The AI revolution is upon us, presenting investors with what Alexander Green, Chief Investment Strategist of The Oxford Club, calls “the most important wealth-building opportunity since the internet.” His newest initiative, “The Next Magnificent Seven,” identifies seven AI-focused companies poised to dominate the next wave of innovation, much like the original “Magnificent Seven” (Google, Microsoft, Amazon, Apple, Tesla, Nvidia, and META) did during the internet revolution.

This review delves into Green’s investment philosophy, explores his past successes, and provides insights into the Next Magnificent Seven stocks that could define the AI era.

Alexander Green’s Proven Track Record

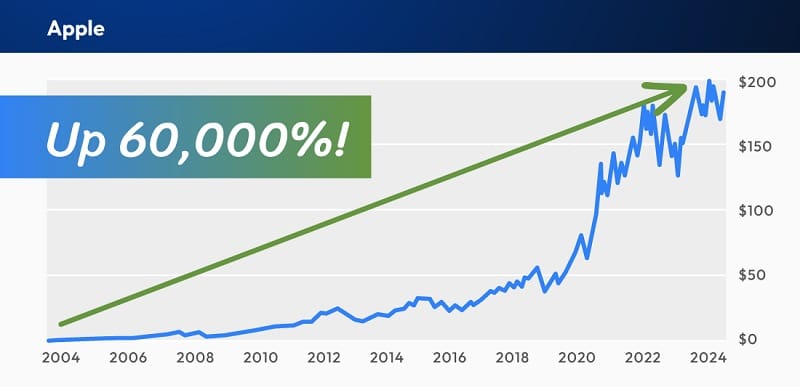

Green’s ability to spot transformative trends before they dominate the market is central to his success. His portfolio includes early investments in some of the best-performing stocks of the past 20 years:

- Apple (1996): Purchased when shares were under $1. Return: ~60,000%.

- Nvidia (2004): Bought at $1.10 split-adjusted. Current price: Over $900.

- Tesla (2013): Recommended at $2.75 split-adjusted. Growth: 60x.

- Netflix (2005): Identified during its early disruption of traditional media.

Green’s knack for identifying transformative companies underscores his credibility in pinpointing the Next Magnificent Seven.

The Investment Opportunity of a Lifetime

Artificial Intelligence (AI) is more than just a buzzword; it’s a paradigm shift poised to redefine industries, create new business models, and drive exponential productivity. Green highlights AI’s transformative potential with compelling statistics:

- AI is projected to add $25.6 trillion to the global economy by 2030, surpassing the combined GDPs of nations like Germany, Japan, and India.

- ChatGPT reached 100 million users in just two months, becoming the fastest-growing application in history.

Much like the internet and smartphones before it, AI is expected to produce immense value for investors who recognize its potential early. Missing this wave, Green warns, could mean missing out on the opportunity to build generational wealth.

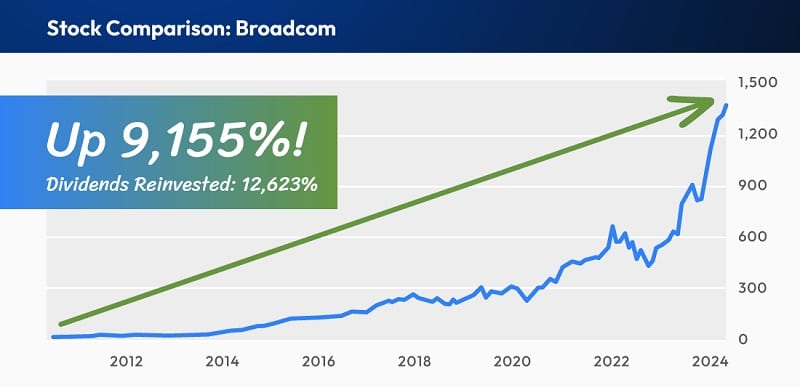

Learning from the Original Magnificent Seven

Green draws parallels between today’s AI revolution and the internet boom of the past two decades, which birthed iconic companies such as Google, Microsoft, Apple, and Nvidia. Dubbed the “Magnificent Seven,” these companies reshaped markets and delivered staggering returns:

- Combined market cap: Over $10 trillion.

