stocks, mutual funds, options futures, or bullion. It has the potential for much higher gains than regular gold and silver.

Commodity Supercycles newsletter comes out every first Wednesday of the month. You will gain access to Shaw’s entire Model Portfolio plus access to his complete library of hundreds of back issues and special reports.

Currently Shaw’s model portfolio has 16 recommendations in buy range.

Throughout the month, Bill will email you updates as needed. You will be informed when it is time to lock-in gains, add or close a position, and other important steps.

— RECOMMENDED —

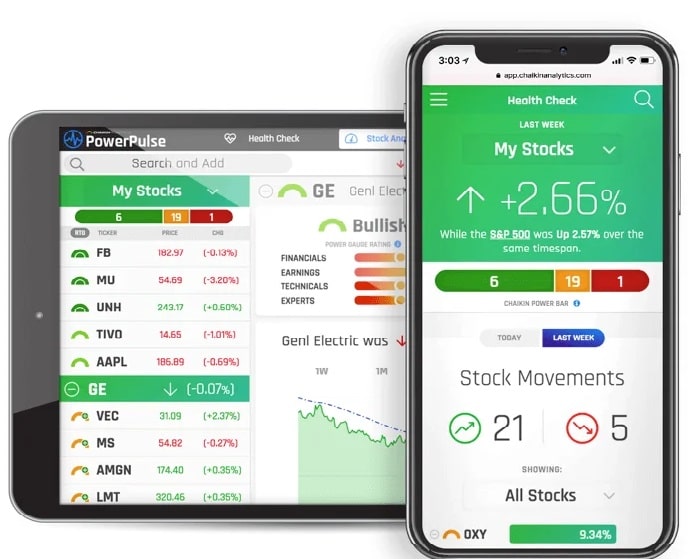

A New Way To See Which Stocks Could Double Your Money

We want to give you FREE access to the Power Gauge system ($5,000 value).

Claim FREE access to The Power Gauge Here

How much does Commodity Supercycles cost?

A one-year subscription to Commodity Supercycles normally costs $199 per year.

Right now, there is a promotion going on and you can gain access to everything mentioned above for only $49 for the entire year – click here.

You also have 30 days to decide if Commodity Supercycles is right for you. If not, they promise you will get full refund.

Bottom line: It might sound too good to be true, but this is one of the most powerful investment opportunities in the current market conditions.