As we step into 2025, the world is buzzing with discussions about artificial intelligence (AI) and its potential to reshape industries, create wealth, and drive innovation. At the forefront of this conversation is James Altucher, an entrepreneur, author, and renowned investor, who has consistently demonstrated an uncanny ability to predict transformative trends in technology and investments.

Through his platform, Altucher’s Investment Network, he aims to democratize access to wealth-building opportunities in what he calls the “AI 2.0 Revolution.”

But is Altucher’s Investment Network legitimate, or is it just another hyped-up offering in the crowded world of investment advice? In this review, we’ll take a deep dive into the service, its features, track record, and whether it can truly empower everyday investors to capitalize on the $15.7 trillion AI boom.

Altucher’s Track Record: Proven Predictions

James Altucher’s investment philosophy is rooted in identifying transformative trends before they hit the mainstream. His track record speaks volumes, with notable predictions that have translated into substantial gains for those who followed his advice:

- 1997: Forecasted the rise of video streaming services.

- 2013: Predicted Bitcoin’s success when it traded at $114. Bitcoin later reached $70,000.

- 2011: Called the stock market bottom during the financial crisis, encouraging timely investments.

Altucher’s background further enhances his credibility. A graduate of Carnegie Mellon University, he worked on IBM’s Deep Blue, the first chess-playing computer to defeat a world champion.

His entrepreneurial ventures include founding tech companies that sold for $10 million and $15 million, respectively. He later used his expertise to manage a hedge fund powered by AI tools he developed.

The Rise of AI 2.0: A Wealth-Building Opportunity

AI 2.0 is the second wave of artificial intelligence innovations, building on early applications like chatbots and image recognition to drive transformative changes across industries.

This next phase is projected to redefine fields like medicine, transportation, cybersecurity, and manufacturing.

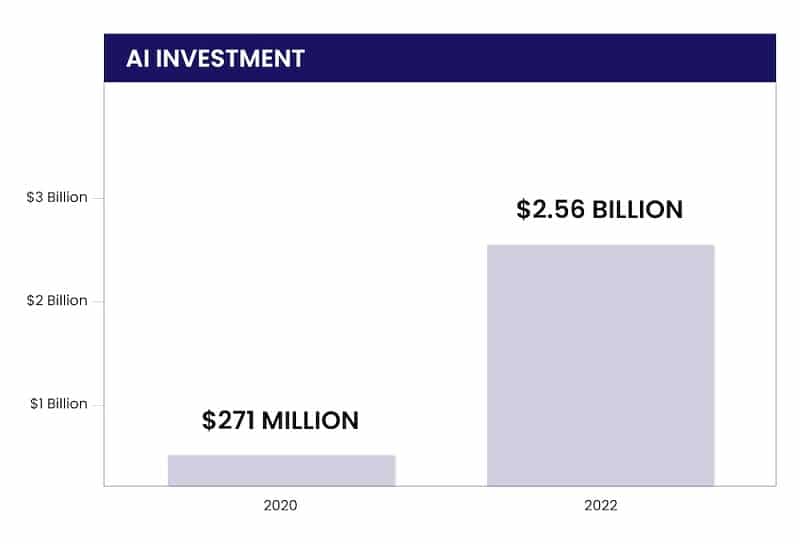

According to PwC, AI could contribute up to $15.7 trillion to the global economy by 2030, with experts predicting that figure could soar to $100 trillion as foundational AI technologies become more advanced.

Altucher believes this moment represents a once-in-a-lifetime “wealth window” for investors. However, he cautions against chasing the hype of flashy, public-facing tools, emphasizing instead the need to focus on companies developing the core technologies powering AI’s evolution.

The challenge for most investors lies in identifying these foundational players—a task Altucher aims to simplify through his Investment Network.

Why AI 2.0 Matters for Investors

AI 2.0’s significance lies in its ability to reshape industries and create economic value. Here are some of the sectors where AI is expected to have the greatest impact:

- Medicine: AI-powered drug development is slashing costs and reducing timelines for new treatments.

- Transportation: Autonomous vehicles, including self-driving cars and drones, are becoming viable.

- Cybersecurity: AI tools offer advanced protection against cyber threats, a growing concern in the digital age.

- Manufacturing: Robots like Elon Musk’s Optimus are revolutionizing production lines.

Altucher believes the companies enabling these innovations—rather than the ones creating end-user applications—will generate the most substantial long-term returns.

Cash In on AI Buyouts

Altucher notes that major tech companies like Google, Microsoft, and Apple, which collectively hold over $400 billion in cash reserves, are aggressively acquiring smaller AI innovators to stay competitive. Using proprietary software, Altucher’s team predicts which companies are most likely to be acquired, offering subscribers the chance to benefit from potential buyout deals.

