Looking for more information about Bryan Bottarelli and Karim Rahemtulla The War Room service? I’ve put an honest The War Room Review, containing everything that we know so far about Bryan Bottarelli’s and Karim Rahemtulla’s trading room.

Table of Contents

Monument Traders Alliance Review

Monument Traders Alliance is focused on helping you make winning trades.

Ready To Try The War Room – Click Here – Best offer + Bonuses

Signing up for their free Trade of the Day e-letter is the first step toward accomplishing this goal. At 5 p.m. ET, Monday through Friday, you’ll receive a quick recap of one of the most important trades they are tracking. These are often the trades that could lead to substantial wealth creation – and you’ll know about them well before anyone else.

Each Trade of the Day issue will focus on one of four unique Smart Speculation strategies that they use at Monument Traders Alliance.

Strategy No. 1: Sharp Paper Insiders

If they track a significant amount of company insiders buying stocks – or they track an unusual amount of options activity occurring on any given options string – it’s time to investigate. Why? Because this activity is often an early indication that a substantial directional move is coming, which means following these early warning signs can lead to tremendous winners.

Strategy No. 2: Smart Speculation Trades

This is where the art of Smart Speculation is revealed. You’ll see how to use their calculated, precise strategies to position yourself whenever the right moment presents itself.

— RECOMMENDED —

No. 1 Stock to Buy for the 2024 Election Year

No. 1 Stock to Buy for the 2024 Election Year

Marc Chaikin’s award-winning Power Gauge system pinpointed the No. 1 stock of the 2016 election year and the No. 1 stock of the 2020 election year… months before the election in November. Now, it just flashed “buy” on the No. 1 stock to buy ahead of the 2024 presidential election.

Click here for the name and ticker.

Strategy No. 3: Small Cap Blasters

Nothing is better than uncovering a small, rapidly growing company that’s under the radar of Wall Street. These gems are revealed to you before they make the financial news shows.

Strategy No. 4: Hot Stove Analysis

Over decades of real-time trading, they have found that a handful of technical formations have proved consistently profitable. These unique formations will be revealed to you the moment they trigger – but only if the timing is right.

If you sign up to receive Trade of the Day, you’ll receive a new issue at the end of each trading day that features one of these four powerful trading tactics. You’ll also receive a weekly review on Sunday. Take a moment to open and review these alerts every day. They’re purposely designed to be short and sweet, but the information they reveal could dramatically impact your wealth.

— RECOMMENDED —

The Biggest Commodity Bull Market in History?

The Biggest Commodity Bull Market in History?

“Commodities will be THE trade of the coming decade,” says the senior analyst behind 24 triple-digit winning recommendations. And it’s not just because they’re among the best ways to BEAT out-of-control inflation… but because they’re at the beginning stages of a massive cycle – one that could hand you quadruple-digit gains if you get in now.

He details his No. 1 favorite commodity play, right here.

Monument Traders Alliance – Meet The Experts

Over the last decade, veteran traders Bryan Bottarelli and Karim Rahemtulla have been quietly recruiting some of the savviest, cleverest, and most successful traders and speculators – and inviting them to join a live, real-time, collaborative platform of individuals with the same common goal: to make winning trades.

Bryan is the founder and Head Trade Tactician of Monument Traders Alliance. He’s also a former CBOE options trader and the founder of Bottarelli Research. Karim is the co-founder and Head Fundamental Tactician of Monument Traders Alliance. He’s also the former Investment Director of The Oxford Club and Chief Options Strategist for Automatic Trading Millionaire, with more than 30 years of investing in options and international markets under his belt.

Ready To Try The War Room – Click Here – Best offer + Bonuses

Bryan Bottarelli

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There he was mentored by one of the country’s top floor traders in the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Standing alongside the pit’s top Apple trader – and executing his trades in real time – is where Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely make their way outside the CBOE to individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit to take a risk. He walked off the CBOE floor and launched his own independent trading advisory service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group of high-level traders – most of whom joined him on day one and were clients ever since.

As a so-called “play tactician,” Bryan used his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan was able to deliver his clients remarkable gains while strictly limiting their total risk.