- Return since 2004: 16,894%, or a 46:1 outperformance over the broader market.

- A $7,000 investment in these companies in 2004 would now be worth $1.18 million.

These results underscore the importance of identifying and investing in transformative technologies early.

The Five Golden Metrics

To identify future winners, Green uses a rigorous selection process built around five “Golden Metrics”:

- Cutting-edge Technology: The company must lead in innovation.

- Massive Market Reach: Products or services must be used by hundreds of millions worldwide.

- Patented Protections: Intellectual property should safeguard the company’s technology.

- Explosive Sales Growth: The company must show a track record of expanding revenue streams.

- Blockbuster Potential: The ability to sustain momentum through successive breakthroughs.

Every company in Green’s Next Magnificent Seven portfolio meets these criteria, setting them apart as leaders in the AI revolution.

The Next Magnificent Seven Stocks

Green’s analysis identifies seven companies that he believes will define the AI era. Each possesses a unique role in AI’s ecosystem, from hardware to software to applications in diverse industries.

1. The AI CPU Developer

This company designs advanced CPUs critical for AI applications, earning recurring royalties through partnerships with tech giants like Apple, Nvidia, and Samsung.

Key Stats:

- Recent quarterly sales: $824 million.

- Projected annual revenue: $3.2 billion.

- Long-term deal with Apple ensures use in iPhones and MacBooks until 2040.

With a strong foothold in the AI ecosystem and direct investments from Nvidia and Apple, this company is poised to join the trillion-dollar valuation club.

2. Reinventing the Internet with AI

This firm is building a faster, more secure internet infrastructure, outpacing Amazon and Google with a network of over 300 data centers worldwide.

Key Stats:

- Fastest network in most countries globally.

- Client base includes 30% of Fortune 1000 companies, such as Walmart and IBM.

- Revenue growth: 79% above Wall Street estimates in the past year.

This company’s growth trajectory mirrors that of Cisco during the internet boom, with less than 1% market penetration today.

3. Semiconductor Market Leader

Based in the Netherlands, this company dominates the photolithography market, producing machines essential for creating advanced semiconductors.

Key Stats:

- Annual sales growth: 30%, with a 51.3% gross margin.

- Backlog of orders: Nearly $40 billion.

- Machine price: $300 million per unit.

Holding a monopoly in EUV lithography, this company is vital to the hardware backbone of AI.

4. Leading AI Software Provider

Ranked as the top vendor for AI and machine learning, this company serves diverse industries, from automotive to healthcare to government contracts.

Key Stats:

- Commercial customers grew from 14 to nearly 300 in four years.

- Secured U.S. government contracts worth $407 million.

- Operating income growth: 145% in the last year.

The company recently turned profitable, positioning itself for exponential growth similar to Tesla’s trajectory in 2020.

5. Revolutionizing Supply Chains with AI Robots

This firm develops AI-driven robots that improve logistics for major retailers, including Walmart, Target, and Albertsons.

Key Stats:

- Revenue growth: 98% in the past year.

- Insider ownership: 19% of shares.

- Cash reserves: $675 million with no debt.

With Walmart installing its systems nationwide, this company represents the transformative power of AI in retail and logistics.

6. Cybersecurity Powered by AI

As AI expands, so do cybersecurity threats. This company uses AI to authenticate users and block hackers, serving high-profile clients like NASA and BP.

Key Stats:

- Subscription revenue growth: 68% year-over-year.

- Customer base: 8,000+ global clients.

- Recurring revenue: 90% of its business.

The booming cybersecurity market, projected to grow to $135 billion by 2030, positions this company as a leader in the sector.

7. Gene-Editing Pioneer

Using AI, this biotech firm leads in gene-editing, developing treatments for genetic disorders and securing the first-ever FDA-approved gene-editing drug.