Avoiding Common AI Investment Traps

Altucher emphasizes the importance of avoiding pitfalls that often derail novice investors. His advice includes:

- Beware of Hype Companies: He warns against businesses rebranding themselves as AI-focused without real expertise, citing the infamous case of the Long Island Iced Tea Corporation’s pivot to blockchain.

- Steer Clear of Startups Without Proven Models: While the world has over 67,000 AI startups, Altucher notes that 99% are expected to fail.

By focusing on companies with a strong track record and foundational innovations, Altucher’s recommendations aim to minimize risks and maximize returns.

Altucher’s Investment Network: Unlock the AI 2.0 Wealth Window

Altucher’s Investment Network is your gateway to unparalleled investment insights, actionable strategies, and exclusive stock recommendations. This subscription-based service focuses on identifying transformative markets like AI 2.0, biotech, crypto, and cybersecurity. Whether you’re a seasoned investor or just starting, this program offers tailored opportunities to grow your portfolio.

The $10,000 to $1 Million AI 2.0 Blueprint

This flagship report is your step-by-step guide to transforming an initial investment into potentially life-changing returns.

- Comprehensive Portfolio: Detailed analysis of 10 AI stocks primed for exponential growth.

- Strategic Entry Points: Clear buy-in price recommendations for each stock.

- Technology-Centric Focus: Targets companies advancing core AI innovations like quantum computing and NLP.

Your $144 AI Jackpot

Aimed at small-budget investors, this report highlights three under-the-radar AI stocks with high-growth potential.

Cash In on AI Buyouts

Discover AI companies most likely to be acquired by tech giants, presenting opportunities for massive gains through proprietary buyout predictions.

Altucher’s Investing 101 Guide

For beginners, this step-by-step guide simplifies the process of setting up a brokerage account and making smart investment decisions.

5 Secret AI Income Generators (Bonus Report)

Learn five ways to generate monthly income from AI without any upfront investment. From freelance AI services to innovative platforms, this guide offers creative ways to pad your income.

Exclusive Subscriber Benefits

- Monthly Insights:

- 12 monthly issues packed with timely investment strategies and exclusive opportunities.

- Weekly Updates:

- Ongoing email updates to track portfolio performance and market movements.

- Actionable Alerts:

- Email and optional text alerts for critical buy or sell recommendations.

Additional Free Bonuses:

- AI Catalyst Calendar: Tracks key market-moving AI events.

- Quarterly Live AI Q&A Webinars: Interact with experts and gain real-time insights.

- Monthly AI Masterminds: Stay ahead with expert-led discussions.

- Unadvertised Perks: Surprise bonuses and exclusive content.

- Access to Premium Daily Newsletters: Stay informed with Altucher Confidential, Paradigm Pressroom’s 5 Bullets, and Paradigm Press Concierge.

Exceptional Value with Zero Risk

Altucher’s Investment Network offers exceptional value with zero risk, making it an unparalleled opportunity for investors. The subscription, regularly priced at $299/year, is now available at a special rate of just $49/year—an incredible 84% discount. Even better, subscribers can lock in this discounted rate for life, ensuring long-term affordability.

To further ensure peace of mind, the service comes with a six-month risk-free guarantee. If it doesn’t deliver at least 10x the value, subscribers can cancel anytime for a full refund, no questions asked, while keeping all reports and bonuses as a thank-you for giving it a try.

Who Can Benefit from Altucher’s Investment Network?

Altucher’s platform is designed for a broad audience:

- Beginner Investors: The Investing 101 Guide simplifies the process of opening a brokerage account and executing trades.

- Seasoned Investors: Advanced reports and proprietary tools cater to those seeking to diversify their portfolios with high-growth stocks.

- Small Budget Investors: With recommendations like the $144 AI Jackpot, even those with modest resources can participate in the AI boom.

Is Altucher’s Investment Network Worth It?

While no investment service can guarantee results, Altucher’s track record and deep understanding of technological trends lend credibility to his claims. The AI 2.0 Revolution represents a significant economic shift, and Altucher’s guidance could provide a valuable roadmap for those looking to capitalize on it.

Key factors to consider include:

- Proven Expertise: Altucher has consistently identified transformative trends well before they became mainstream.

- Comprehensive Resources: Subscribers gain access to a wealth of information, from beginner guides to advanced investment strategies.

- Focused Approach: The network prioritizes companies with foundational AI technologies, steering clear of hype-driven distractions.

Conclusion: Your Opportunity in the AI Wealth Boom

Altucher’s Investment Network offers a mix of guidance, actionable insights, and exclusive tools, making it a potentially valuable resource for anyone looking to navigate the complexities of AI investing.

Whether you’re starting with $144 or $10,000, the service aims to empower investors to secure financial independence and participate in what could be the next great tech revolution.

James Altucher describes AI 2.0 as the most significant wealth-building opportunity of our era, akin to the Gilded Age’s transformative innovations. With the “wealth window” expected to close by 2025, he urges investors to act decisively.