Along the way, Bryan developed a cumulative track record that could impress even the most successful hedge fund manager – it covered a total of 5,727 trades, averaged 13.97% per trade and amassed total gains in excess of 80,005.91%.

Bryan’s top pick was Taser International, which he recommended at $4 a share and later sold for $63 – a 1,400% gain.

He now spends his days moderating one of the most elite trading forums ever created, The War Room.

— RECOMMENDED —

‘This Is How I’d Invest $1 Million’

‘This Is How I’d Invest $1 Million’

“This is how I’d invest $1 million right now,” says legendary investor Whitney Tilson. He’s posting a new portfolio of stock picks for 2024. He isn’t buying the Magnificent Seven… or putting an equal amount of cash into each. Instead, he’s using the Monte Carlo method to see which of 4,817 stocks could double your money.

Click here for the full details

Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent to him every semester and sold them for a profit to his fellow classmates who were trying to avoid the horrendous British food.

He then graduated to stocks and options, becoming one of the youngest CFOs of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There he learned his trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

Educated in England, Canada and the United States, Karim’s fluent in several languages. His undergraduate studies were completed in economics and foreign languages. His graduate studies resulted in a master’s degree in finance. Karim travels the world regularly, seeking out the best investment opportunities.

He developed a covered call strategy in the late ’90s while Investment Director of The Oxford Club and identified a unique aberration. The trading system he built around this allowed him to hand his readers a win percentage of more than 80%.

Not satisfied with that system, he turned to LEAPS and put selling strategies as co-founder and chief options strategist for the groundbreaking publication Wall Street Daily. After that, he honed his strategies for readers of Automatic Trading Millionaire, where, since inception, he has not recorded a single realized loss. And that’s including a span of more than 40 recommendations over an 18-month period.

While even he admits the record is not the norm, it showcases the effectiveness of a sound trading strategy.

He has closed out positions in as little as a few hours for triple- and quadruple-digit gains. His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of a venture capital publication gives him unique insight into low market cap companies, and he brings that experience into the daily chats of The War Room.

With more than 30 years of experience in options trading and international markets, Karim also contributes to The Oxford Income Letter and Wealthy Retirement. He is the author of the best-selling book Where in the World Should I Invest?

Ready To Try The War Room – Click Here – Best offer + Bonuses

The War Room Service – Learn More Here

The War Room is truly a game-changing, wealth-generating portal – one that will open your eyes to a world of trading, speculation and wealth creation unlike anything you’ve ever experienced.

If you’re ready to begin trading and speculating like never before, then we invite you to enter The War Room. As you’ll soon see, The War Room is a unique, game-changing, collaborative platform where an elite group of like-minded traders gather each trading day to offer insight, ideas and community – all with the same goal: to make winning trades.

Every trading day, The War Room founders, Bryan Bottarelli and Karim Rahemtulla, will offer you…

Ready To Try The War Room – Click Here – Best offer + Bonuses

Live, Real-Time, Actionable Recommendations

Gone are the days of hearing about a big winner on CNBC – after it’s already happened. In The War Room, you’ll get live, real-time plays, strategies and tactics that will deliver trading winners on a daily basis.

You’ll always know the second it’s time to act – buy or sell.

Collaboration With Other War Room Members

Trading doesn’t have to be a lonely game. In The War Room, you’ll have the chance to meet like-minded traders, all sharing their best ideas for daily wealth creation.

This community of traders has never before been available, which makes The War Room recommendation portal unique.

How to Restore the Lost Art of Smart Speculation

Forget everything you’ve learned. The theme of Monument Traders Alliance is to speculate in a way that will hand you a tremendous return if you’re right and cost you a small loss if you’re wrong.

Starting in May, you can put these principles to work for yourself – inside The War Room.

Ready To Try The War Room – Click Here – Best offer + Bonuses

3 Concerns About The War Room, Resolved

Let’s discuss the top three concerns we’ve been receiving about The War Room.

“I don’t have time to sit in front of my computer all day.”

War Room Solution: Luckily you don’t have to. In fact, the beauty of The War Room is that you can receive trade recommendations on your own time at your own leisure. For instance, say you have 30 minutes to trade the open, but then you need to attend an important meeting. In that case, wake up, trade for the first 30 minutes – and then take off.