Key Stats:

- Pipeline: 20 treatments in development, targeting cancer, diabetes, and cardiovascular diseases.

- Landmark achievement: Approval of the first gene-editing therapy.

- Potential market: Multi-billion-dollar healthcare opportunities.

This company stands at the intersection of AI and biotechnology, promising life-changing medical breakthroughs.

The Urgency of Investing Now

Timing is everything. Green warns that delaying investments in AI could significantly reduce returns. He cites examples like Vertex Pharmaceuticals, where a 10-month delay slashed potential returns from 4,137% to just 833%.

AI adoption is accelerating faster than any previous technological revolution. Early investors stand to benefit the most.

The Oxford Communiqué: Subscription Options

The Oxford Communiqué provides three tailored subscription plans, designed to meet the needs of a wide range of investors.

1. Premium Subscription – $99/year (Regular Price: $249/year)

This all-inclusive package offers both digital and print access to The Oxford Communiqué along with premium features:

- Model Portfolio Access: Full access to the Oxford Trading Portfolio, Gone Fishin’ Portfolio, and Ten Baggers of Tomorrow Portfolio.

- Detailed Reports:

- “The NEXT Magnificent Seven: How These Seven AI Stocks Could Make You a Millionaire.”

- “The #1 AI Hypergrowth Stock: Your Second Shot at Apple, Amazon, or Netflix.”

- “How to Build a Million-Dollar Portfolio from Scratch.”

- Additional Benefits: Exclusive Clubroom access, a library of special reports, and invitations to high-profile global events.

2. Deluxe Subscription – $139/year

The Deluxe Subscription includes everything from the Premium Subscription, plus an extra bonus report:

- “The #1 AI Stock: How to Retire on This Obscure Under-$10 Stock.”

3. Standard Subscription – $59/year (Renews at $79/year)

The Standard Subscription provides digital access to The Oxford Communiqué and essential reports, offering an affordable entry point for investors interested in AI opportunities.

365-Day Money-Back Guarantee

All subscriptions come with a 365-day money-back guarantee, ensuring a risk-free experience. If you’re unsatisfied with your membership for any reason, you can cancel within the first year for a full refund—no questions asked. Additionally, even if you cancel, you’ll retain all the reports, including The NEXT Magnificent Seven, as a free gift.

Special Bonus: The #1 Hypergrowth AI Stock

In addition to the seven core stocks, Alexander Green highlights a bonus opportunity: The #1 Hypergrowth AI Stock. This company is at the forefront of helping businesses integrate AI solutions to enhance productivity and efficiency.

Here are some of its key stats:

- Sales Growth: Revenue has grown from $607 million in 2021 to $1.3 billion in 2024.

- Business Model: Focused on building AI bots and algorithms that drive productivity gains across various industries.

This stock represents a short-term opportunity that perfectly complements the long-term growth potential of the Next Magnificent Seven portfolio.

Tools to Build Wealth

To ensure subscribers maximize their investment potential, Alexander Green provides additional resources:

- “How to Build a Million Dollar Portfolio from Scratch”: A comprehensive guide offering practical strategies inspired by investing legends like Warren Buffett and Peter Lynch.

- The Oxford Communiqué: A monthly newsletter featuring stock recommendations, market insights, and updates on the Next Magnificent Seven.

- Clubroom Access: Weekly live discussions that provide real-time updates on market trends, in-depth portfolio reviews, and the opportunity to interact with investment experts.

Conclusion: A Generational Wealth Opportunity

Alexander Green’s Next Magnificent Seven represents a once-in-a-generation opportunity to harness the wealth-building power of AI. With projections of $25.6 trillion in economic value by 2030, AI is poised to redefine industries and create immense value for early investors.

Whether you’re a seasoned investor or just starting, this curated portfolio provides a roadmap to participate in the AI revolution. As Green emphasizes, the key is to act now. Waiting could mean missing out on the defining wealth-building moment of the century.