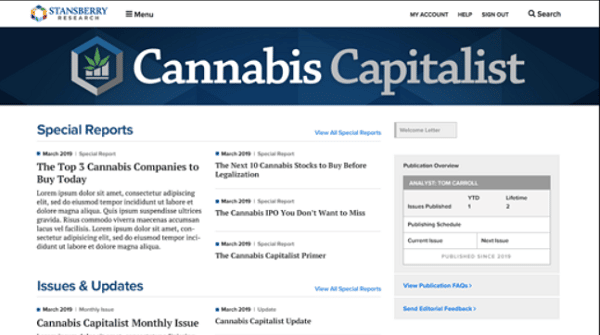

Cannabis Capitalist Review (Actual Member) Review

Looking for more information about Tom Carroll’s Cannabis Capitalist Research? I’ve put an honest Tom Carroll’s Cannabis Capitalist Review, containing everything you need to know about Tom Carroll’s Cannabis Capitalist Service.