Live your life.

You have a busy schedule. We absolutely get it. That’s why The War Room is so revolutionary. There will be trade recommendations made all day long. Whenever you’re free, simply enter the room – and receive recommendations in a way that fits into your schedule.

For example, say that later the same afternoon, you have another 30 to 60 minutes free. Jump back into The War Room – and perhaps you’ll catch another new recommendation – and then go on with the rest of your day.

Ultimately, The War Room is a place where you can spend 15 minutes trading, all day trading or anywhere in between. It’s entirely up to you. Whenever you’re available during market hours, The War Room is available for you to get winning trade recommendations.

“I can’t catch every single trade.”

War Room Solution: Luckily you’re not expected to make every single trade. In fact, expecting to make every trade is simply unrealistic. Rather, The War Room is designed for you to trade only when you’re available. Once again, you have a life. You’re busy, you have commitments – and you have vacations.

When you’re available, we invite you to jump into The War Room, contribute to the conversation, catch up with your friends and fellow traders, and get a few trade recommendations. And when you’re not around? That’s perfectly fine.

Will you miss some trade recommendations? Of course you will. Nobody expects you to be around for every play.

In fact, The War Room has a feature explicitly designed to let you get away from your command center and live your life. You will be notified via e-mail or text message any time a new recommendation is posted. That way, you’ll always be alerted to any new buy or sell actions wherever you are. See the message, log in to The War Room, place the trade and then get back to whatever you were doing. It’s that easy.

“I’m afraid I’ll miss the right time to sell.”

War Room Solution: Get ready to learn the magic of the “limit order.” A limit order is a pre-specified price to buy (or sell). In our case, the emphasis will be on the sell aspect of your transaction. Here’s the scoop…

A limit order gives you complete control over your execution price. More importantly, you can place a limit order to trigger any time you’re not at your computer watching the action – but you still want to sell in case your play achieves a certain price. It’s like having your own automatic trader working for you – all for no additional commission!

Let’s walk through a real-life example.

Ready To Try The War Room – Click Here – Best offer + Bonuses

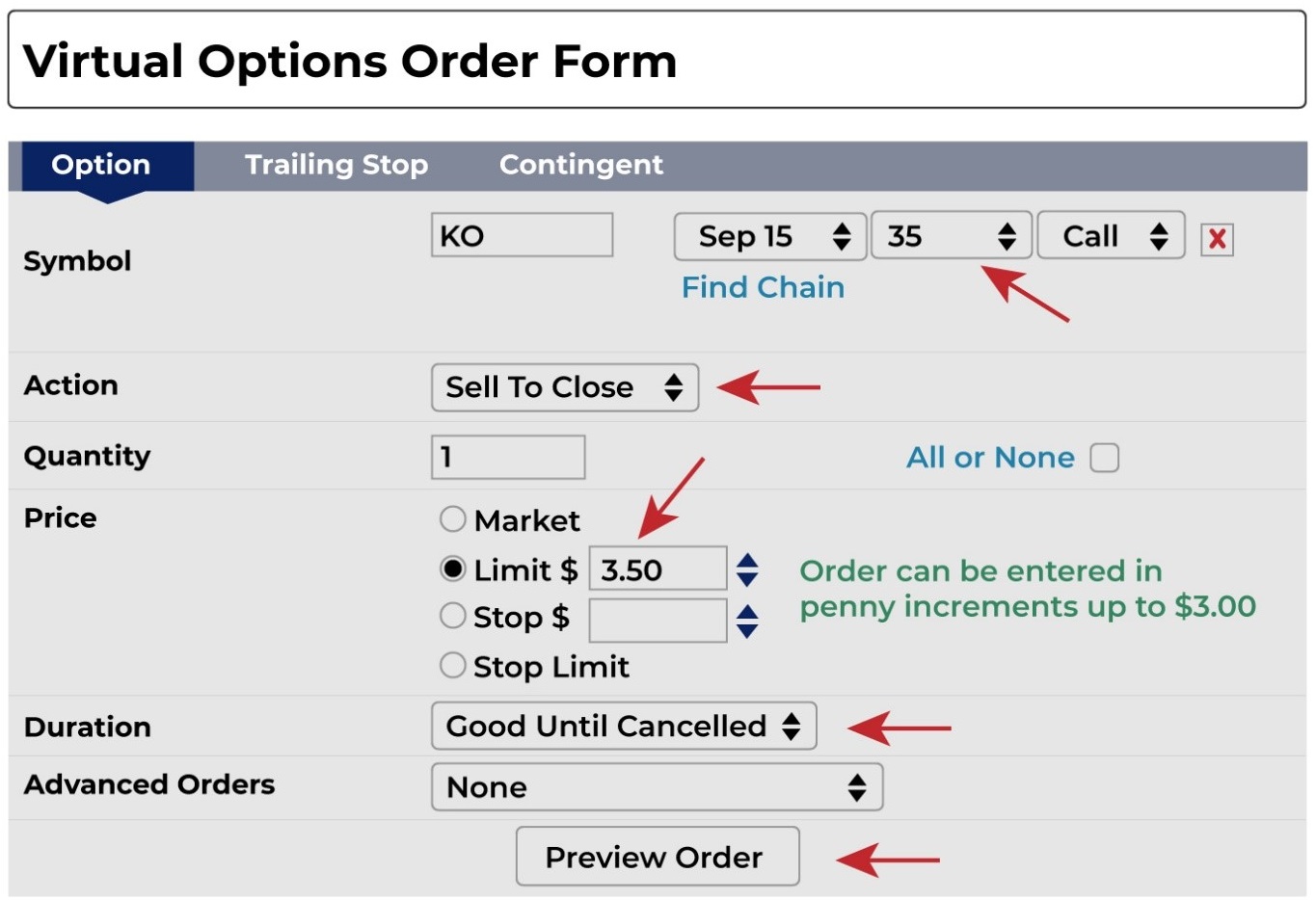

Say you logged in to The War Room at the open at 9:30 a.m. ET, and the first trade out of the gate was to buy the Coca-Cola (NYSE: KO) September $35 calls for $2.50. You bought in – you’re watching – and you’re ready to lock in profits when the timing is right.

But then, 30 minutes later, you realize you forgot about an executive meeting you absolutely have to attend at 10 a.m. – followed by an 11:45 tee time at your country club. You get worried, thinking, “What if I need to sell my Coca-Cola calls while I’m away?” The answer: Set a limit order.

You see, before you take off, simply set the following limit order ABOVE your entry price and mark it “Good Until Cancelled.”

Say you’re happy with a 40% gain. That would mean setting your limit order at $3.50. This process is shockingly simple:

- Enter the Coca-Cola September $35 calls

- Choose “Sell To Close”

- Set the limit price to $3.50

- Choose “Good Until Cancelled”

- Preview your order – and submit!

With this limit order in place, you’re free to go about your non-trading activities – work or play. If Coca-Cola moves up while you’re gone, the order will automatically execute. You might even finish your golf round and be pleased to see that your 40% gain triggered while you were away. What could be more effective?

Limit orders are a great tool for discipline – but for some reason, nobody uses them. If you purchase an option for $3 and you’re willing to sell it for $4, go right ahead and immediately set a sell limit order. That way, you know your sell will get executed the moment your option’s bid price hits $4 (or higher).

Knowing you have a standing limit order on the books, you’re free to spend the rest of the day doing whatever you want – golf, meetings, lunches – all while knowing you’ll profit without having to monitor prices every moment of the day.

It is, however, important to note that a limit order is not guaranteed to execute. It will trigger only if the bid price reaches – or goes above – your limit price. In other words, if you get back to your command center and you see your limit order has not triggered, that means your desired sell price has not yet been reached. In this case, you can either maintain your limit order or adjust it however you see fit.

Takeaway: By using these tricks, you can smartly speculate in The War Room – on your own time, at your own leisure.

Ready To Try The War Room – Click Here – Best offer + Bonuses

1 thought on “The War Room Review – How’s Monument Traders Alliance Service?(Bryan Bottarelli and Karim Rahemtulla)”